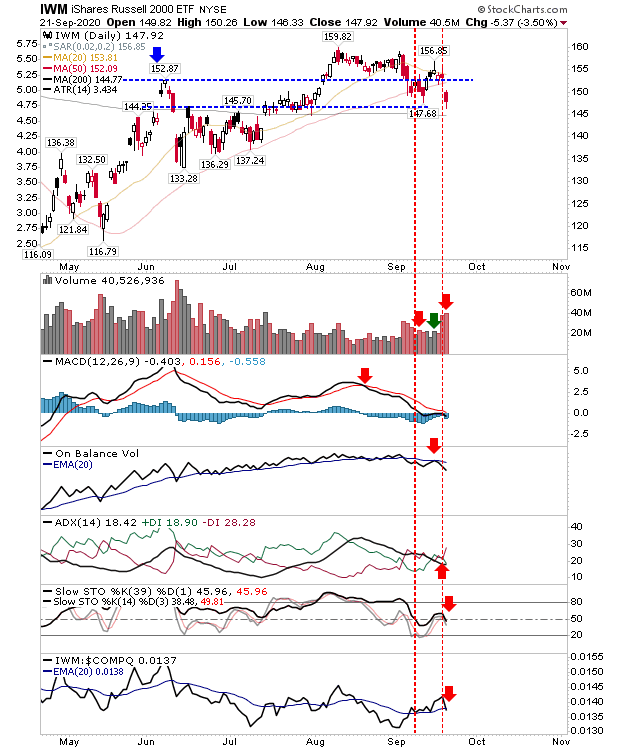

Indices continued to decline yesterday, with measured move targets for the S&P 500 and NASDAQ still in play. However, the real damage was done in the Russell 2000 (via IWM). The index made a clean break below its 50-day MA on a gap down with new 'sell' triggers in Stochastics, ADX and relative performance.

Volume climbed to register as distribution. The index, which had been defending the breakout, is now having to contend with a new level of overhead supply.

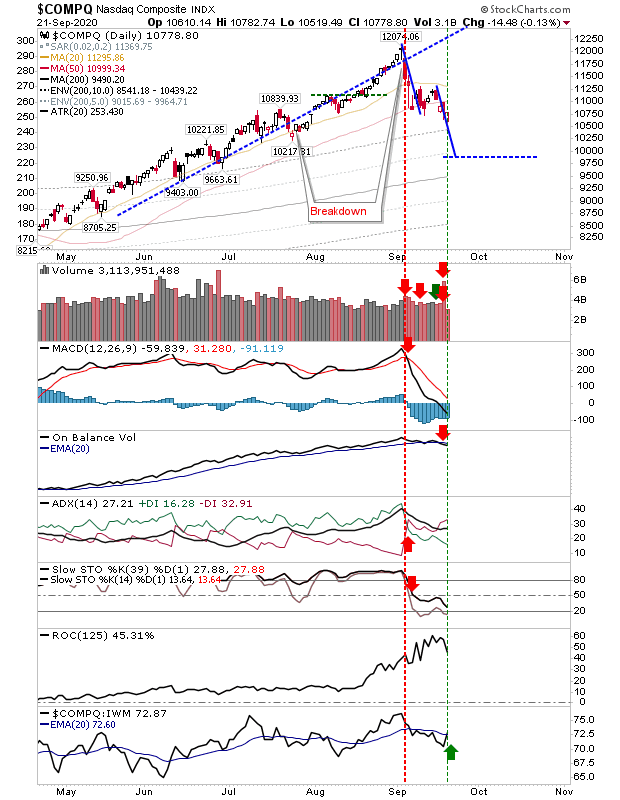

The NASDAQ recovered from its early morning gap down, but not enough to register a higher close. Volume was lighter than Friday, so no distribution. Current action remains on course to complete the measured move lower in an ABC correction.

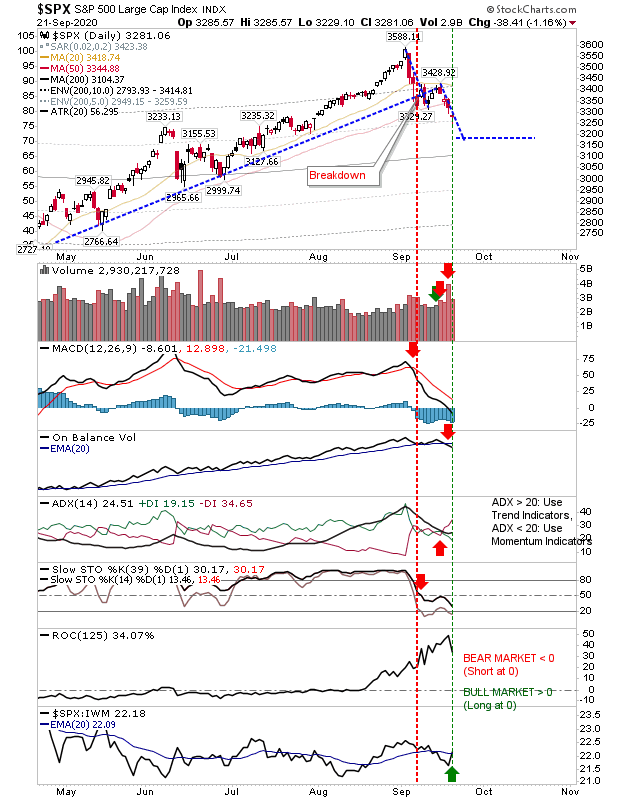

The S&P also recovered lost ground during the day to finish with a neutral doji. Technicals are net negative and weakening. The only positive was in relative performance with defensive Large Cap stocks retaking a leadership role over more speculative Small Caps—although this is more damaging in the long-term as investors flock to safety.

With the heavier than expected loss in the Russell 2000 on Monday we need to keep a close eye on this index. If the index continues to lose ground it will lay the groundwork for a crash as all indices will be experiencing larger than expected losses—although there is nothing yet to suggest this will happen.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.