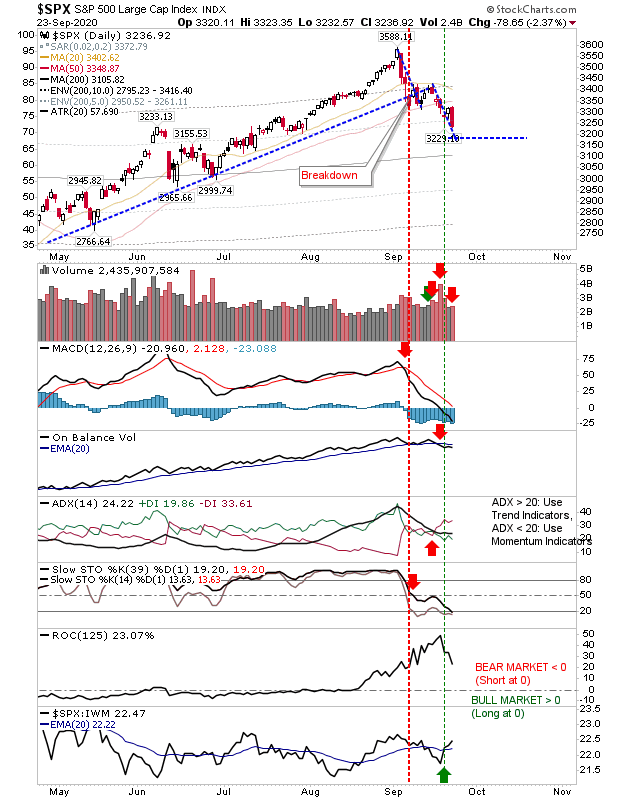

Sellers again stamped their authority on markets yesterday, with significant pushes lower. This completely erased the weak buying of Tuesday. Markets remain on course to reach their measured move targets. The index closest to doing so is the S&P.

No surprise to see technicals for the S&P net negative, although the index continues to outperform speculative Small Cap stocks. Volume climbed to register distribution, an additional confirmation for yesterday's selling. Once the measured move target is reached—likely today—next up will be the 200-day MA.

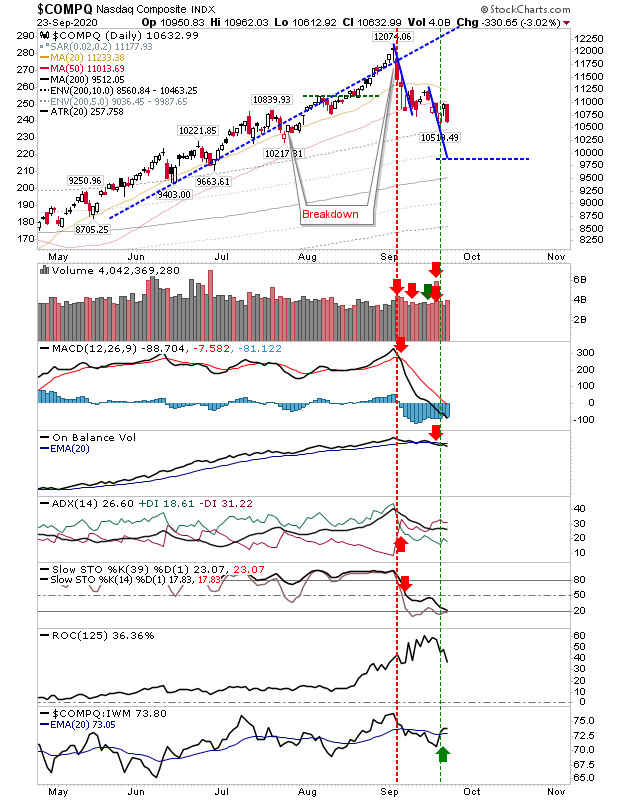

The NASDAQ also took a big hit as it undercut Tuesday's selling on higher volume distribution. Unlike the S&P it still has plenty of room to run before it gets to the measured move target or its 200-day MA. A trade opportunity may still be there for those looking for a shorting opportunity.

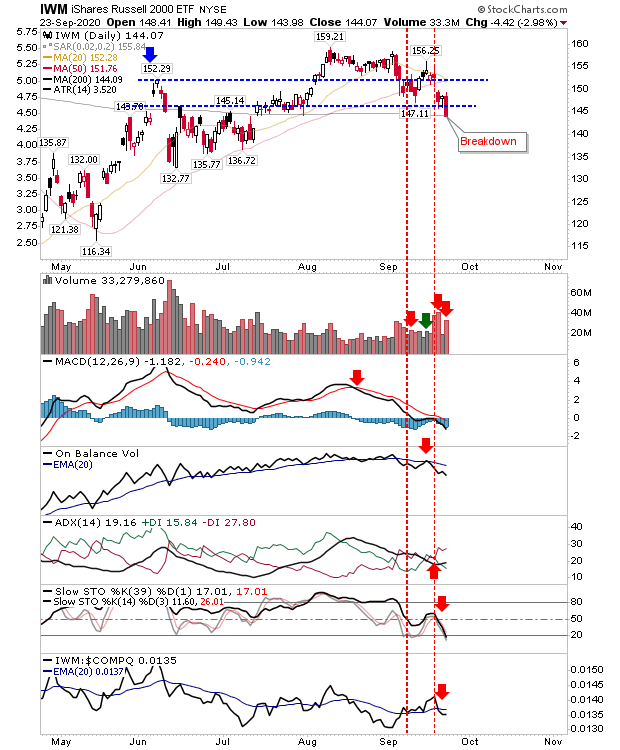

Small Caps (via IWM) undercut its swing low and finished the day on its 200-day MA. The index hasn't enjoyed the same level of gains as the NASDAQ and S&P, but was unable to escape the selling of those indices. Technicals are net negative, although the trend in On-Balance-Volume has shown stronger selling than the S&P and NASDAQ—not great news if you are looking for the Russell 2000 to lead out a rally.

It's hard to see things improving until after the election, and even then, a victory for Joe Biden would probably lead to acceleration in the selling; Democrats are perceived as bad for business and a 'sell the news' event would look to be a more probable outcome, assuming Trump is not re-elected.