Forget about yesterday's non-action, the damage was done on Wednesday on a significant escalation in volume. Yesterday was just a pause in that selling. Optimists might see yesterday's performance as a bullish harami, but in the absence of an oversold condition (momentum technicals) I would discount this.

Expectations are for a move back to June lows - and possibly new lows - but should this happen then we would likely see a significant bullish divergence in breadth metrics. It would yet be another major buying opportunity for investors, but let's see what the next few days bring.

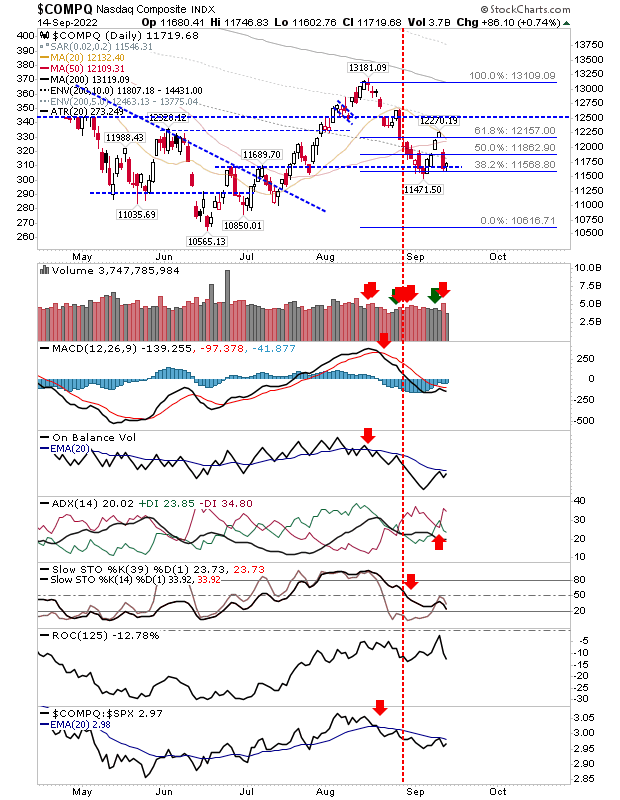

The Nasdaq is back at the 62% retracement (38.2% on the chart) for a second time. I wouldn't expect this second test to be successful, but for now - that is what it's doing. Yesterday's buying volume was well down on Wednesday's selling and technicals remain firmly bearish.

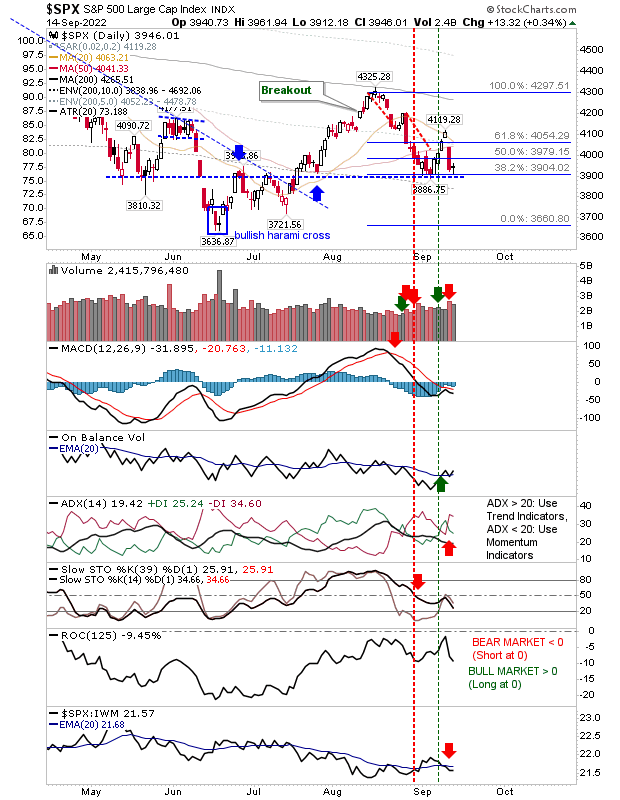

It was a similar picture for the S&P, although the index has the benefit of an earlier bullish cross in On-Balance-Volume which at least tips the buying trend in favor of bulls. As with the Nasdaq, we are looking at Fibonacci retracement support. And as with the Nasdaq, the likelihood of further losses is perhaps favored.

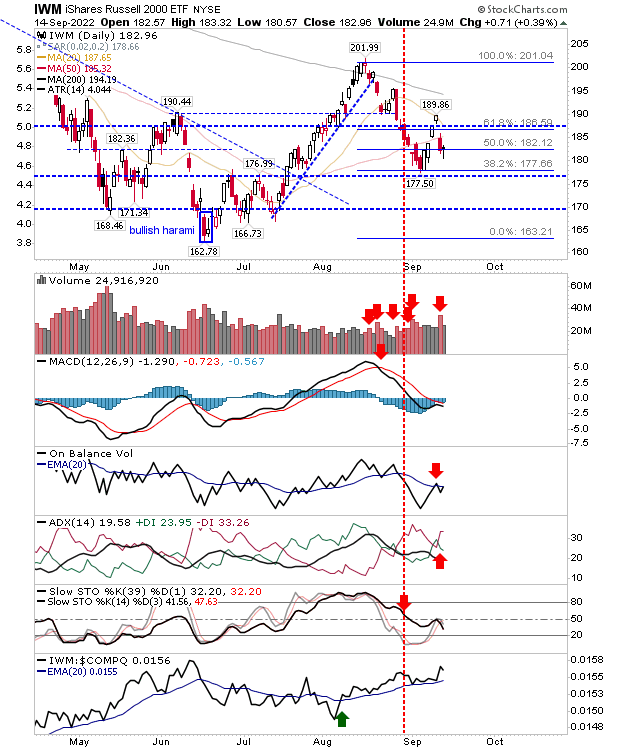

The Russell 2000 also dug in its heels, but did so without challenging the lower range of Fibonacci retracements. Unlike the S&P, there wasn't any positive technicals but it is still best placed to recover should buyers build off yesterday's doji. If there is a concern, it's that stochastics [39,1] are on the bearish side of the mid-line and remained so during the recent 4-day bounce.

Bulls have struggled when they have had the advantage and bears have made losses look easy. Yesterday's doji would normally give bulls something to work with, but I'm not sure there is enough here to see a move back to August swing highs.