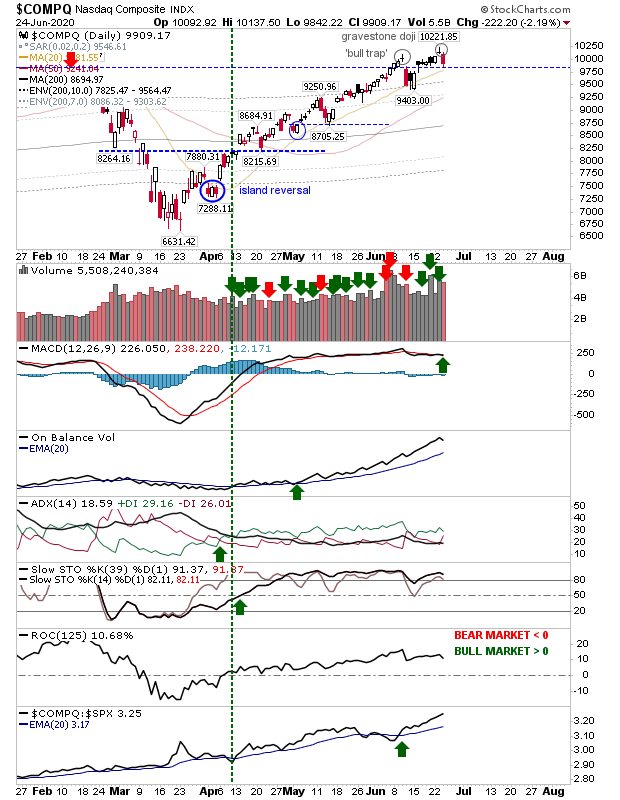

The NASDAQ had been the lead index as it posted new all-time (post COVID-19) highs, but Wednesday's selling followed Tuesday's bearish gravestone doji; collectively, it looks like a bearish evening star. The only thing remaining is breakout support, which has yet to be violated. Selling volume was down on Tuesday's buying so it wasn't all in bears' favor.

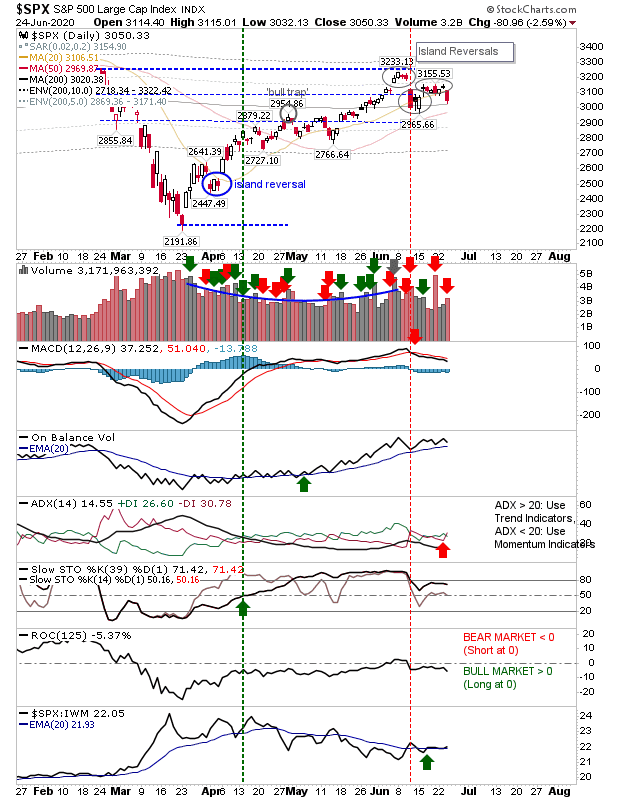

The S&P has been unusual in that there have been a series of bearish reversals; two bearish and one bullish for the month of June. Unlike the NASDAQ, yesterday's selling volume ranked as distribution, which is perhaps not surprising as the index has yet to challenge all-time highs.

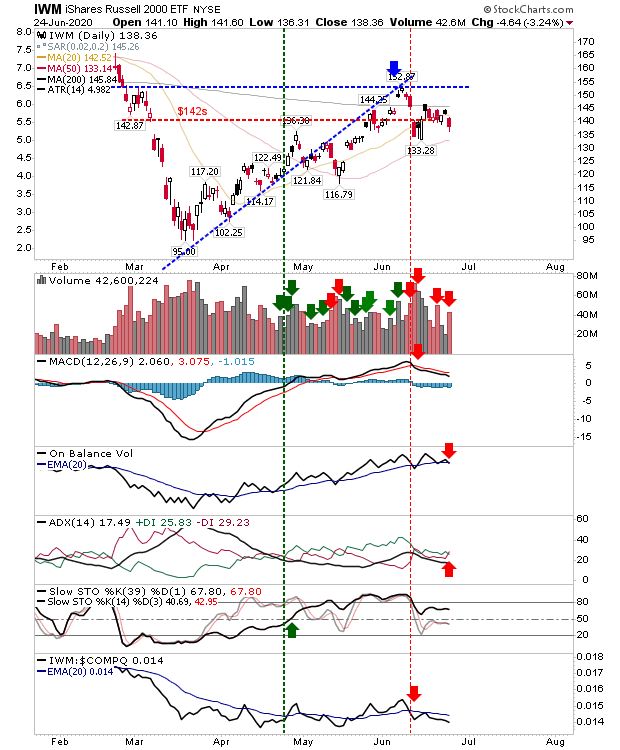

The Russell 2000 (via iShares Russell 2000 ETF (NYSE:IWM)) also experienced confirmed distribution as a series of 'sell' triggers took hold of the index. However, stochastics remain on the bullish side of the fence. The index is underperforming the NASDAQ and only has converged 50-day MA and the June swing low to hang on too.

Yesterday marked a revisit of the selling of two weeks ago; that selling didn't lead to any follow through...but will this one?