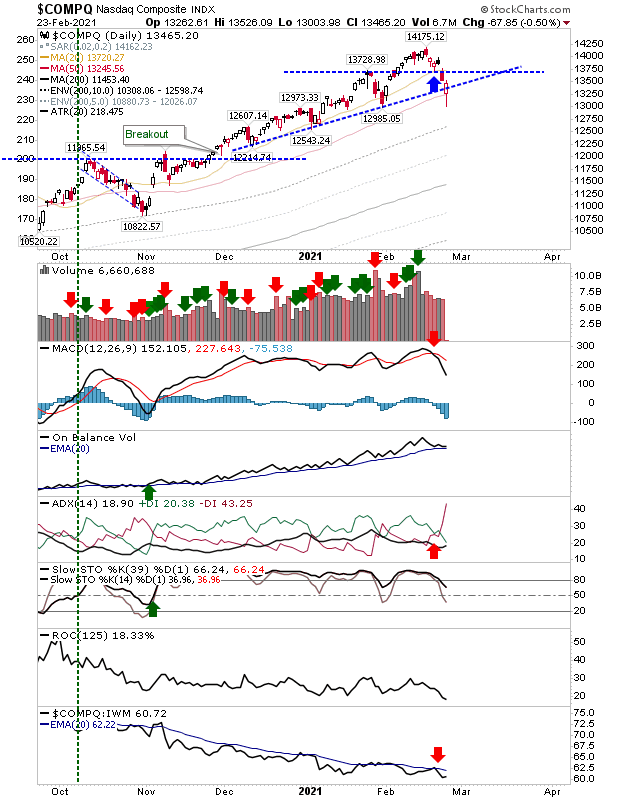

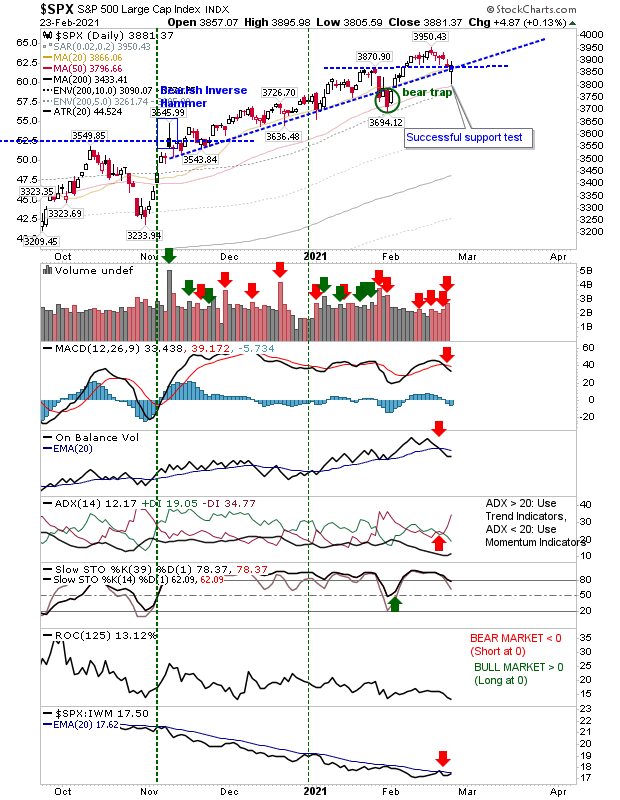

Perhaps a degree of complacency has crept into the market? Tuesday's selling brought the NASDAQ and S&P back to successful tests of their 50-day MAs. What was concerning was the general lack of volume on what is typically an important support test for the indices. Both the S&P and NASDAQ were able to stage successful intraday recoveries, but again, volume should have been more to support it.

What we need to watch for today are losses—typically from the open—that push down into yesterday's spike low for the aforementioned indices. Particularly if this selling volume picks up relative to yesterday. I would think any close below Tuesday's finish would indicate that yesterday's lows (or the 50-day MAs) will act as support for long. The NASDAQ probably did enough to defend trend support, although technically there was a big uptick in ADX, and the bearish MACD accelerated downwards.

The S&P had to make a larger recovery from its 50-day MA to make it back to trendline support. A day like yesterday would typically be very positive and trading volume was good. It's just a question whether the 'sell' triggers for the MACD, On-Balance-Volume and ADX will be of greater significance.

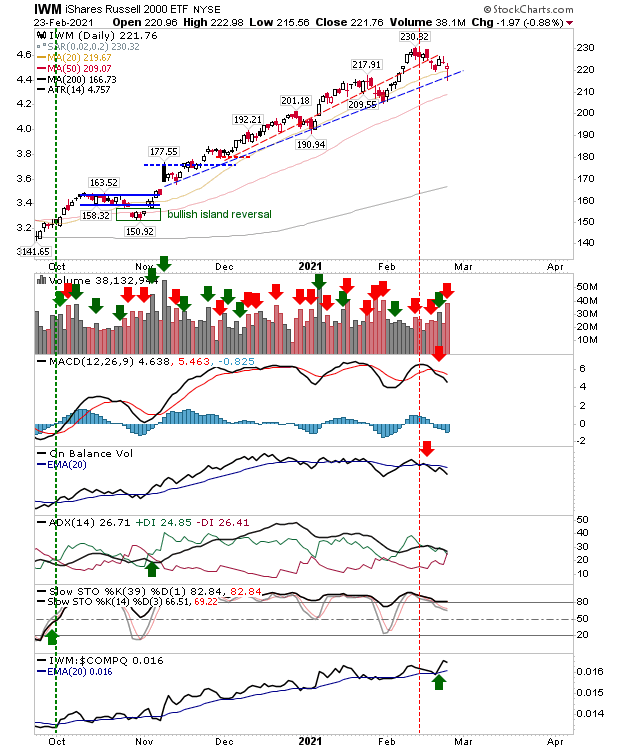

The Russell 2000 (via IWM) was not immune as sellers took the index to trendline support, although it remained well above its 50-day MA. Volume climbed in confirmed distribution to go with the 'sell' triggers in the MACD and On-Balance-Volume. Relative performance has also been improving.

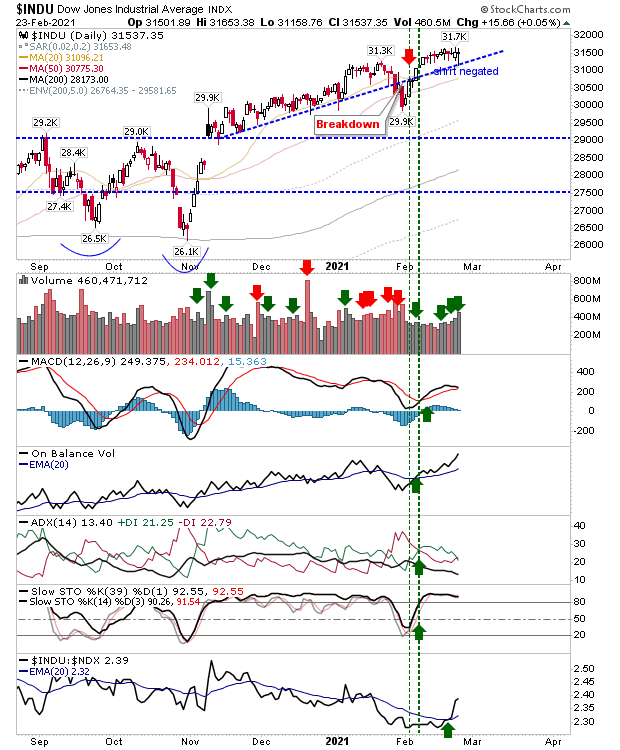

The Dow Industrials held support on higher volume accumulation as it successfully defended support. Given the action for other indices it was relatively low key.

Going forward, we will want to see how strong 50-day MA support and/or trendline support is for the lead indices. Yesterday was a warning sign, but there were still enough latent bulls to bid prices higher.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI