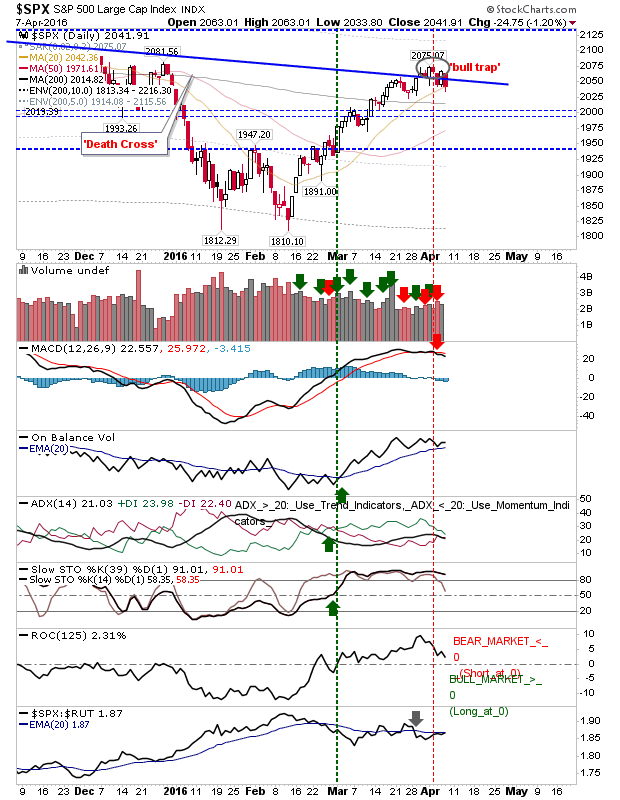

Wednesday belonged to bulls, Thursday was a day for bears. Thursday's action returned prices to Wednesday's lows but not enough to break the trend off February's swing low. A swing low of substance should be in the works soon - the question is whether Thursday is the start of it.

The S&P finished with a 'bull trap', expanding on the earlier MACD trigger 'sell'. Other technicals remain positive and relative performance is swinging back in favour of the S&P.

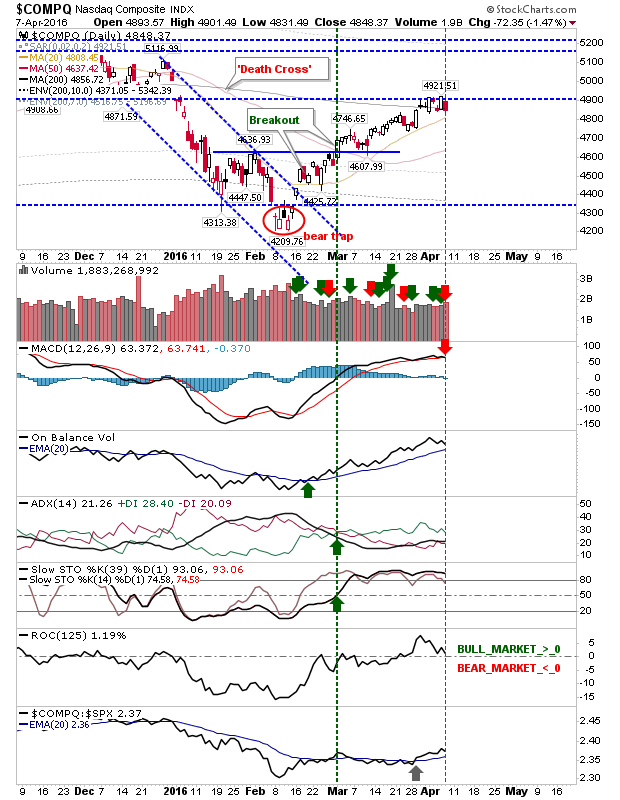

The Nasdaq remains pegged by resistance around 4,900. Thursday's volume registered as distribution and was accompanied by a MACD trigger 'sell'. These are cracks.

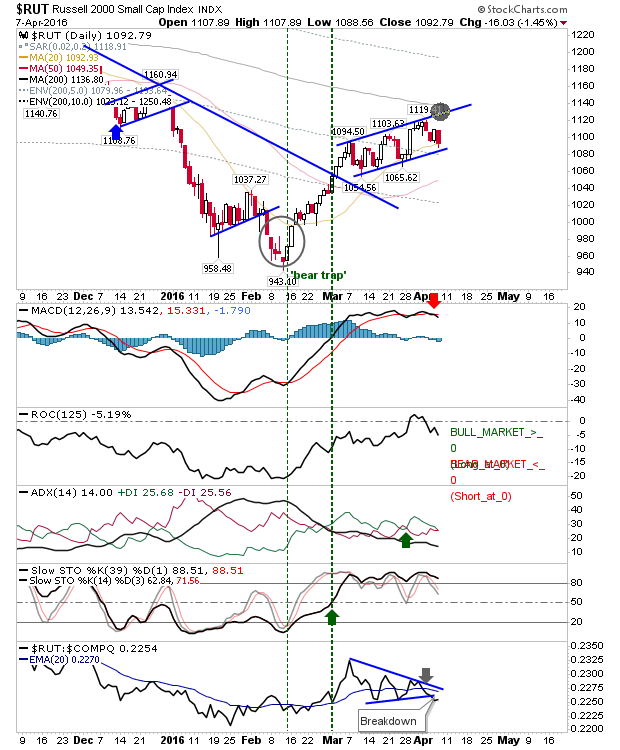

The Russell 2000 hasn't yet made it to the marked resistance zone I thought it would tag. There is a chance the index could bounce off rising channel support and reach it, but if this is to happen the Russell 2000 would have its move today (and nothing is guaranteed!). The MACD 'sell' pulled further from the bullish zero line.

For Friday, bulls will want to see a quick comeback if the rate of advance off the February low is to continue. It may prove healthier to see a decent pullback to shake out the weak hands before moving to new highs. Those on the sidelines may be looking to the short-side, but stops will need to be tight as an upside breakout could runaway.