Investing.com’s stocks of the week

All indices suffered selling on Friday, although selling volume was light. But given the Trump announcement after the Friday close it's hard to see anything but selling on Monday. The context to the selling will be a bounce that has struggled to reach the highs of August. Traders who were waiting for a retest of August highs before selling may find themselves doing this sooner. The lead in candlesticks to Monday will not help the mood.

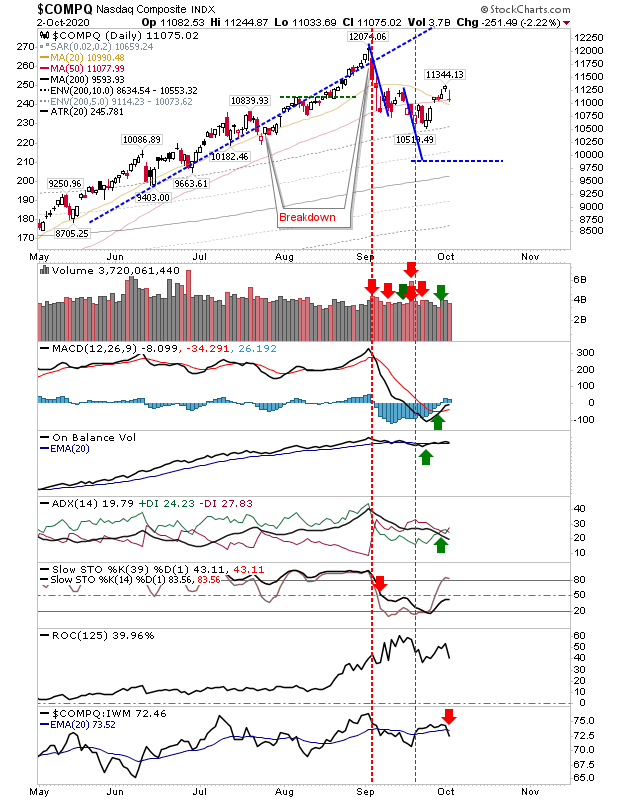

The NASDAQ looks to have finished with a bearish 'evening' start reversal. The 'buy' signal in the MACD, On-Balance-Volume and ADX are still intact, but I doubt all will survive by Monday's close. The 50-day MA is also support (for now). Stochatics are firmly on the bearish side of the divide (anything below 50 is bear market land). The index has also returned to a period of underpeformance relative to the Russell 2000.

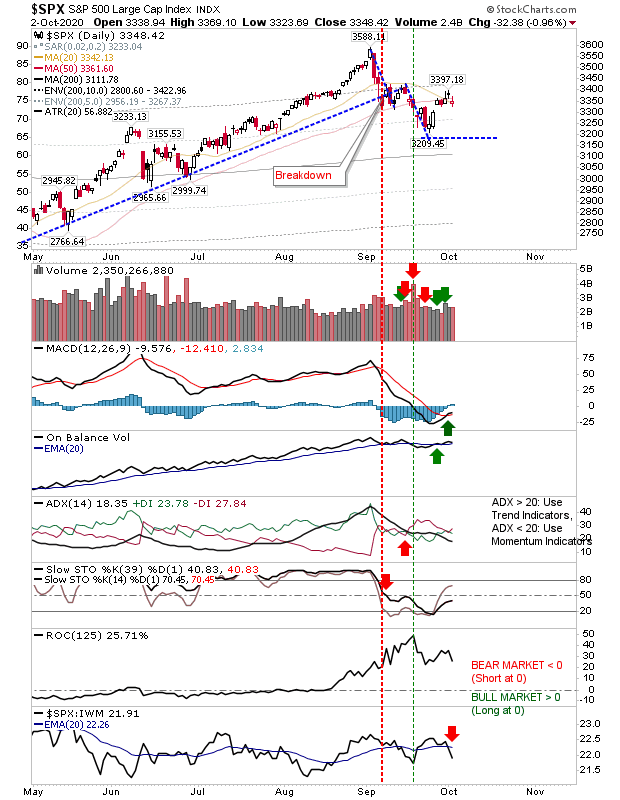

The S&P is in a similar state as the NASDAQ although it finished the week before its 50-day MA. It too has a 'buy' trigger in the MACD and On-Balance-Volume, but is also underperforming against the Russell 2000.

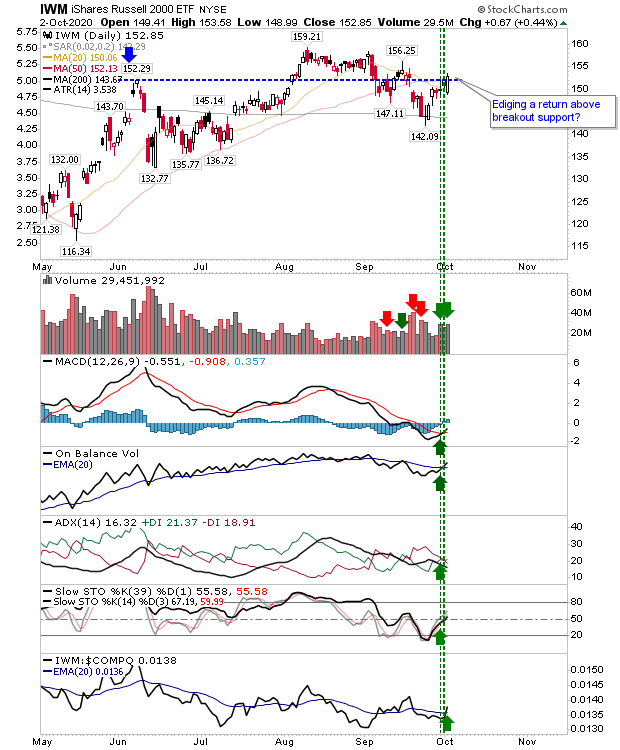

The Russell 2000 (via IWM) was the one index to benefit from Friday's selling in the NASDAQ and S&P, as money rotated into more speculative growth stocks. Unfortunately, Trumps' COVID-19 diagnosis throws these wins into the bin, and the index may find it difficult to hold onto its gains. Technicals are all net positive, including relative performance gains against the NASDAQ and S&P. Friday's action would have been seen has broadly positive for all indices—despite losses in Large Cap and Tech indices—but it's hard to see how this will play out over the next couple of weeks.

It's going to be a roller coaster run into the election. Trumps' COVID-19 diagnosis will keep traders on their toes for the first half of October and the election will feed into action for November. If there is a Biden win it's probable we will get a sell-off after the election; business and industry don't like "regulatory loving" Democrats no matter what the reality would be of a Biden administration. If Trump was to pull this out of the hat, another 4 years of inept incompetence would probably be too much for businesses to deal with—just look at the shitshow that is Brexit to know that right-leaning businesses have their limits. Roll on 2024.