Weekly Trend Model signal

Trend Model signal: Risk-on

Direction of last change: Negative (downgrade)

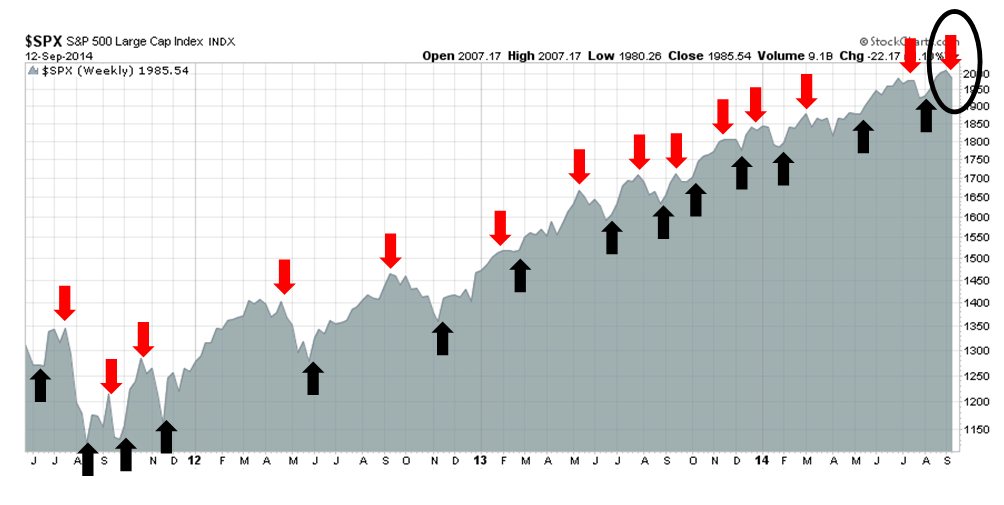

The actual historical (not back-tested) buy and sell signals of the Trend Model are shown in the chart below:

Good news, bad news

This is a good news and bad news kind of market. The bad news is that US equities appear poised for a pullback of some fashion. I had indicated last week that momentum was faltering and it may be prudent to pare back some positions around month-end (see Sell Rosh Hashanah?). The weakness became more evident as last week wore on, which prompted me to tweet that my long positions were stopped out on Tuesday. The S&P 500 then proceeded to bob up and down for the rest of the week, which frustrated both bulls and bears alike, and ended Friday on a negative note.

The good news is that, barring some surprise, there appear to be no signs of an intermediate term top in sight.

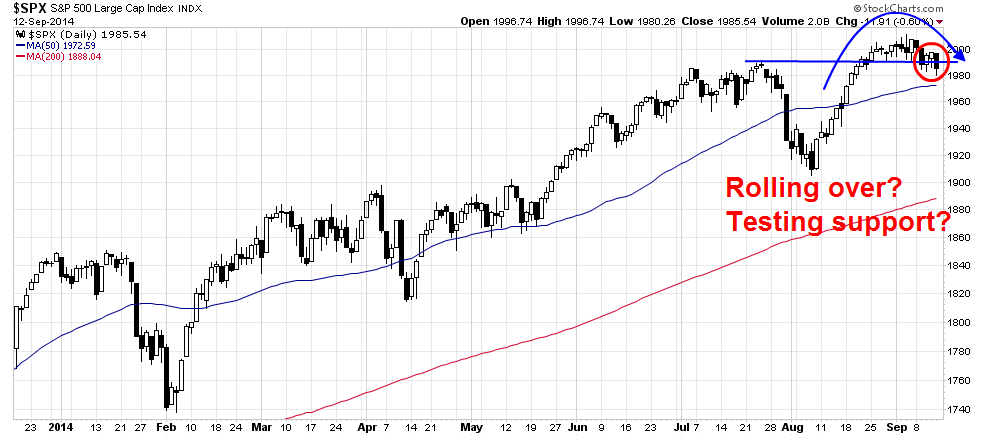

Short-term deterioration

Shorter term, however, I am seeing signs of technical deterioration. The SPX violated support and appears to be starting to roll over.

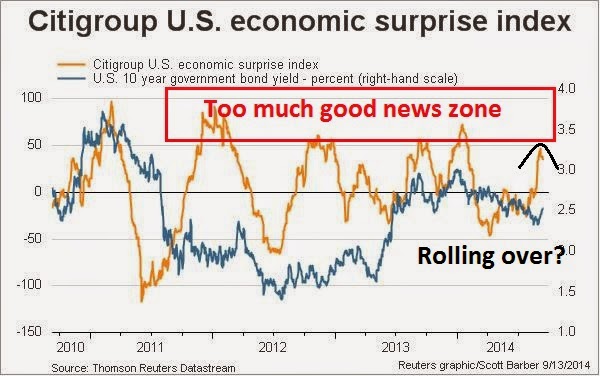

I had suggested last week that macro-economic releases were approaching the "too much good news" zone and vulnerable to a rollover. Almost on schedule, the Citigroup Economic Surprise Index started to turn south.

Declining growth expectations may prove to be an impetus to a loss of momentum in forward EPS estimates - a crucial ingredient that has been supportive of this bull run. Indeed, the Atlanta Fed`s GDPNow, a "nowcast" of Q3 GDP growth, fell from 3.6% on September 4 to 3.4% on September 12. Brian Gilmartin reports that the forward EPS growth rate has fallen for seven consecutive weeks, which is a worrisome sign for the bull case (emphasis added):

Per ThomsonReuter’s “This Week in Earnings”, the forward 4-quarter estimate fell to $125.80 from last week’s $126.34, or a decline of $0.48 on the week.

The p.e ratio on the forward estimate as of Friday’s close is 15.78(x) and the PEG ratio is now 1.73(x), still relatively attractive.

The earnings yield (some think this is a proxy for the equity risk premium) rose to 6.34% last week, from 6.29%.

The year-over-year growth rate on the forward estimate fell to 9.13% from last week’s 9.15%. This is the 7th straight weekly drop for the forward estimate growth rate.

Another potentially bearish signal comes from insider trading, the so-called "smart money". Barron's weekly report of insider activity shows that the ratio of sales to purchases have ticked up into bearish territory.

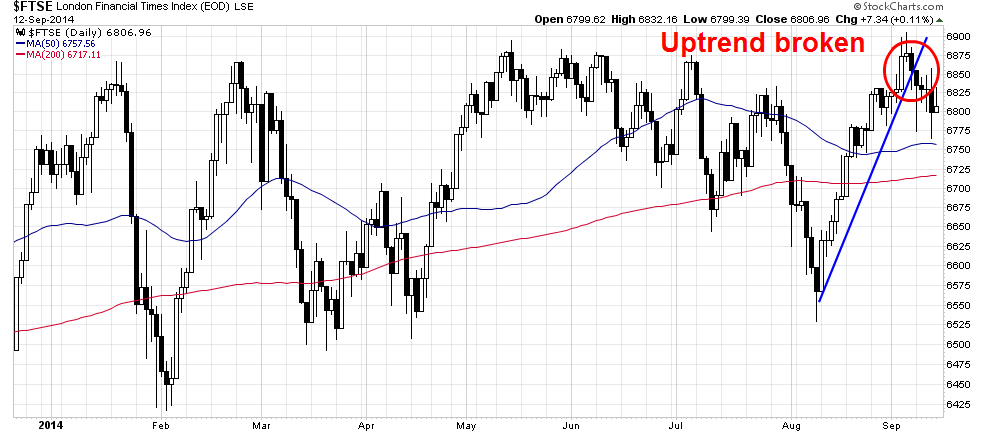

Across the Atlantic, equity markets are losing their bullish momentum as well. In particular, the UK market is getting nervous at the prospect of the Scottish Referendum.

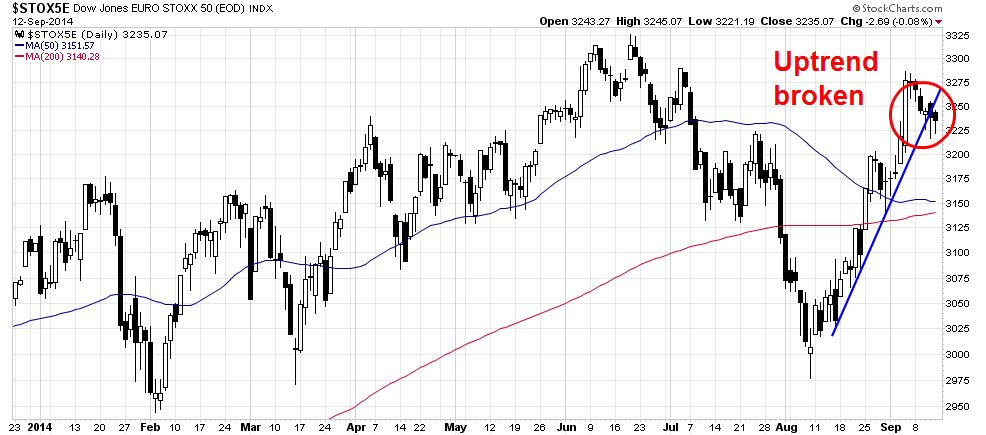

On the Continent, the Euro Stoxx 50 is showing a similar pattern of the violation of a short-term uptrend. European stocks may be reacting to several key risks. First, the French-German divide is getting wider, as embattled French President Hollande tries to win a vote of confidence and persuade Berlin to ease off on penalties as France will miss its deficit targets. These tensions are occurring in the wake of an apparent growing rift between Mario Draghi and Angela Merkel on the wisdom of continued austerity. As well, the combination of current weak growth environment and further sanctions on Russia could push Europe into a recession, creating further uncertainty, as evidenced by the sentiments voiced by Bob Shiller in a Project Syndicate essay.

As well, the interest rate environment is becoming a little less friendly. Ambrose Evans-Prichard wrote that both the US and China are edging towards tighter monetary policy:

The world financial system is at an inflection point as the US and China both switch off monetary stimulus, a form of synchronized tightening by "G2" superpowers.

Bank of America has warned clients that the glory days of "maximum liquidity" we have enjoyed in the post-Lehman era are coming to an end, with sweeping implications for asset markets across the world.

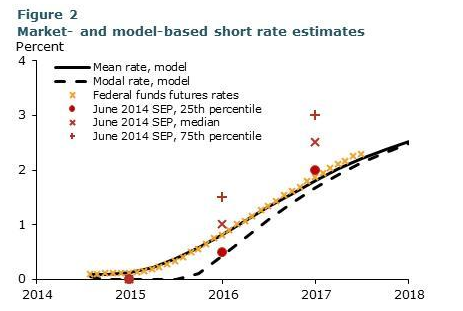

He also pointed out that the San Francisco Fed released a research note indicating that the market has become more dovish than the Fed`s own projections. Is this an implicit warning for the markets ahead of the FOMC meeting?

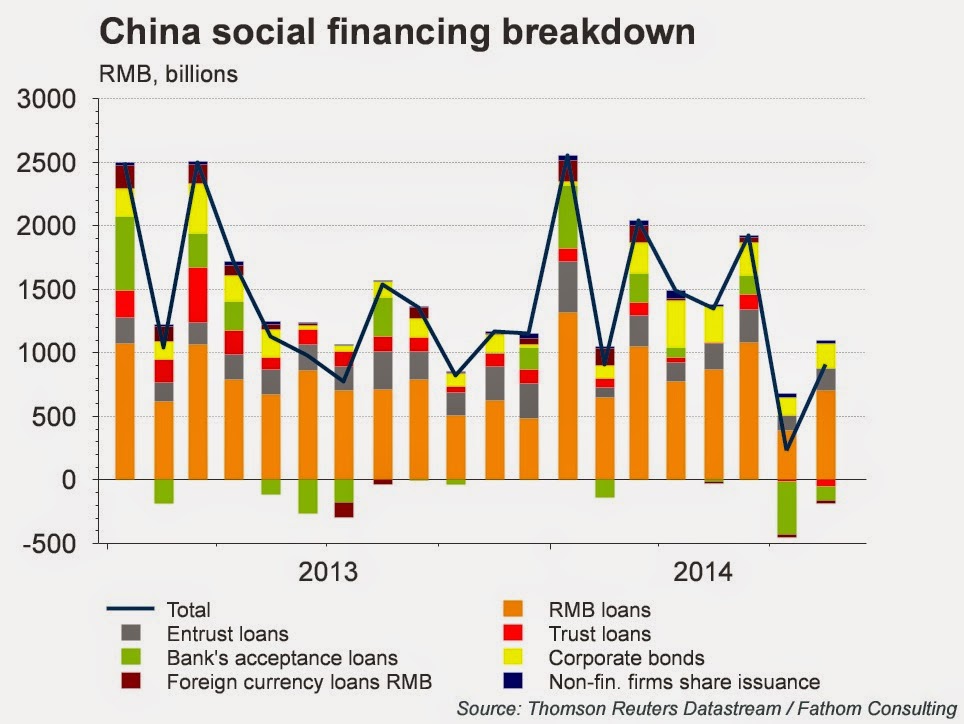

As for China, Thomson-Reuters shows that Chinese credit growth, as measured by social financing is dropping off. As credit has been a key driver to China`s economic growth, you can be sure that the pace of GDP growth will surely follow.

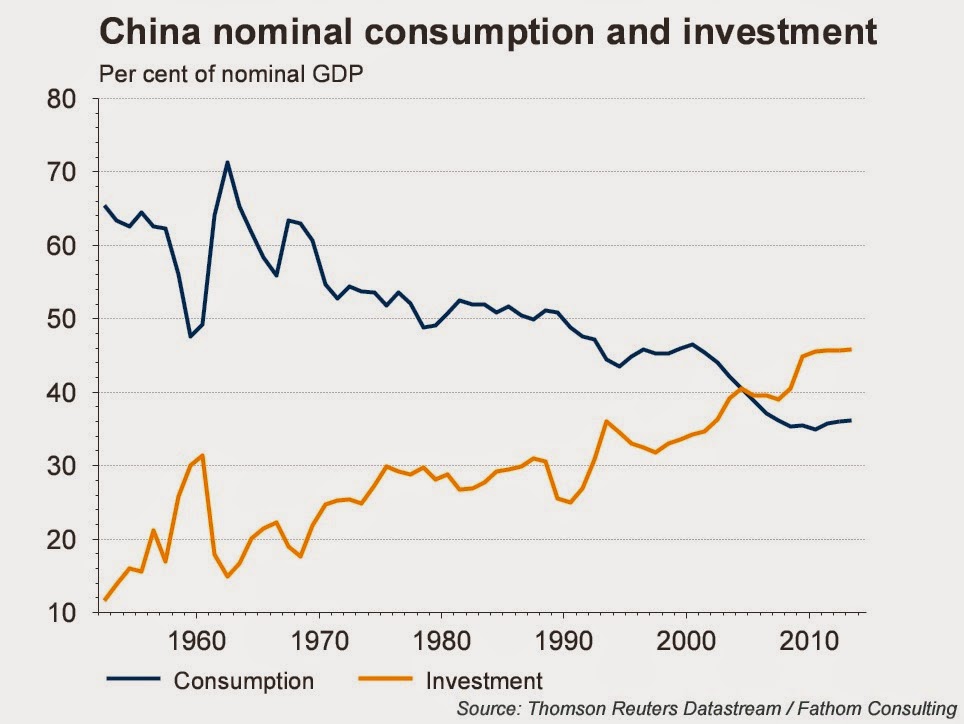

Optimists might suggest that the slowdown could be a positive sign as the economy is re-balancing from infrastructure to consumer driven growth. Unfortunately, the latest statistics show few signs of re-balancing:

Evans-Pritchard also pointed out that China is signaling that the markets cannot expect further wholesale or fiscal monetary stimulus in response to slowing growth:

In aggregate, the great central banks are turning hawkish. China's premier, Li Keqiang, sent a chill through the World Economic Forum in Tianjin this week, warning that markets can no longer count on easy money. "We are restructuring instead of expanding the monetary supply," he said.

The Communist Party is willing to endure the economic slowdown, no longer responding to each hiccup with more credit, so long as urban unemployment remains near 5pc. For now the economy is still generating 1.2m jobs a month.

China's budget reform will soon halt rampant borrowing by local governments, adding fiscal tightening to the mix. Regulators are shutting down chunks of the shadowing banking industry.

The lack of credit growth is having a real effect on the Chinese property market, which has been a linchpin of growth (also see my discussion last week of the rising risk levels at Michael Pettis on the risks of the long landing scenario):

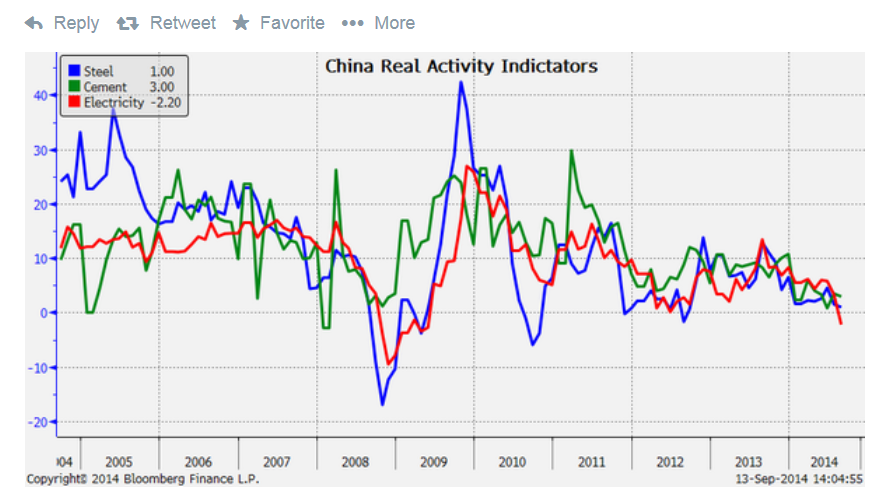

Other Chinese growth indicators are also turning south. As the chart below shows, the Li Keqiang Index is weakening, led by falling electricity usage. Indeed, the latest economic releases, namely industrial output and retail sales, came in well below expectations - confirming the hypothesis of a slowdown.

We are seeing the real-time reaction to the China slowdown in the commodity markets. Since China has been a large swing consumer of commodities, commodity prices have therefore been a sensitive barometer of Chinese growth. As the chart below shows, the CRB Index has been tanking since April. The equal-weighted CCI is faring even worse.

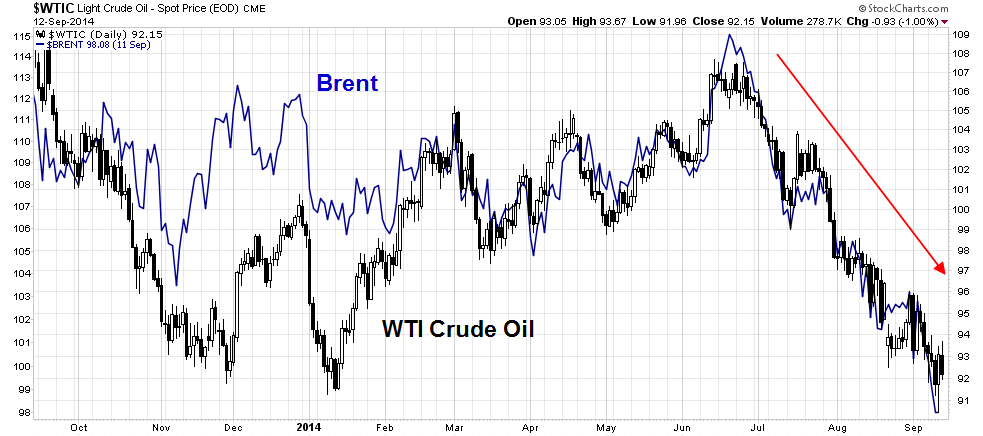

Oil markets aren`t behaving any better.

Industrial commodities, which had been holding up reasonably well, are losing momentum.

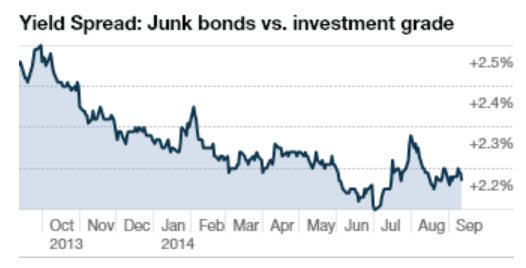

When I add it all up, it points to the start of a global growth scare which will rein in risk appetite. Already, junk bond spreads are starting to widen.

No sign of a major top

When I use the framework of market cycle analysis, the good news is I don`t see the signs of a market top. As a reminder, here is how I explained the market cycle analytical framework (see The bearish verdict from market cycle analysis):

Here is an idealized version of a market cycle and how market leadership evolves over the course of that cycle:

Early cycle: The economy is in recession or on the edge of a recession. In response, the central bank stimulates the economy with low interest rates (or unconventional policy). As a result, stock begin to rise, led by interest sensitive sectors, such as Financial and housing related stocks.

Mid cycle: Some analysts split this part of the cycle into several pieces, but here is roughly how market expectations change. The economy gets better, or is perceived to get better. More jobs are created and consumers have more money to spend. Corporations find that they start to get capacity constrained. They respond by hiring more people, which leads to a virtuous cycle of more consumer spending, and buy more capital equipment. During this part of the market cycle, Consumer Discretionary, capital equipment sensitive sectors like Technology and Industrial stocks lead the market higher.

Late cycle: The economy starts to overheat and inflation starts to tick up. At this point, inflation sensitive commodity related sectors like Energy and Materials start to outperform. The central bank responds to rising inflationary pressures by raising interest rates, which leads to...

Bear phase: The stock market falls because of the expectations of higher interest rates and falling growth. Defensive sectors such as Consumer Staples, Utilities and Healthcare outperform during this phase.

There are a number of important caveats to this analytical framework. First, this is an idealized cycle which ends with either an inventory recession or the expectations of slowdown caused by an inventory recession. What we went through was not a typical inventory recession but a balance sheet recession, which recovered very slowly.

More importantly, I am describing a market cycle and not an economic cycle. Realize that this framework is based on technical analysis and not economic analysis. A market cycle behaves like an economic cycle, but it only describes the market response to expectations, not the actual economic result. As an example, the economic cycle started at the trough of the Lehman Crisis in 2008-09, but I believe that the market cycle actually began in late 2011, when the markets got over the trauma of the debt ceiling impasse in Washington and the ECB acted to relieve the pressures of the eurozone crisis with its LTRO program.

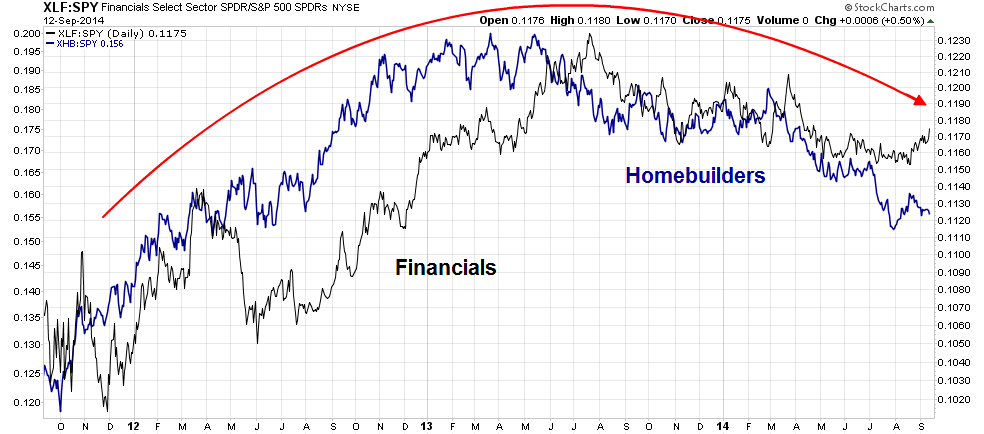

Let`s go to the charts. Here are the early cycle sectors (Financials via Financial Select Sector SPDR Fund (ARCA:XLF) and Homebuilders via SPDR S&P Homebuilders (NYSE:XHB)), which have rolled over on a relative basis. Bulls can point to the hopeful sign that perhaps the financials are starting to turn up, but the trend seems to be down, for now. (Note that these series of charts show the relative performance of individual sectors compared to the S&P 500, unless otherwise indicated).

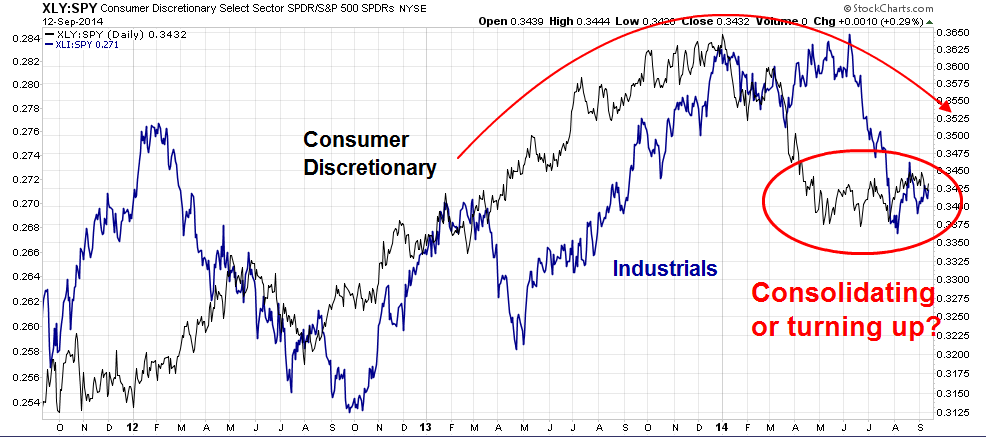

The mid-cycle sectors (Consumer Discretionary via SPDR Consumer Discretionary Select Sector (ARCA:XLY) and Industrials via Industrial Sector SPDR Trust (ARCA:XLI)) have also rolled over on a relative basis, though they may be trying to consolidate and perhaps re-take the leadership position here.

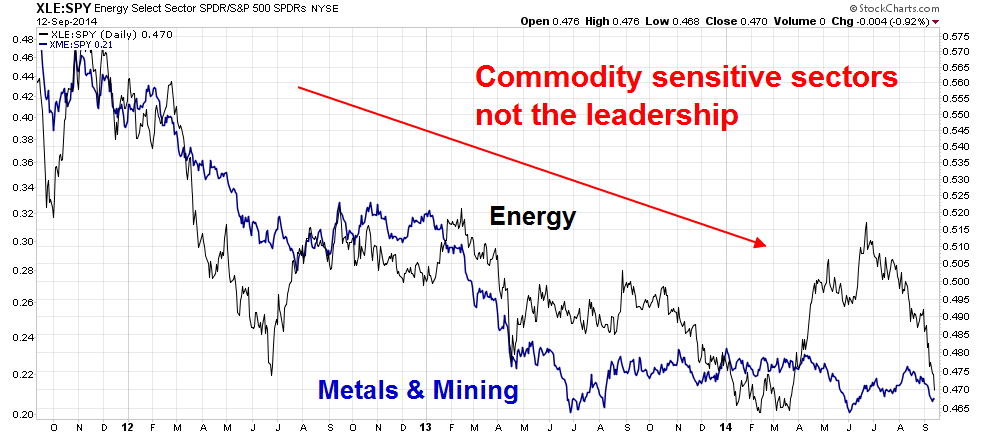

So far, the market cycle analysis picture does not look especially bullish. However, the late cycle inflation sensitive sectors (Energy via SPDR Energy Select Sector Fund (ARCA:XLE) and Metals and Mining via SPDR S&P Metals & Mining (ARCA:XME)) are not the market leaders either, which is not surprising given the weakness shown by commodity prices. This is a key indication that a major top is probably not in sight.

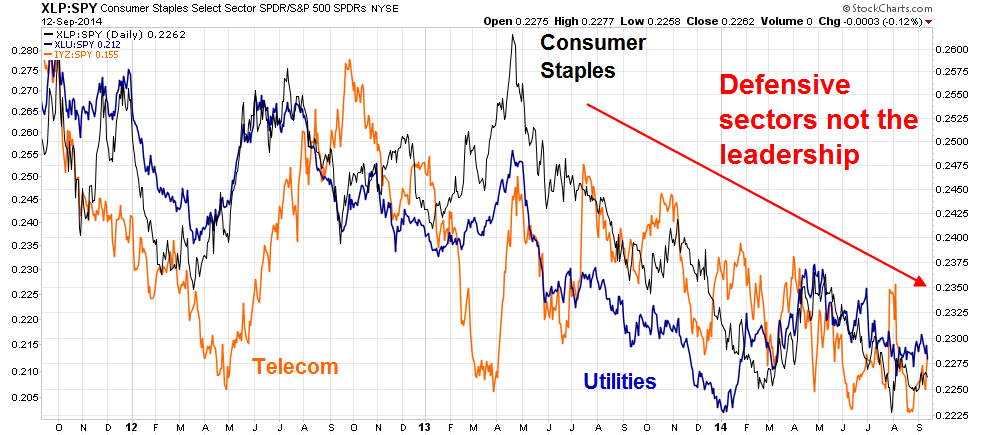

If a bear cycle was truly starting, then the defensive sectors ( such as Consumer Staples via SPDR - Consumer Staples (ARCA:XLP), Telecom via iShares US Telecommunications (NYSE:IYZ) and Utilities via SPDR Select Sector - Utilities (NYSE:XLU)) would be turning up on a relative basis. Does the relative performance chart of these sectors show that? Nope.

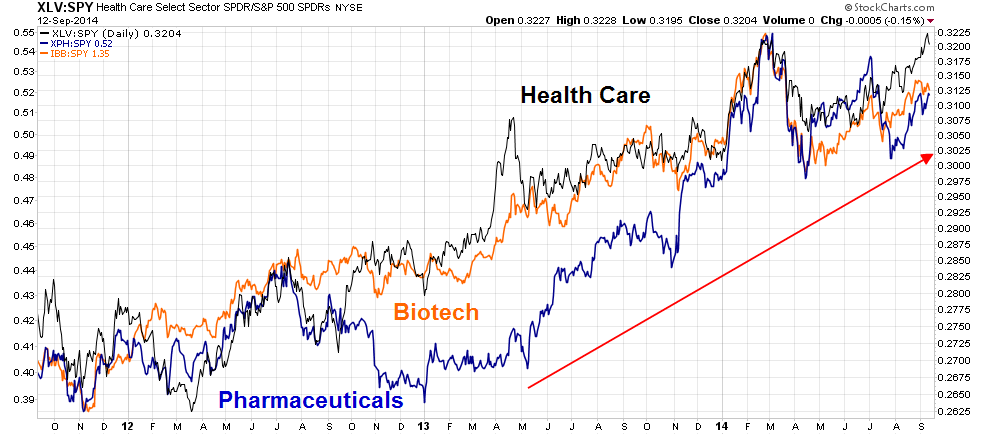

What are the market leaders? It seems that the market leadership in this cycle has been somewhat unusual. One notable market leadership sector has been Health Care (via SPDR - Health Care (ARCA:XLV). I have shown the relative performance of health care and its key components, pharmaceuticals (via SPDR S&P Pharmaceuticals (NYSE:XPH)) and biotechnology (via iShares NASDAQ Biotech (NASDAQ:IBB)). All of them have shown a steady relative uptrend against the market.

Given the steady leadership shown by health care stocks, one of the key questions is whether the sector is in a bubble. While I do not have any firm opinion as to whether we are seeing a health care bubble, Morningstar has analyzed the evolution of sector weightings over time and excessively high weights indicate an unsustainable advance. For now, their conclusion is that no sector has raced ahead of the others - indicating that even if health care is in a bubble, it is in no danger of being pricked.

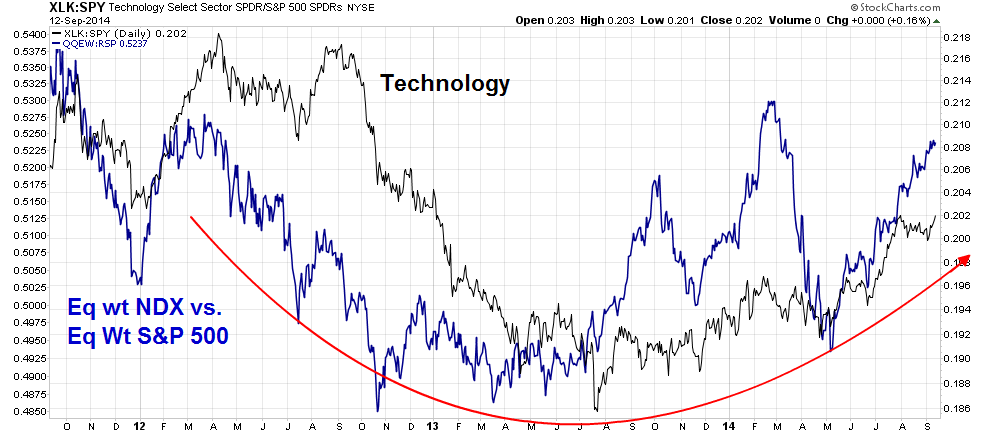

The other emerging market leader has been technology (via SPDR Select Sector - Technology (NYSE:XLK)). The sector has been bottoming out on a relative basis and has started to turn up. The upward march of this sector is not all an Apple (NASDAQ:AAPL) story. The black line in the chart below shows the relative performance of the tech sector compared to the SPX, while the blue line is the equal-weighted NASDAQ 100 relative to the equal-weighted SPX, which greatly reduces the AAPL effect.

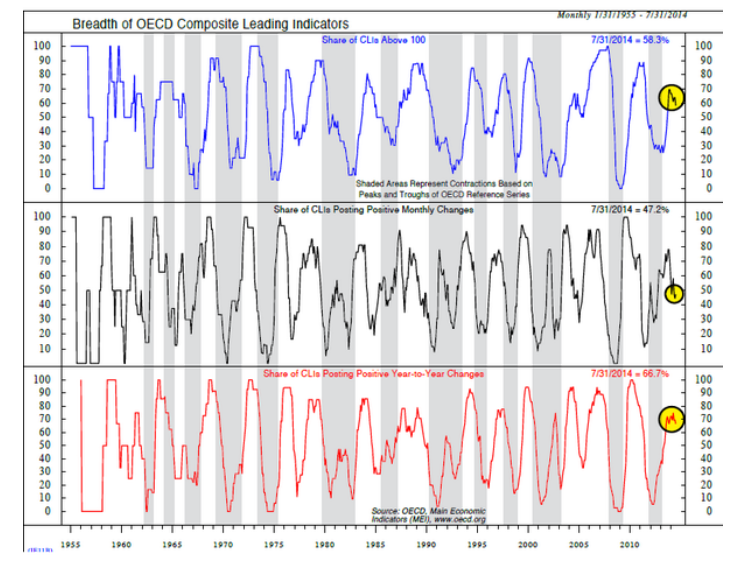

Technical analysis is the art of listening to the markets. What I am hearing from Mr. Market is that we are seeing a mid-cycle pause in growth. Analysis from Alejandra Grindal of Ned Davis Research is pointing in that direction.

A correction on the horizon?

When I put it all together, the weight of the evidence suggests that the major US equity indices are due for a pullback of some sort, but the longer term trend is still up. At this point, the depth and duration of any potential market weakness is unknown. We will have to wait to see how the fundamentals develop.

My inner investor remains relatively unfazed, as the Trend Model remains in at a risk-on signal and market fundamentals remain sound.

On the other hand, my inner trader has noted that the direction of the Trend Model change is negative, which represents a tactical sell signal. My inner investor got stopped out of his long positions last week and he has taken on a small short position. He is highly nervous as event risk this coming week (FOMC meeting, Scottish Referendum) is likely to produce volatility and a high risk of whipsaw, which is anathema to the trend following models that he is using.

Disclosure: Long TZA

Cam Hui is a portfolio manager at Qwest Investment Fund Management Ltd. ("Qwest"). This article is prepared by Mr. Hui as an outside business activity. As such, Qwest does not review or approve materials presented herein. The opinions and any recommendations expressed in this blog are those of the author and do not reflect the opinions or recommendations of Qwest.

None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that may be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions. Past performance is not indicative of future results. Either Qwest or Mr. Hui may hold or control long or short positions in the securities or instruments mentioned.