On July 9th I posted an article about my technical view on European indices. In that article, I said that despite the fears of a Grexit (that would not happen) and despite the China Stock Market sell off, European indices were showing signs of an upward reversal from important support levels and that the declines from their highs were corrective overlapping patterns.

In that post I was more optimistic than I am now. As stated in the epilogue to that article:

So should we fear for the worst? I do not believe so. I believe that we are in a corrective process and we should soon see some reversal signals. The bull market is far from being over despite all the talks about GREXIT in Europe…my belief is that this is not gonna happen.

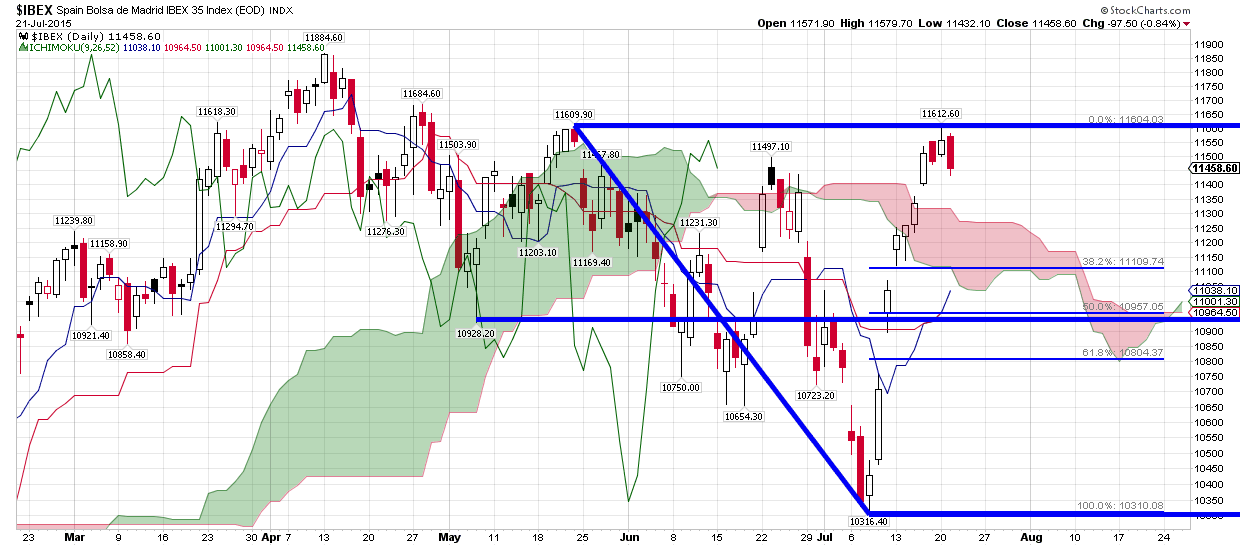

Now, after 13 days and a huge rally in European markets we are seeing again the first signs of a possible bearish reversal. Here is a chart of Spain's IBEX:

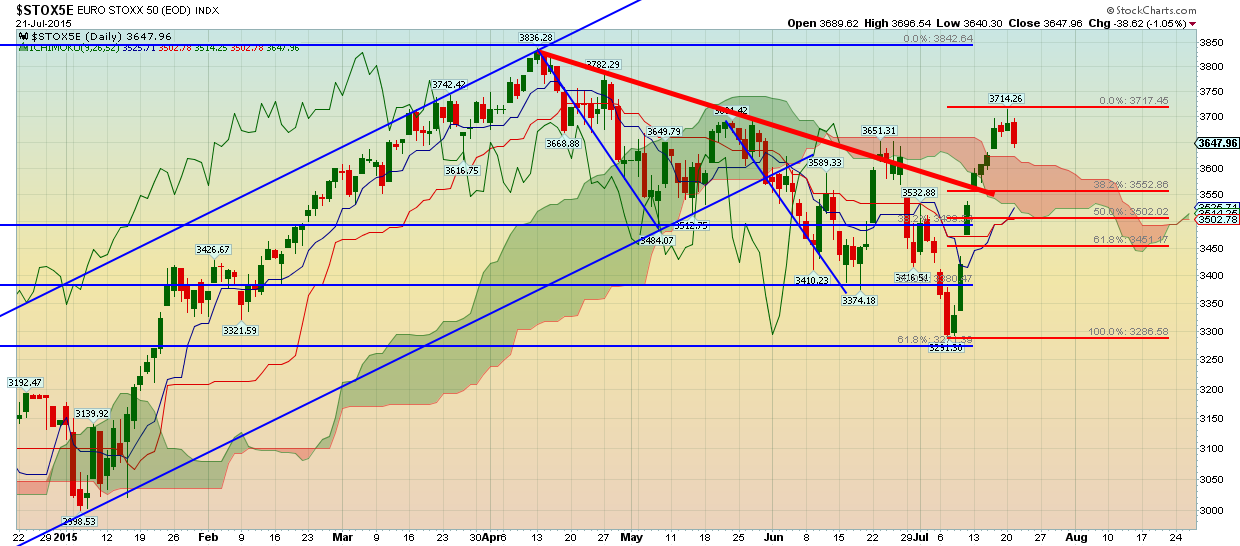

European indices (Euro Stoxx 50 chart, below) have all staged an impressive move from their July lows and it is now time for a retracement. There are two scenarios in play now. The first and most probable scenario in my opinion is for the pullback to be corrective.

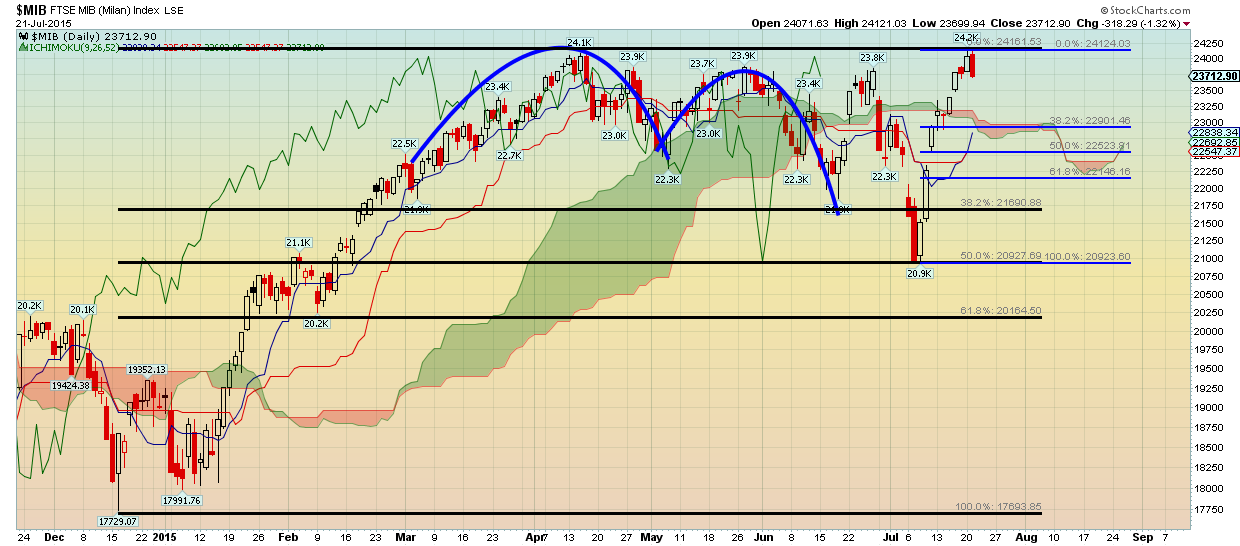

The pullback should be of a corrective pattern and should reach the 61.8% Fibonacci retracement of this latest rally. Some stronger indices (see the Italian FTSE MIB chart, below) could even see a retracement of only 38% but the overall picture implies a pull ack over the next few days. This pullback will need to hold above the July lows and then give a new bullish reversal signal that will bring the bigger and strongest upward wave to new highs in all indices. This summer is expected to be very hot…towards either direction because even the bearish scenario still has some chance of success.

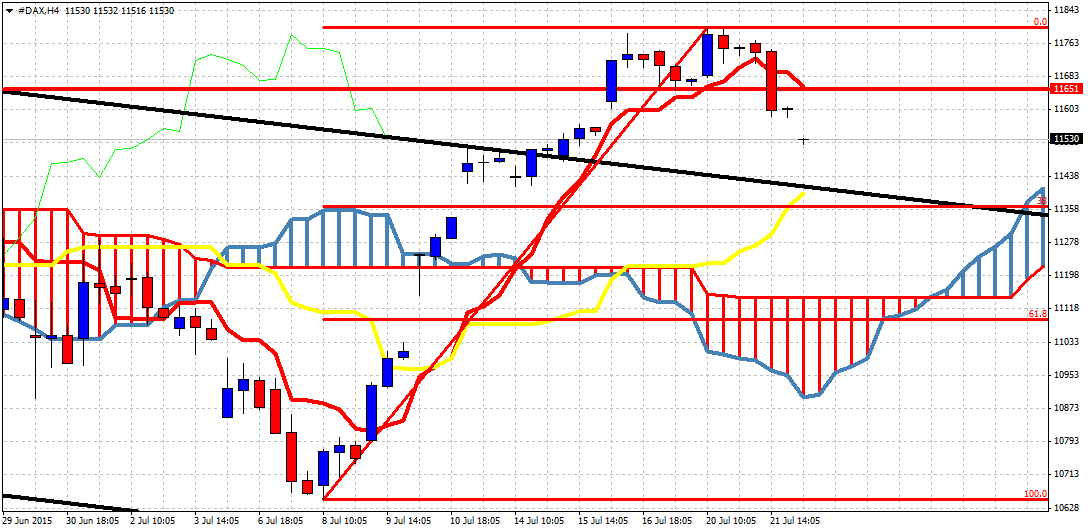

So what is the bearish scenario and how will we identify it? Since yesterday, markets are showing some weakness and have given short-term reversal signals. If this decline continues below the 61.8% retracement levels, this will be a bad sign for bulls. Bears want the indices (such as Germany's DAX, below) to hold below recent highs and break below July lows. Breaking below July lows will open the way for a much deeper correction in equities.

Bulls on the other hand will want this decline to be a healthy retracement and hold above the July lows. Then they would get confirmation of the impeding new highs once we break above yesterday highs.

Disclosure: None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that may be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions.