Market focus

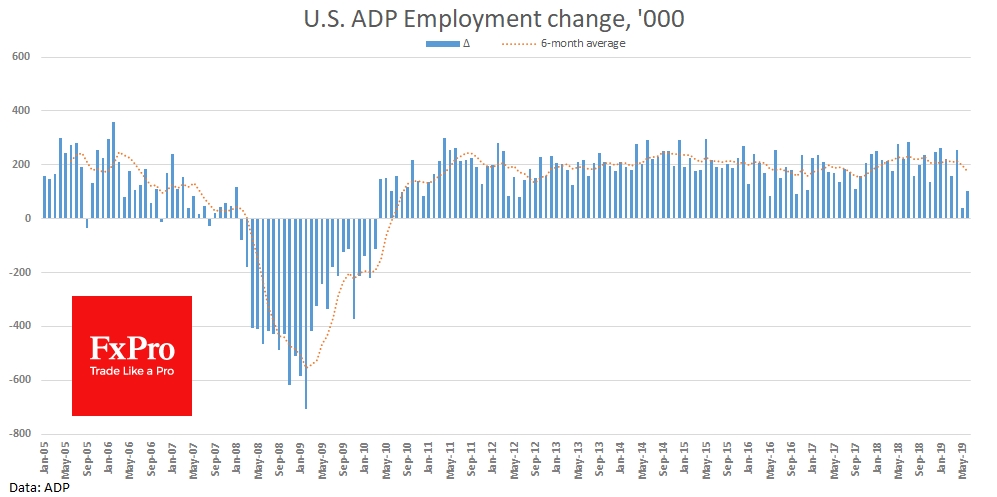

Markets switched to a mode that can be briefly described as “the worse, the better.” On Wednesday, the indices updated highs on the rather weak US macroeconomic data. The trade deficit rose to the highest levels this year, while Non-Manufacturing ISM fell to its lowest level in almost two years. June's ADP data noted an increase in the private sector employment by 102K – after 42K the previous month. This is much weaker than expectations (140K), reflecting a clear loss in employment growth in recent months. It may also hint to a weak official report, set to be published this coming Friday.

The markets are convinced that the largest central banks will come to the rescue in time. Christine Lagarde, appointed as the new Head of the ECB, is expected to maintain the position of economic stimulus. In addition, Trump has nominated two candidates – for positions in the Fed – that are inclined to a soft monetary policy, which also increases the chances of easing and supports the demand in the stock markets and puts pressure on the yield of long-term Treasuries.

Stocks

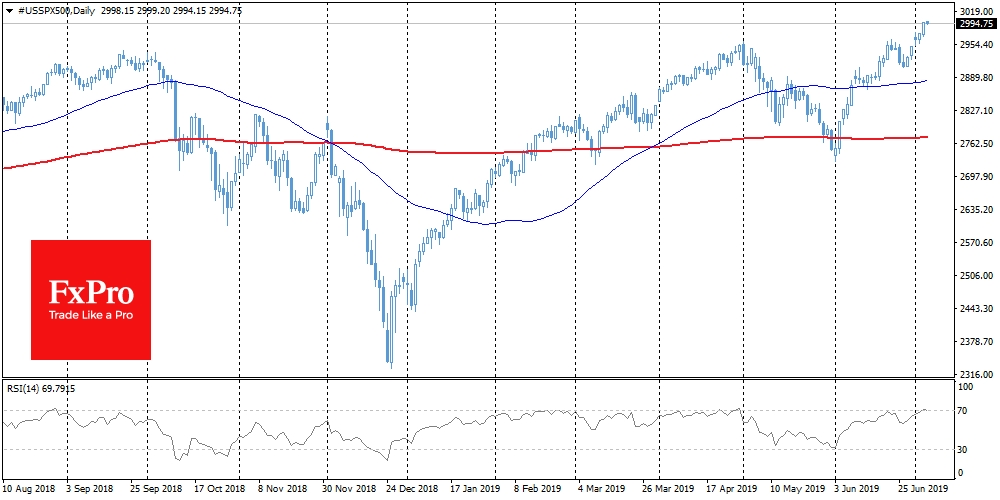

On the stock markets, investors continue to look for yielding assets, which reinforces the purchase of shares and gold. The Dow Jones and S&P 500 closed at historic highs during a shortened trading session on Wednesday. European Euro50 finished the day at the highest levels of the last 14 months.

On Thursday, due to the holiday in the United States, trading activity is expected to be suppressed, forcing it to focus on Friday's data on the US labour market. Currently, SPX is close to the psychologically important round mark of 3000, and Dow Jones is just shy of 27,000. By breaking through these levels, buyers can be inspired to proceed.

EUR/USD

Bulls did not leave attempts to move forward above 1.1300 on Wednesday. American statistics strengthened speculation about the imminent rate cut, which put pressure on the dollar quotes. However, EUR/USD was actively selling above 1.1300. Also pay attention to the lower intraday highs and lows in the pair during the last week, which reflects the strengthening position of sellers. Further pressure could be placed on the single currency rate if the ECB, as expected, does not linger with new stimulus.

The FxPro Analyst Team