Summary: The course of US politics might depend on what happens to the US economy during the past three years. Predictions are difficult, but the trend is clear: the economy is slowing.

By most metrics, economic growth peaked in January 2015. Here are graphs showing the past five years, all in terms of percent year-over-year growth. These show the trend, washing out the noise — but does not show the most recent changes.

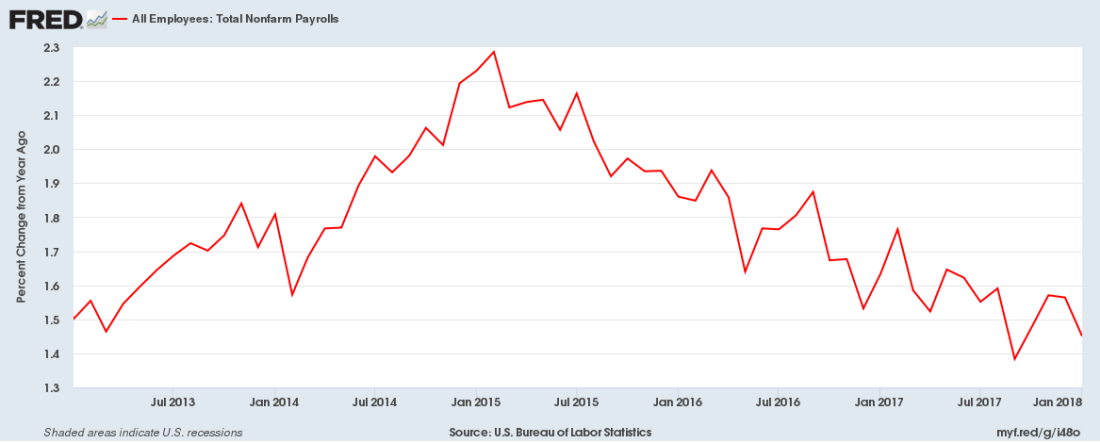

Job growth

Growth in nonfarm payrolls peaked in January 2015 at 2.3%. In January 2017 it was 1.4%.

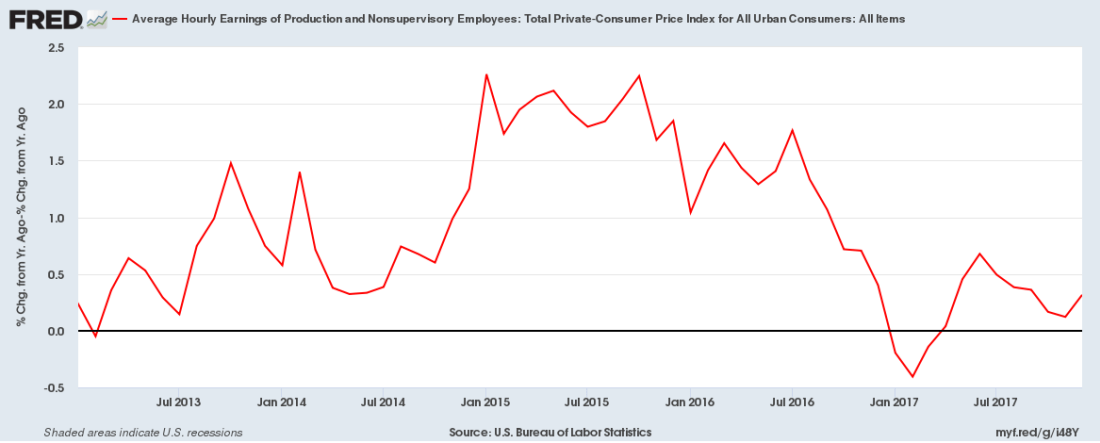

Workers’ real wages

Growth of workers’ wages per hour — wages of production and non-supervisory workers (85% of all workers) minus the CPI — peaked in January 2015 at 2.3%. In December (the last month available) it was 0.3%. It was probably roughly the same in January (hourly wages were unchanged).

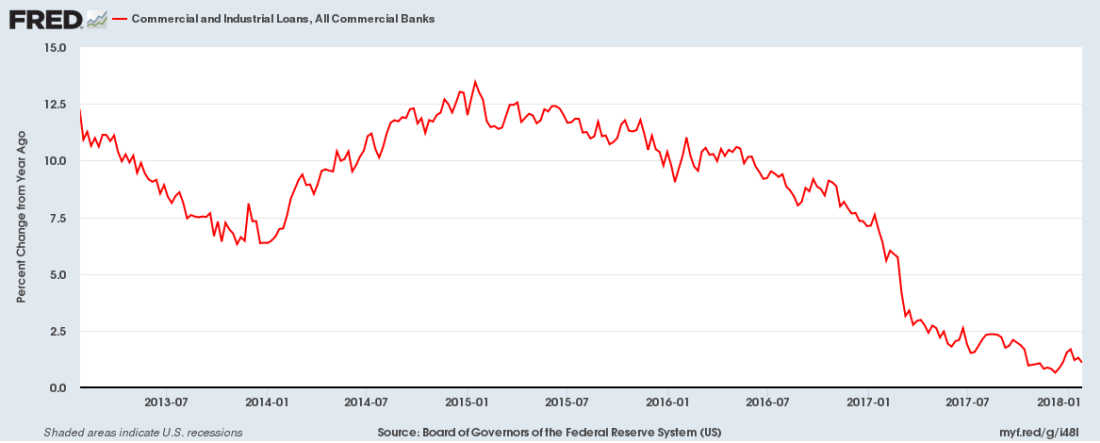

Commercial and Industrial Loans

Growth in Commercial and Industrial Loans by banks peaked in January 2015 at 13.5%. It was +1.1% in January. The largest drop was from January 11, 2018 to March 8.

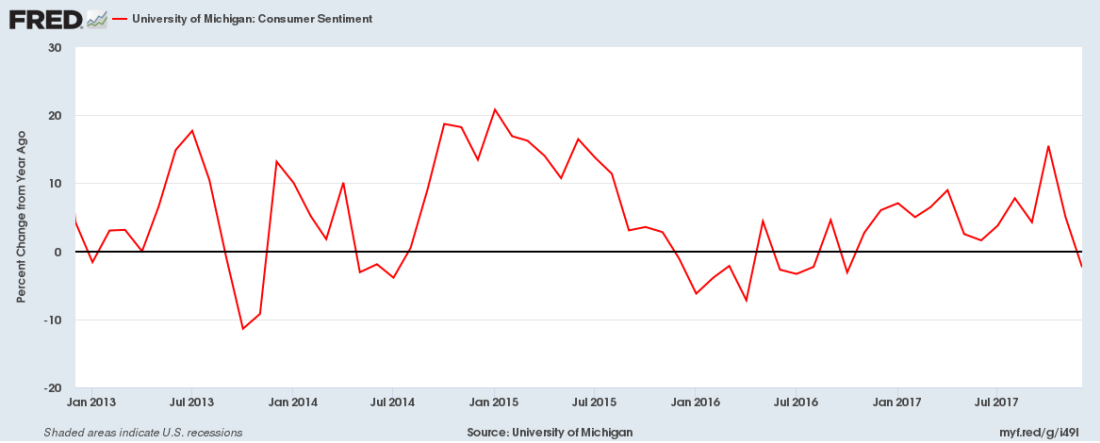

University of Michigan Consumer Sentiment Index

Improvement in this measure of consumer sentiment peaked in January 2015 at +20%. In January it was –2%. It is a leading indicator.

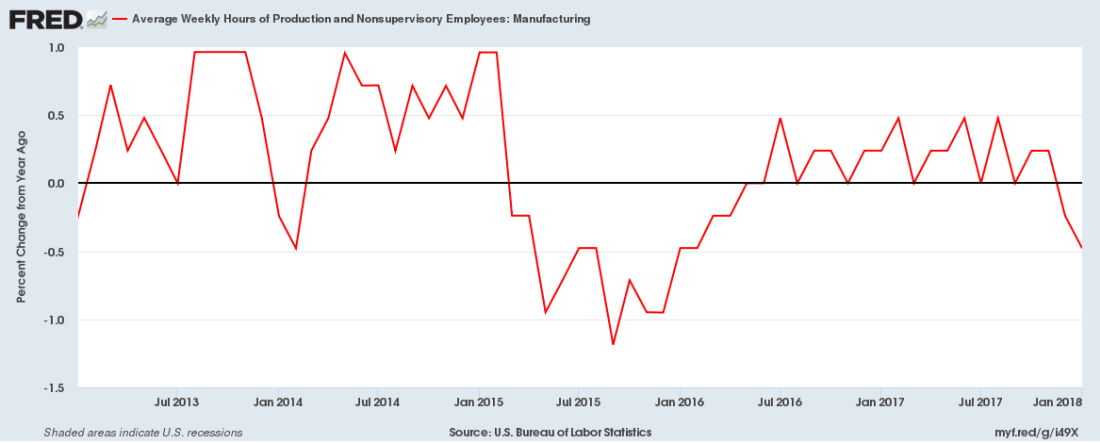

Average weekly hours

Growth in average weekly hours of production and non-supervisory workers peaked in January – February 2015 at 1%. In January it was –0.5%.

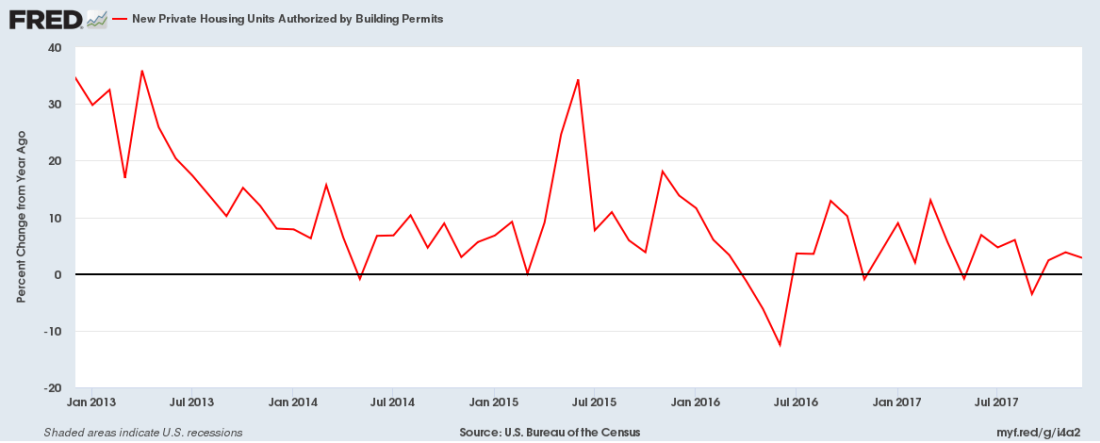

Building permits

Growth in new permits for private housing units peaked in June 2015. This is a leading indicator.

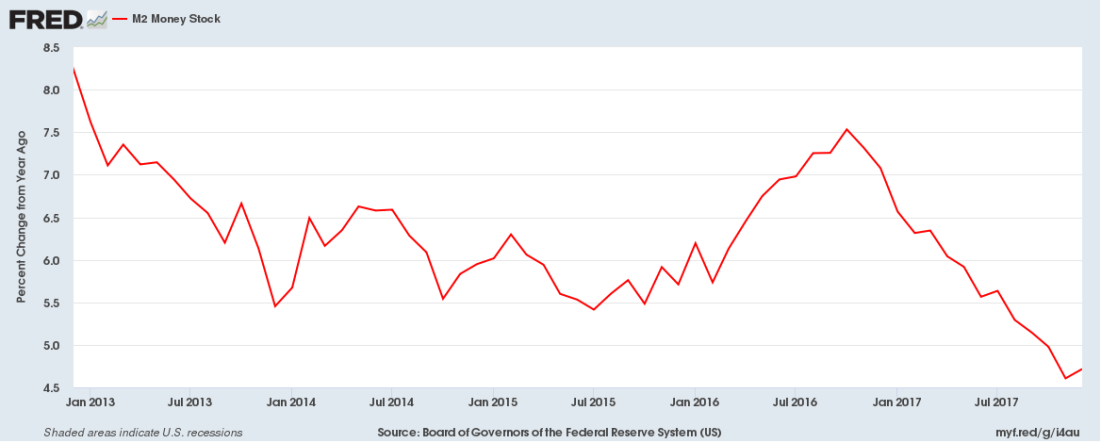

The supply of money

M2 consists of M1 (cash and checking account) plus savings accounts, money market accounts, and small-denomination time deposits (less than $100,000).

The OECD Leading Indicators look strong!

The OECD Composite Leading Indicator (CLI) for the US peaked in July – August 2014 at 101.0. It was 99.9 in November 2018. The CLI for the full OECD has followed the same path. Note: unlike the other graphs, this shows the absolute value of the CLI (not the YoY change).

Some leading indicators continue to rise

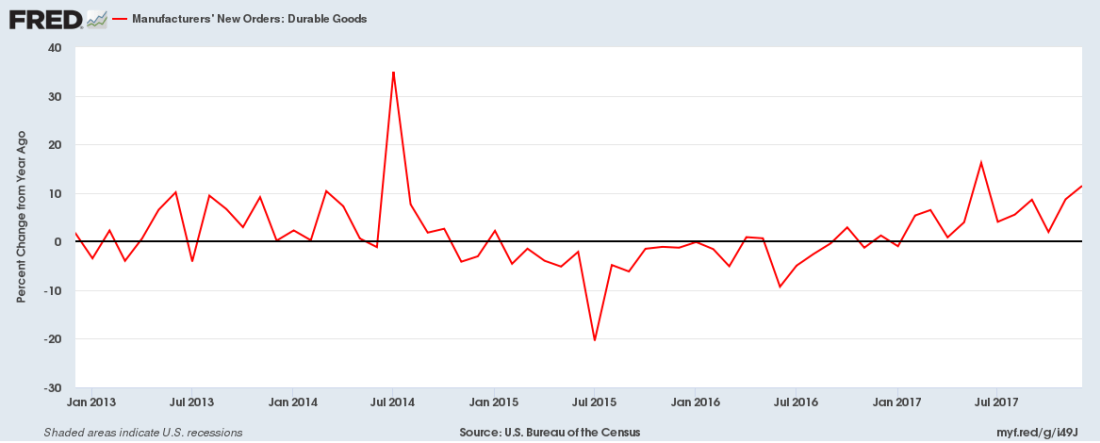

The big story: Durable goods.

Growth in new orders for durable goods are accelerating, after lagging throughout the expansion.