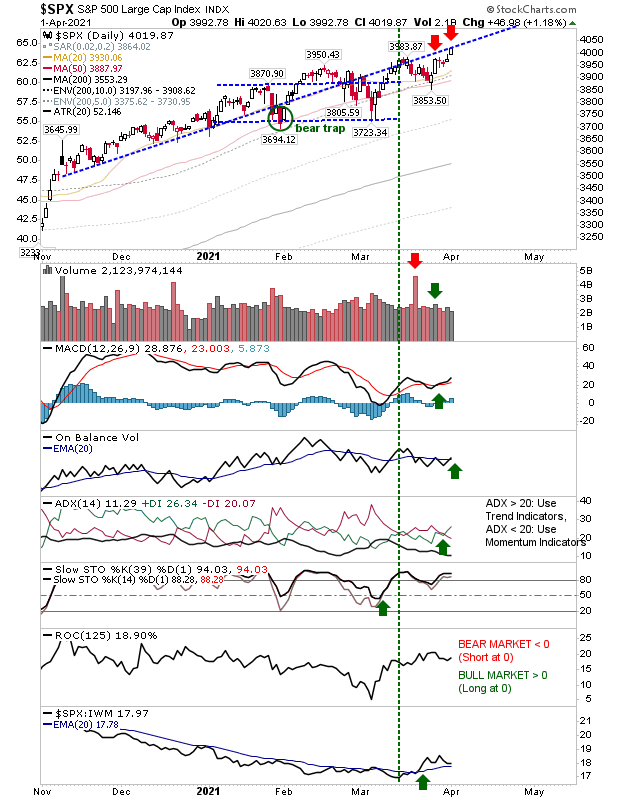

All indices made gains, but only for the S&P was it significant. Even then, the S&P still has trendline resistance to overcome despite the new closing high. Technicals for the S&P are net bullish, and more importantly, the index is a relative leader. Volume could be better, but any gain from here will be enough to clear resistance and accelerate gains.

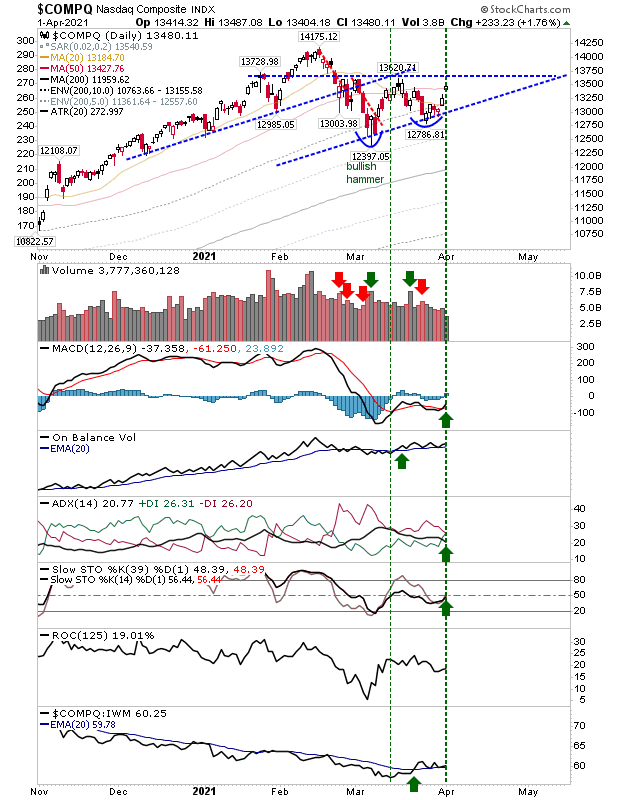

The NASDAQ managed a gain which took it above its 50-day MA, but it remains pegged by swing high resistance of both March and February swing highs. The gains in the NASDAQ came with 'buy' triggers for the MACD and stochastics as technicals return net bullish. Even relative performance is starting to see some life (relative to the Russell 2000) despite month's of successive losses.

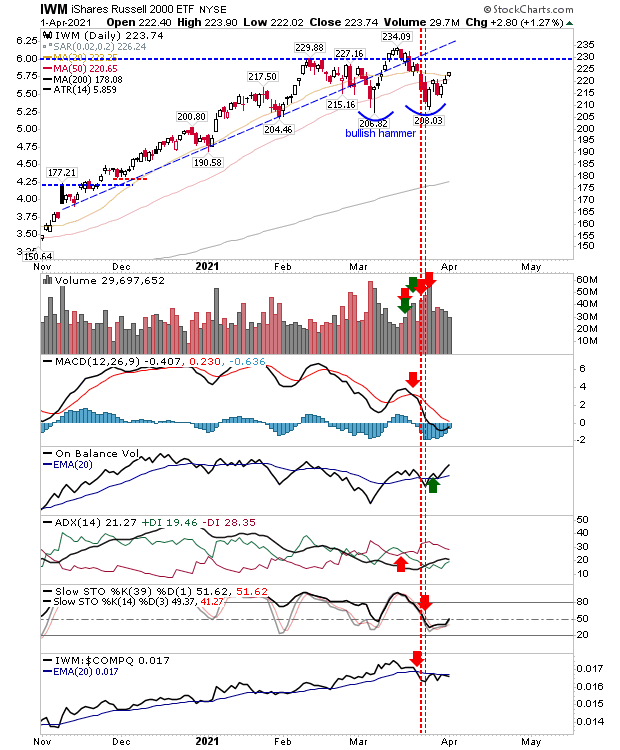

The Russell 2000 made a small gain above the 50-day MA, but technicals are more mixed; On-Balance-Volume and Stochastics are bullish, but ADX and MACD are not. The rally is lacking momentum, which is reflected in the relative underperformance to the NASDAQ. After an extended period of favor, it appears to be losing ground.

Large Caps remain flavor of the day, although there is a chance for both the NASDAQ and Russell 2000 to firm up support with a push to affirm their 50-day MA breaks.