We had a rare scenario when the #sectorbreadth analysis for the S&P 500 touched the 90% territory of overboughtness. Not surprising, yesterday's action started to see some easing off highs, although the set of candlesticks has more in common with a neutral set up - so bulls are reluctant to give up this rally.

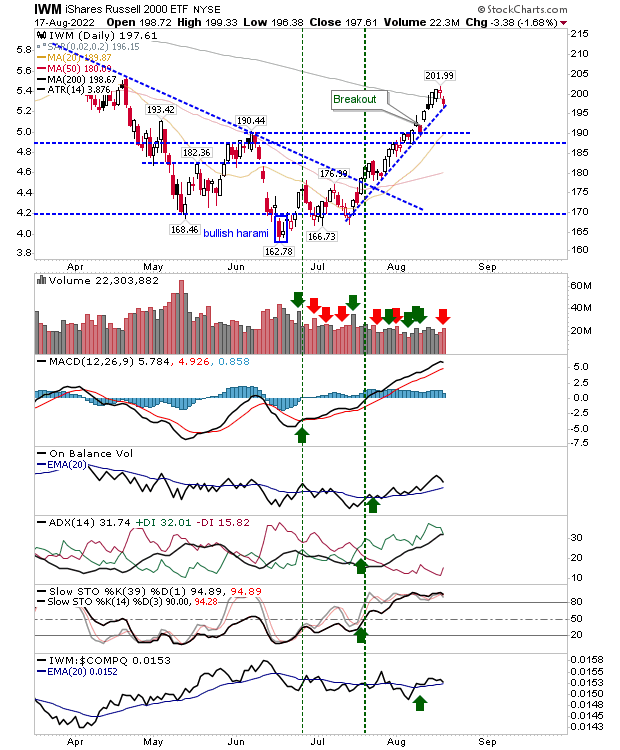

The lead index - the Russell 2000 - after pushing above its 200-day MA earlier in the week, sellers had managed to push the index back below its 200-day MA. Despite this loss, technicals remained net bullish.

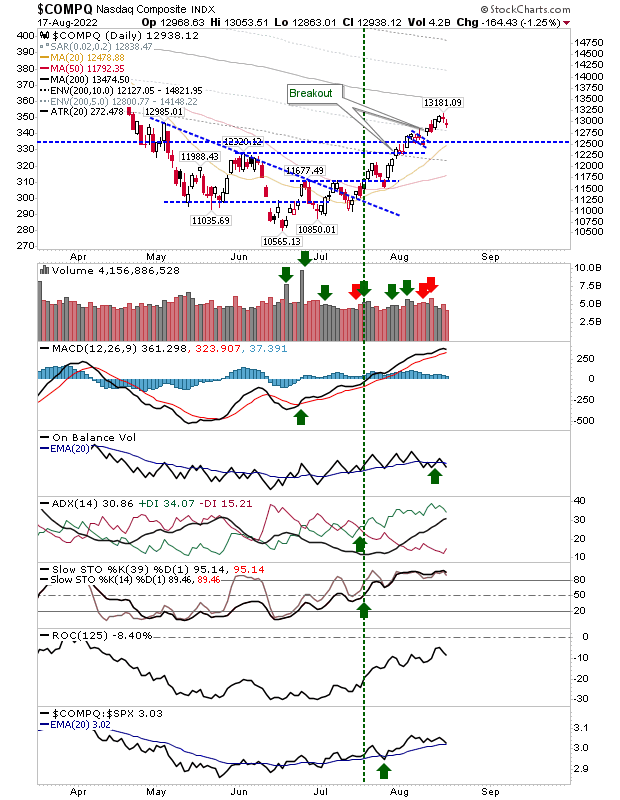

The Nasdaq similarly reversed, but did so before it made it to its 200-day MA. The two doji of yesterday and Wednesday appeared in a no-mans land between 50-day and 200-day MAs and there is plenty of room to support; the first such test is likely to be its 20-day MA. Expect further losses, but nothing likely to rate as a 'sell'.

The S&P reversed on the test of its 200-day MA in a modest move lower. Technicals are net positive, with On-Balance-Volume managing to return a 'buy' trigger despite the selling. I would be looking for a test of the June swing high (then resistance - now support).

For the remainder of the week, look for moves to test the former swing highs of May/June. The selling over the last couple of days has been modest and ideally we would want this to continue into support tests.