Market Brief

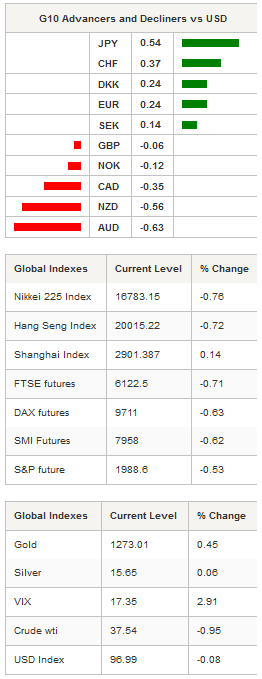

The JPY strengthened further against the US dollar amid better-than-expected GDP figures. The Japanese economy contracted -0.3%q/q in the December quarter last year, beating median forecasts and first estimates of -0.4%. In spite of this relatively good news, Japan’s economic outlook does not look constructive as private consumption showed no sign of a pick-up, while exports fell 0.8% and imports plummeted 1.4%. Overall, the lack of dynamism of the Japanese economy casts a shadow over the inflation outlook, increasing the odds of another easing move from the BoJ. USD/JPY is currently trading at around 113, down 0.45% since Tokyo’s open. On the medium-term, the pair continued to move sideways between 112.16 and 114.87.

Apart from the Japanese story, global financial markets were broadly driven by the release of the Chinese trade data. Exports fell an astonishing 20.6%y/y (in yuan terms) in February, missing the consensus of -11.7% and below the previous reading of -6.6%, while imports contracted 8.0%y/y versus -11.7% expected and -14.4% in January. Just a couple of days after the NPC unveiled the new GDP target range of 6.5%-7%, the massive drop in exports and sluggish imports raises concerns about the country’s ability to meet this new objective. As a result, traders lost confidence in the current rebound and dropped riskier assets to rush into safe haven ones. Gold rose 0.45% to $1,273 an ounce, while other commodity prices turned red. Copper was down more than 1%, palladium fell 1.15%, while the West Texas Intermediate plummeted 0.95% to $37.54 a barrel.

On the FX market, the Swiss franc and Japanese yen gained ground as risk-off sentiment returned. USD/CHF fell almost 1% from Monday’s high, down to 0.9915 from 1.0012. On the upside, a resistance can be found at 1.0038 (high from February 29th), while on the downside a support lies at 0.9847 (low from February 16th). Overall, the wait-and-see attitude of the market ahead of the ECB meeting will likely prevent major moves on the FX market but it would however favour safe haven currencies such as the Swiss franc. After rising 1.20% last week, EUR/CHF was able to consolidate slightly below the 1.10 threshold as fears of a SNB intervention kept short-sellers on the sidelines. However, as we are get closer to the ECB meeting, the risk remains clearly on the downside for the pair.

On the equity market, European futures are blinking red across the board, following the negative lead from Asia. The Footsie was down 0.71%, the DAX fell 0.63%, while in Switzerland the SMI was down 0.62%. US futures are also trading lower as the S&P fell 0.53%, while the Nasdaq was down 0.64%.

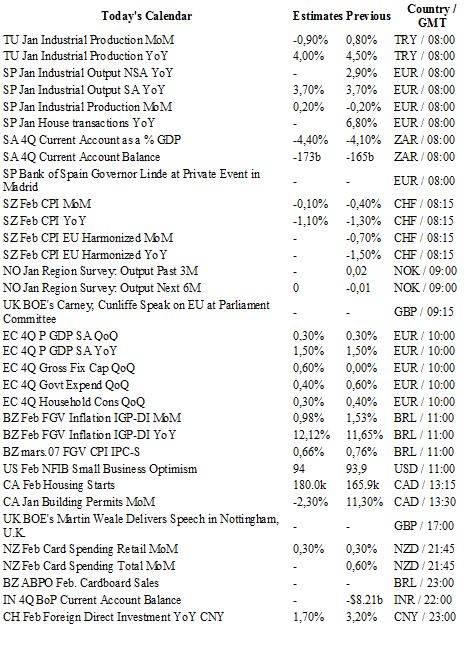

Today traders will be watching the unemployment rate from Switzerland; industrial production from Germany, Turkey and Spain; current account balance from South Africa; CPI from Switzerland; GDP from the eurozone; housing starts and building permits from Canada.

Currency Tech

EUR/USD

R 2: 1.1193

R 1: 1.1068

CURRENT: 1.1026

S 1: 1.0810

S 2: 1.0711

GBP/USD

R 2: 1.4591

R 1: 1.4409

CURRENT: 1.4239

S 1: 1.3836

S 2: 1.3657

USD/JPY

R 2: 117.53

R 1: 114.91

CURRENT: 112.92

S 1: 110.99

S 2: 105.23

USD/CHF

R 2: 1.0257

R 1: 1.0074

CURRENT: 0.9912

S 1: 0.9847

S 2: 0.9660

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.