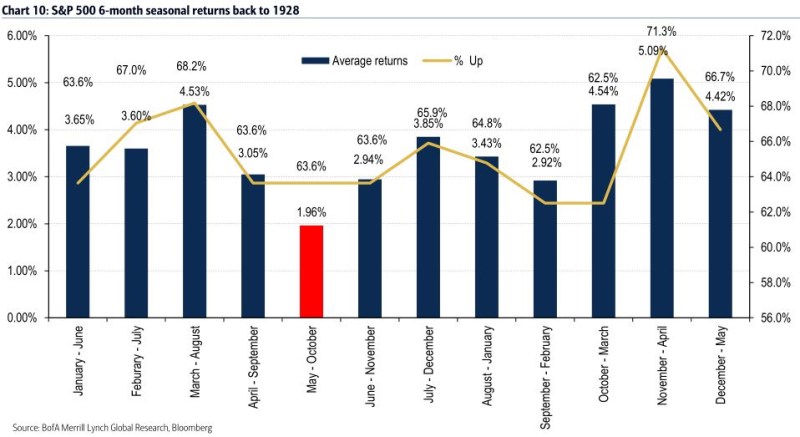

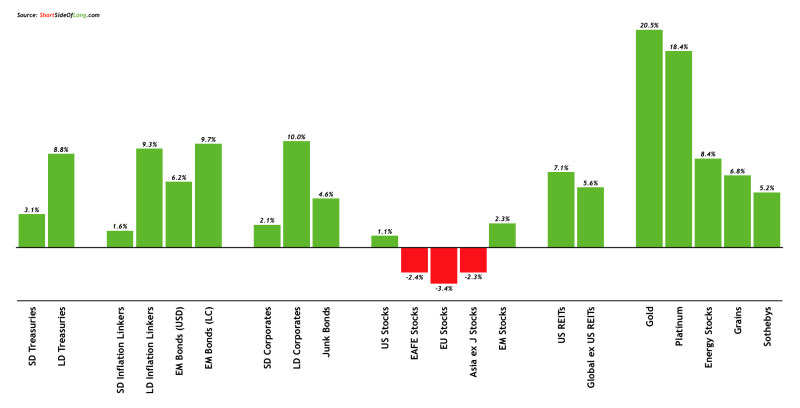

I am currently writing from a very warm and extremely humid Saigon (or Ho Chi Minh City), where change is coming – the rainy season is about to start. The interesting fact about this change in weather phenomena is its close similarity and correlation to the stock market seasonality. Saigon’s rainfall increases dramatically from May to October, while the dry season occurs from November to April. Likewise, the most disappointing period of stock market performance is May to October, while outperformance occurs from November to April. I’m sure we have all heard the famous “Sell In May & Go Away” quote. This year, we enter May with the following year-to-date performance for major asset classes:

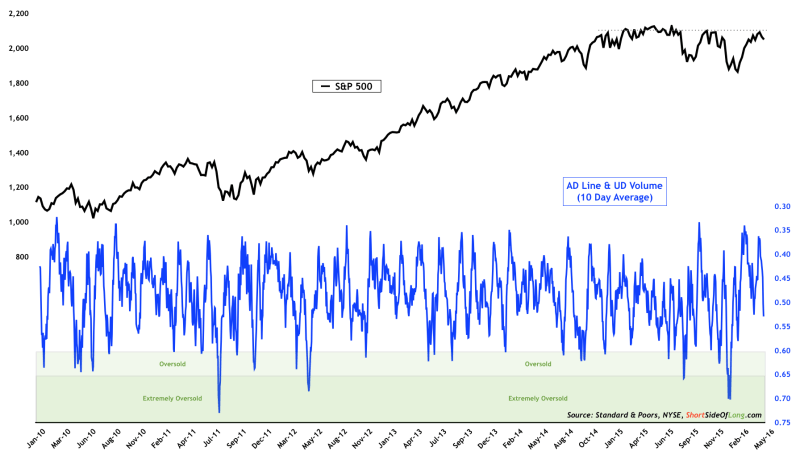

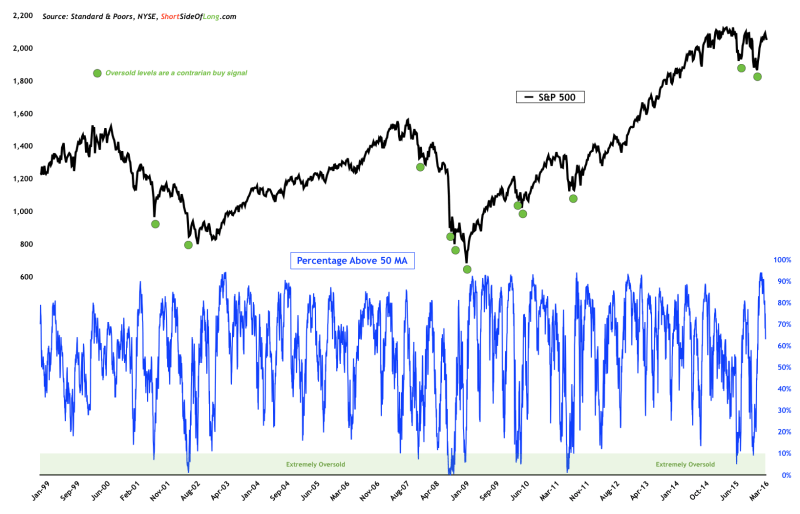

What stands out to me is the underperformance of global equities against all other asset classes. It is worth mentioning that the oversold conditions and extremely pessimistic sentiment in February led to a sharp rally over the last 10 weeks (we discussed these points in our mid Feb post). With seasonality now turning negative, I would advise my readers to exercise caution. Vertical rallies, such as the one we recently witnessed in the S&P 500, are not sustainable on annualised basis. Certain market pundits have advised buying the recent dip, but we would argue in the following several charts, that the market isn’t oversold just yet:

- Chart 1: Advance decline line & up down volume averaged over 10 trading days haven’t fallen enough to signal oversold conditions.

- Chart 2: percentage of S&P stocks trading above their 50 day moving average hasn’t even fallen below neutral levels yet.

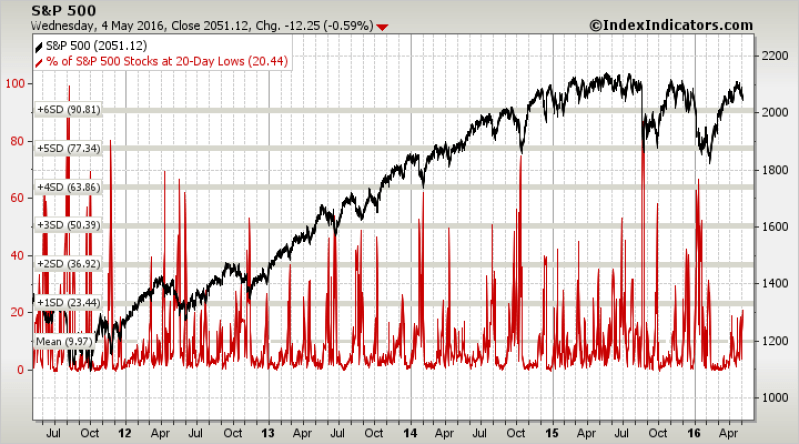

- Chart 3: percentage of S&P stocks trading at 20-day new lows hasn’t spiked to at least 50% of the index components.

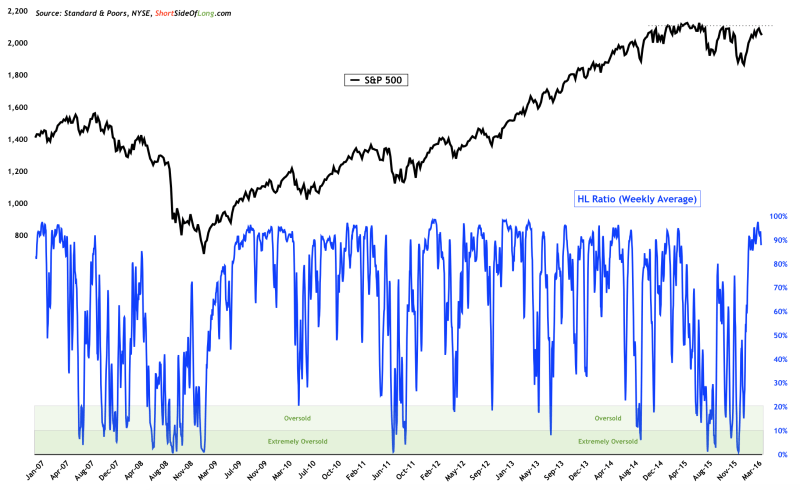

- Chart 4: NYSE 52-week new highs versus 52-week new lows ratio still remains elevated and not even close to neutral levels.

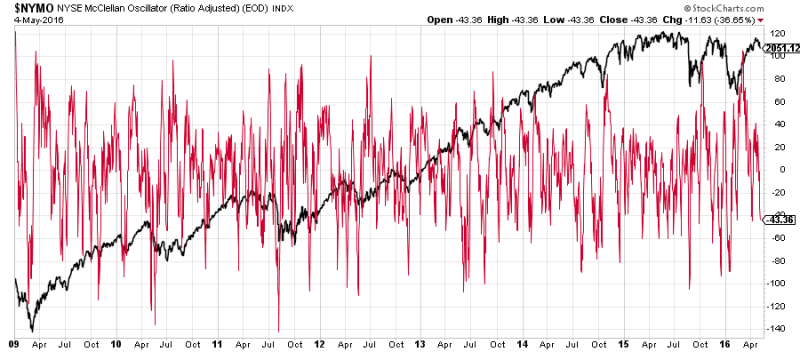

- Chart 5: NYSE Mcclellan Oscillator is close to becoming oversold, but we would prefer lower readings of around -80.

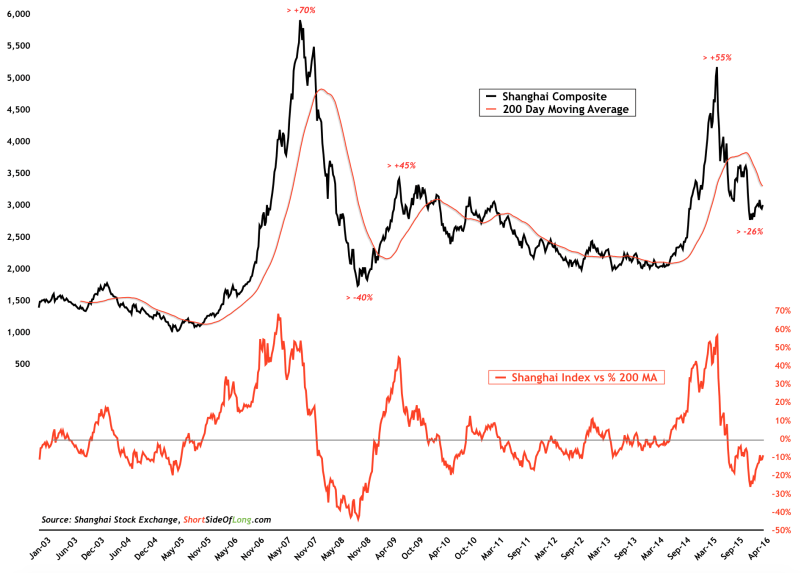

More importantly, the bull market has entered its 7th year and has tripled since March 2009. It should not be a surprise to any shrewd investor that valuation statistics rank US equities as very expensive. Therefore, is it even worthwhile trying to “pick up a few pennies in front of a steamroller?” Investors who remain bullish on stocks as an asset class, should look abroad towards more attractive foreign markets. In particular, emerging markets remain cheap despite the recent 25% rally. Personally, I do not see much opportunity in any stock market apart from China and Vietnam. Regular readers of this blog might remember our bearish China case from July 2015 newsletter:

Here I am making an extremely significant point. I want my readers to understand that when it comes to investing, any financial asset including the stock market can (at times) completely disconnect from reality, fundamentals and common sense. Markets are ruled by human emotions just as much as intellect, mainly greed and fear.

While I am bullish [on China] from the long term perspective, I do not think that a buying opportunity is present just yet. While the 30% fall in four weeks is a serious crash by any standards, I hold a view that the market hasn’t finished its mean reversion just yet (please observe the chart above). The recent speculative rally took the Shanghai Composite price more than 55% above its 200 day moving average. There are definitely similarities to the previous two peaks in October 2007 and August 2009, which traded 70% and 45% above 200 day moving average respectively.

Historically, periods when asset prices trade excessively above the mean, are usually followed by a reversion where prices also trade below that mean. Vigilant investors among you should notice that the index is still trading more than 16% above the 200 day MA and if history is of any guide, price will eventually find its way below this mean.

Several investment banks that missed almost the entire rally, as they stubbornly carried on with their neutral outlook (code word for remaining bearish) through the 2013-14 bottoming period, have recently started recommending their clients “to bottom fish” the crash. Majority of these investment bankers are usually too early to buy the fall and always too late to participate in the new rally.

We have stayed patient all this time and are now hoping for the final leg down in mainland Chinese shares, which have become one of the worst performing stock markets over the last 12 months. There is a strong support around 2,500 points on the index and a fall towards this level would entice us to start our purchases. Investors can use ASHR ETF in United States to play this stock market.

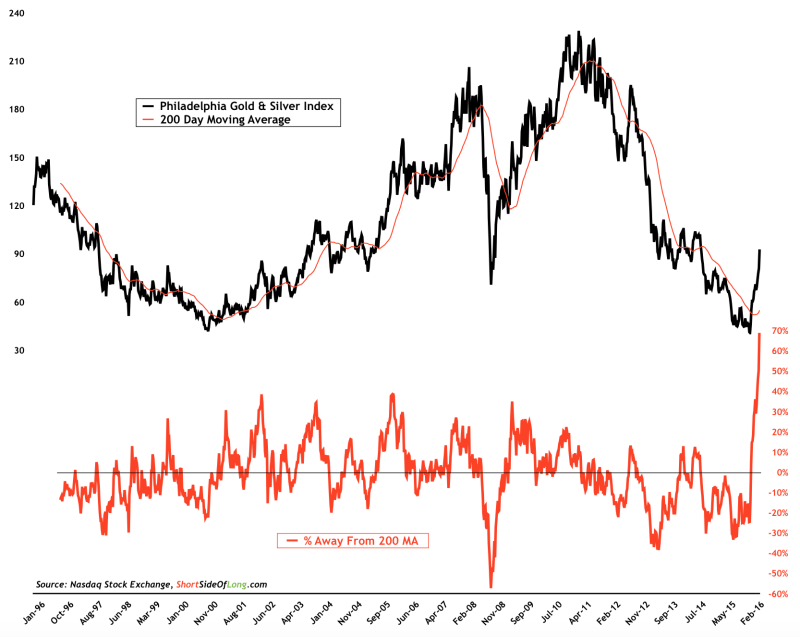

The analysis mentioned above, regarding Shanghai’s rally above its 200 day moving average, can also be applied to the recent surge in Gold Miners. Firstly, I would like to congratulate any speculator who has managed to catch this movement in price, the most powerful short term rally in several generations. I would shake your hand twice over if you caught the Silver Junior Miners rally, which are up more than three fold since January. Regardless of whether one believes Gold has embarked on a new bull market or still has further correcting to do, the rally in Gold Mining equities is extremely… and I repeat, extremely overbought from the short term perspective. The price will soon revert back towards its mean, so we opened some short positions against the GDX (NYSE:GDX) ETF at the start of the week and would like to add a few more if given the opportunity.

I have spent the last several months coming and going out of Vietnam. Out of the whole South East Asia region, which has great prospects for future growth, to me Vietnamese economy stands out above the rest. Surprisingly, the stock market (priced in USD) has barley responded and it is here that we find a great opportunity. After dropping almost 85% during the Global Financial Crisis of 2008, the nations equities have largely moved sideways and remain depressed after long eight years (prolonged base-building phase). If one holds a view that just about all financial asset prices (especially S&P 500) are artificially juiced up by central bank easing, then Vietnamese equities have NOT even had a whiff of that sugar high. This market is all but forgotten and thats the way we like it. We started buying recently.

Close family friends from the very remote Papua New Guinea came to visit me in Vietnam recently. They were also pleasantly surprised by the booming economy and saw huge opportunities. I’ve been invited to visit their beautiful country very soon, and I plan to post a lot of picture from this untouched part of the world. I’m sure at least some of you will be interested to see this these amazing beaches and tropical rainforests. Finally, next week I shall be returning back to Hong Kong for awhile, so any readers who would like to catch up and discuss financial markets over a coffee or a beer, please do not hesitate to email me.