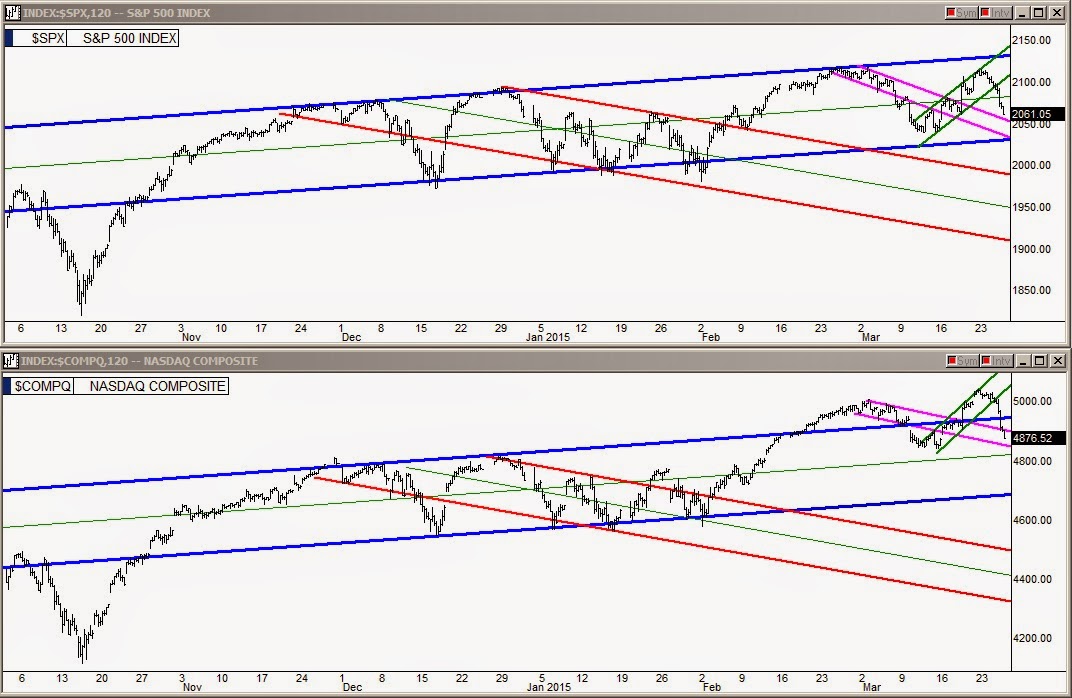

The selling began accelerating in the market yesterday as the indices followed through on slipping out of the March uphill green line channels from Tuesday. Looking at the charts below, it is easy to see that the NASDAQ is in a lot better shape than the S&P 500 as it is likely to catch support in its pink channel on Thursday. However, the S&P won't catch support on the lower line of its pink channel until it is nearly down to the lower line of its long-term blue channel line.

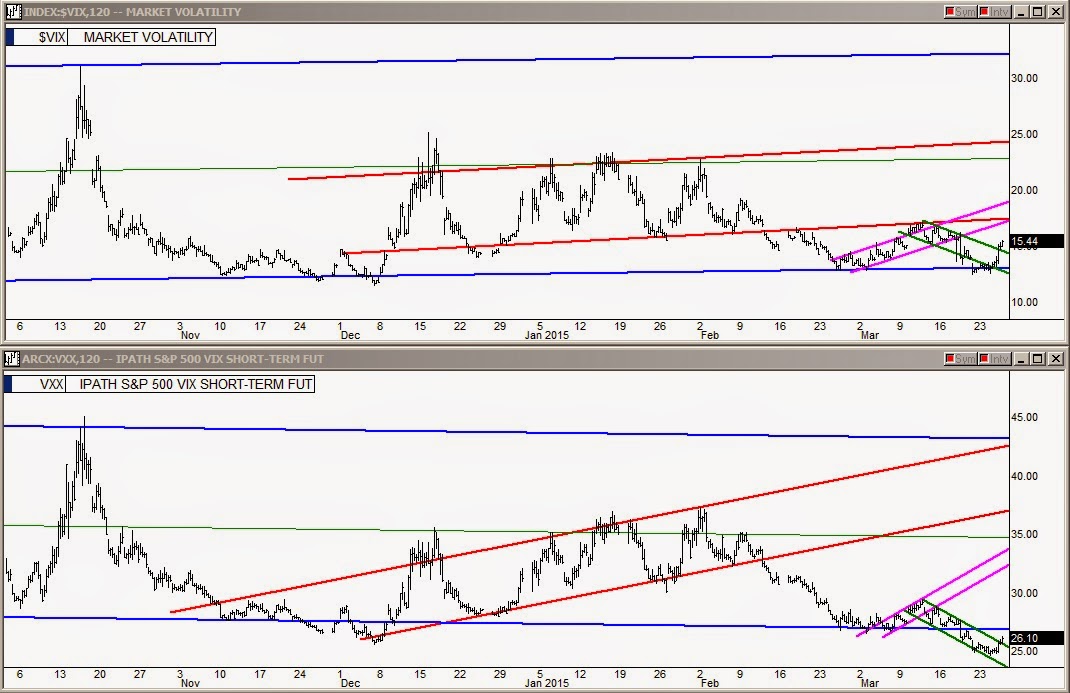

Taking a look next at the VIX and iPath S&P 500 VIX Short-Term Futures ETN (ARCA:VXX) charts below, we see a fairly sizable reactionary move in the VIX, but comparing it to the not so volatile move in the VXX, it looks as though traders are still convinced that Yellen's SPY and QQQ buying algorithms will save the day shortly as they always have.

I'm not sure that it is a good assumption, believing that Yellen will never, ever let this market have a substantial correction.