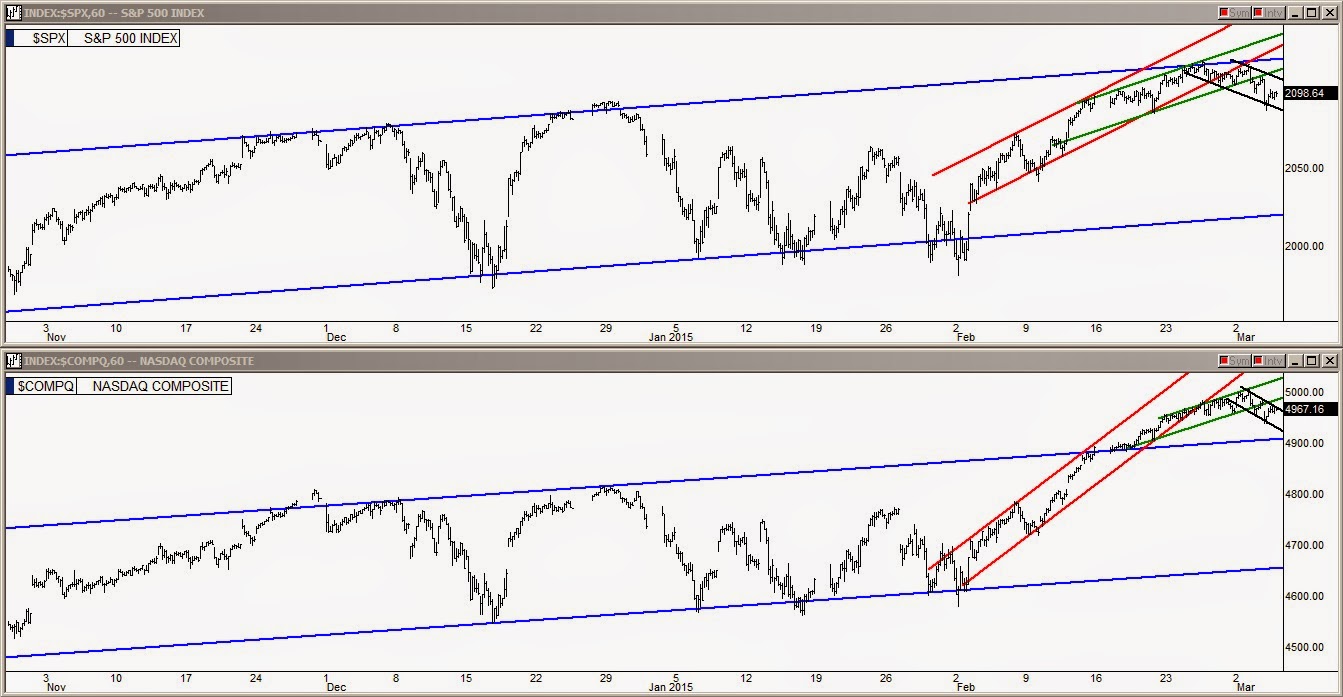

In the market Wednesday, the stock indices suffered another modest loss as they continue to establish declining channels. After peaking, the S&P 500 and NASDAQ skipped the traditional two to three days of sideways movement and instead went directly into the black descending channels after leaving the secondary green line ascending channels shown in the charts below.

The selling that has materialized so far has not produced an equally comparable rise in the CBOE Volatility Index and iPath S&P 500 Vix Short Term Fut (ARCA:VXX). The VIX & VXX moves remain somewhat subdued compared to the decline in the S&P and Nasdaq as shown in the charts below.

Traders and investors remain complacent about the downward travel so far, likely assuming that the Fed's buying algos will be switched back on before any more damage is done to the S&P and Nasdaq. This is probably a reasonable assumption but we will have to wait and see if they actually do step in and break the stock indices back up out of these descending channels for the purpose of building a second top. If they don't we are likely to see a continued decline in the S&P and Nasdaq with a lot of bounces planned at every possible EMA pair and intraday channel to keep the shorts at a minimum.