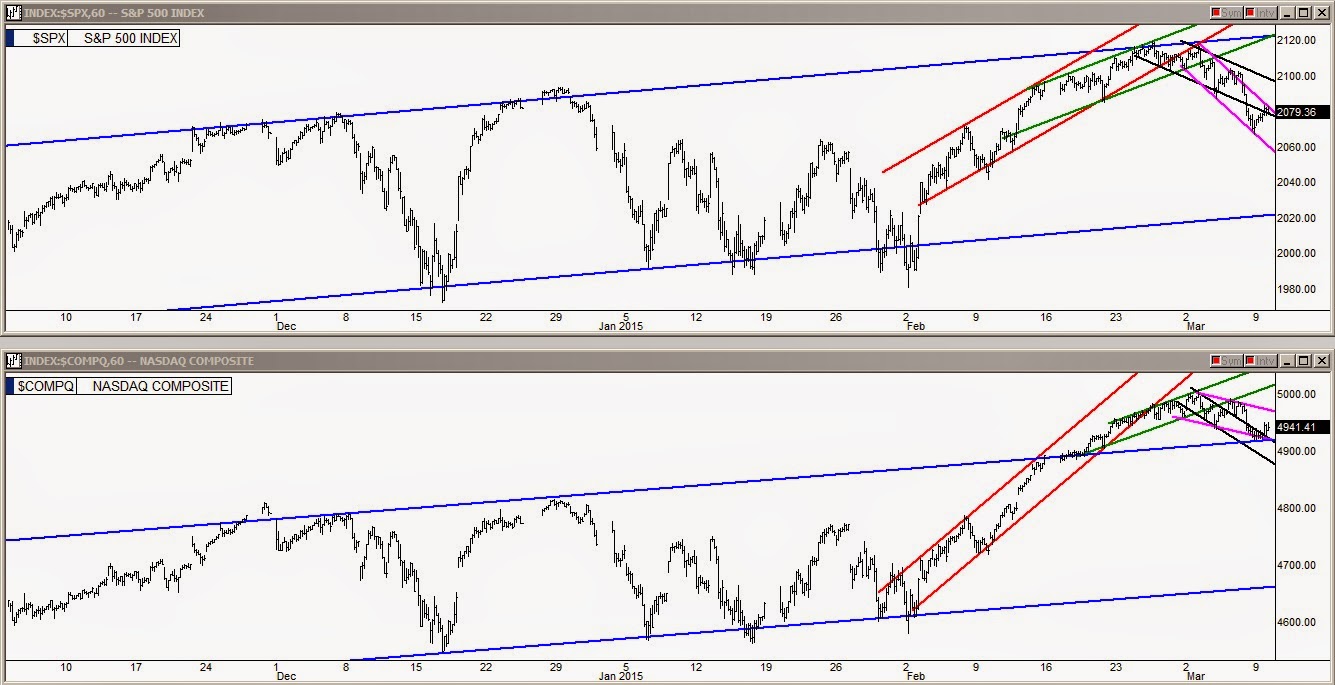

In the market Monday, we had a modest up day as the key stock indices maneuvered to hold their twenty-day EMA lines, a token point for at least some sort of a bounce. While both the S&P 500 and NASDAQ bounced today, an interesting divergence has begun in their channel charts. Looking at the sixty-minute charts below, we see that the newest channels shown in pink are affecting these two indices differently.

In the first chart of the S&P, we see that the newly developed pink channel is trying to increase the rate of decline by forcing it out of the black line channel. In the Nasdaq chart, the newly formed pink channel is doing just the opposite, it is trying to break the Nasdaq back up out of its black line channel. This refusal by the Nasdaq so far to develop steeper declining channels is being helped by the fact that the Nasdaq found support Monday at the top of its long term blue line channel.

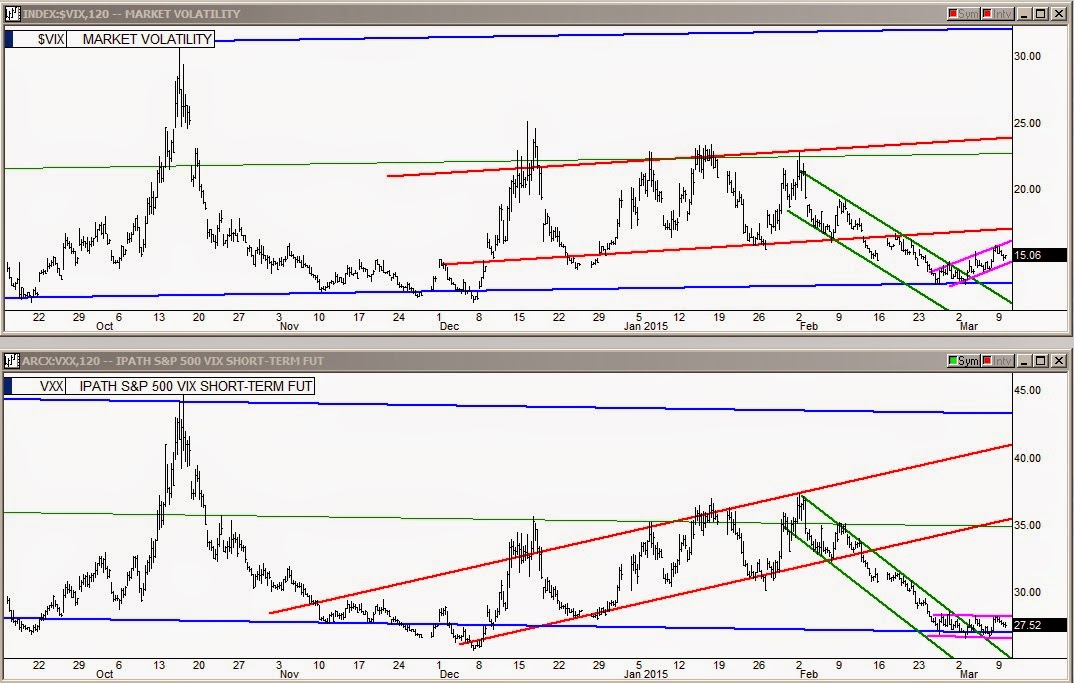

Next, taking a look at the 120 minute VIX and iPath S&P 500 Vix Short Term Fut (ARCA:VXX) charts below:

The VIX, shown in the upper chart, is steadily climbing as more and more components of S&P 500 begin to roll over. The VXX (VIX Futures ETF) has been moving sideways instead of up as VXX traders are taking a more cautious stance because they understand how easy it would be for the Nasdaq to bounce for several days here and lift the broad market with it. If the Nasdaq slips down into its long term blue line channel, however, I expect the VXX to catch up with the VIX quickly.