Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

The S&P 500 snapped its three-day string of modest declines with a modest advance of 0.31%. But today's opening surge seemed to promise more. Major European indexes were in rally mode when the US equity markets opened, and the EURO STOXX 50 would subsequently close with a 1.59% gain.

Futures were promising before the opening bell, and the disappointing ADP jobs estimate pushed them yet higher -- apparently another "bad news is good news" reaction in hopes of delaying a Fed rate hike. The "reverse psychology" peaked an hour after the opening bell, and the index gave back two-thirds of its gain by early afternoon. The closing 0.31% gain put the index up 1.99% for the year.

The yield on the 10-year note closed the day at 2.28%, up 5 bps from yesterday's close.

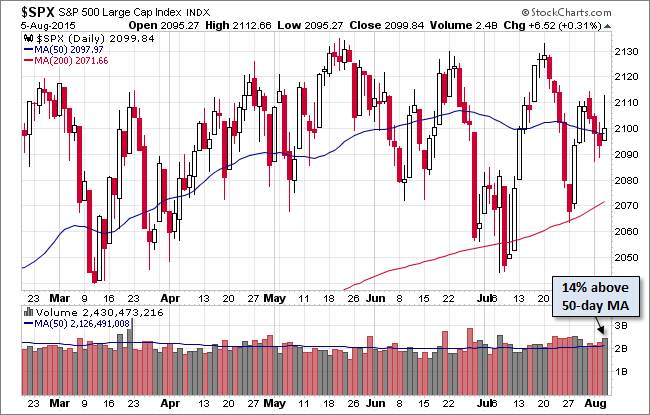

Here is a snapshot of past five sessions.

On the daily chart we see that volume was above its 50-day moving average, and the closing price, a hair below the 2100 level, is back above its 50-day moving average.

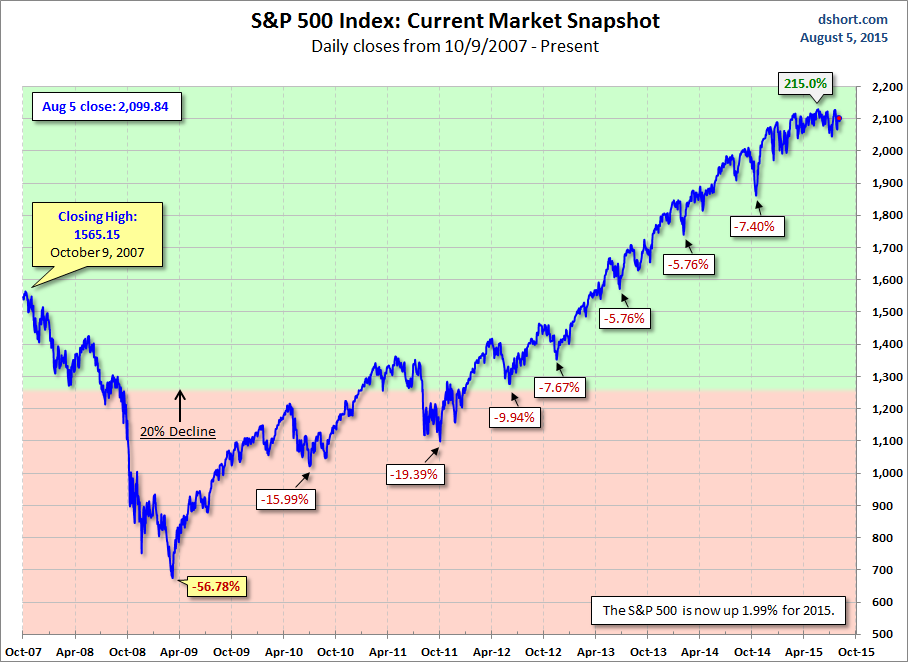

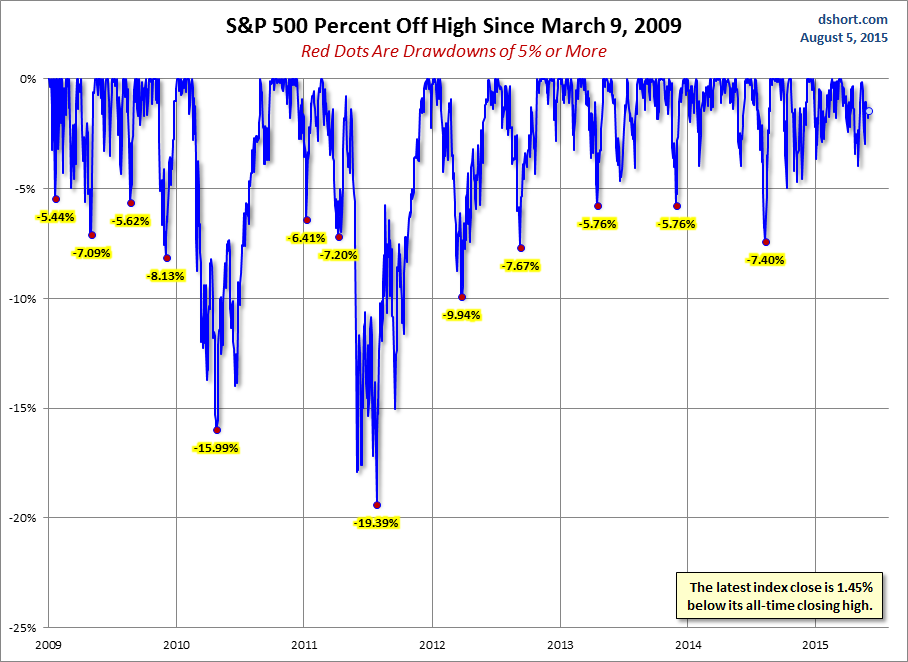

A Perspective on Drawdowns

Here's a snapshot of selloffs since the 2009 trough.

For a longer-term perspective, here is a charts base on daily closes since the all-time high prior to the Great Recession.