Before the US markets opened, European indexes were having a bad day. The Euro Stoxx 50 would subsequently close with a -1.85% loss. To make matters worse, the pre-market release of the Empire State Manufacturing Index came in well below forecast at -1.98, a contractionary reading. And 45 minutes later we learned that Industrial Production for May had dropped -0.2 percent, also surprising to the downside.

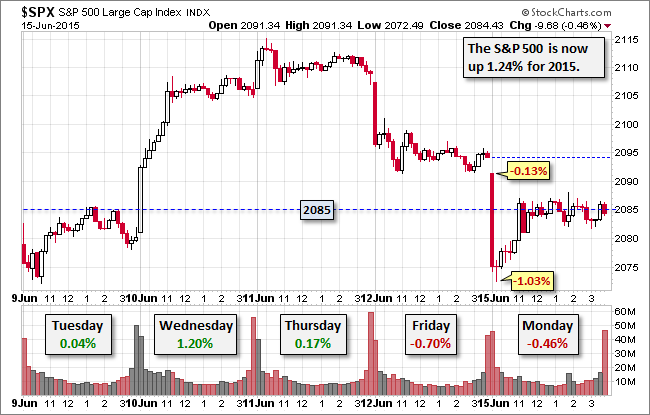

Not surprisingly, the S&P 500 plunged at the open and hit its -1.03% intraday low about 20 minutes later. By late morning it had recovered about half its loss and then traded in a narrow range around the 2085 level, a level it had broken through last Wednesday. The index ended its sideways move with a -0.46% loss for the day. Tomorrow's housing permits and starts will probably have little impact on the market. The big news this week (aside from a global shock) will be the big FOMC news on Wednesday — minutes, forecasts and a press conference.

The yield on the benchmark 10-year note fell three bps to close at 2.36%.

Here is a 15-minute chart of the past five sessions.

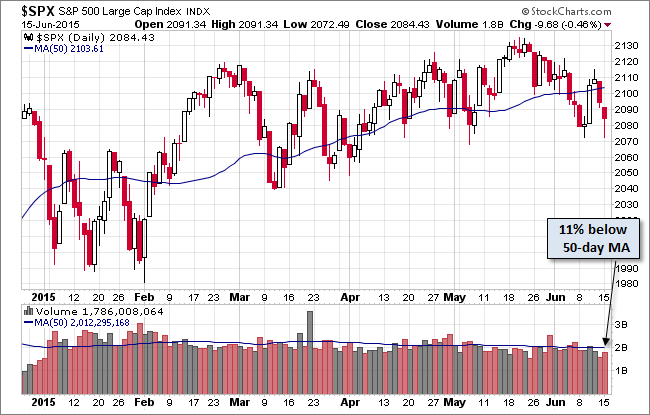

Here is a daily snapshot of the index, which remains below its 50-day moving average. Ten of the 16 sessions since its record close on May 21st have been in the red.

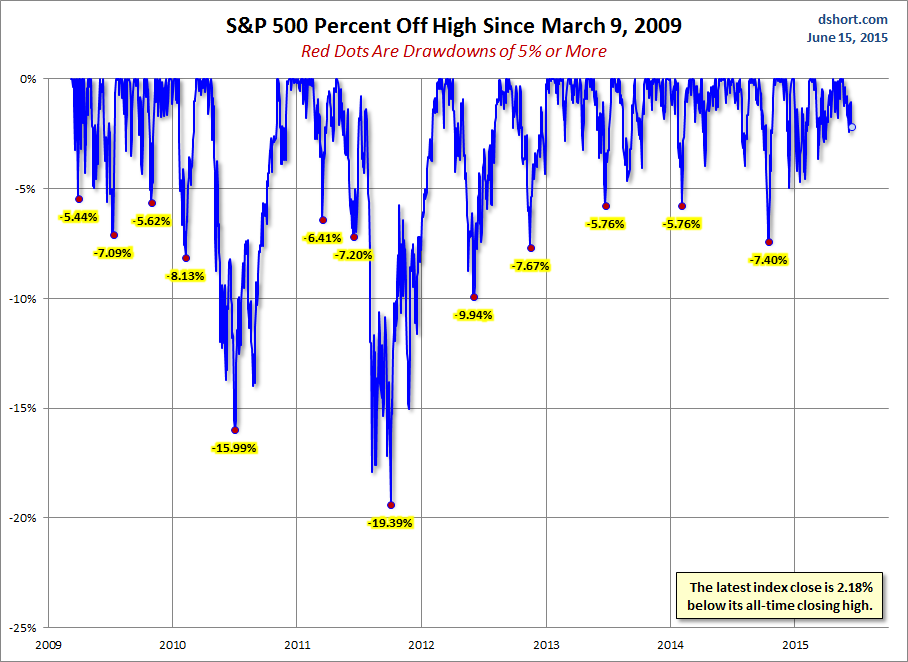

A Perspective on Drawdowns

Here's a snapshot of selloffs since the 2009 trough.

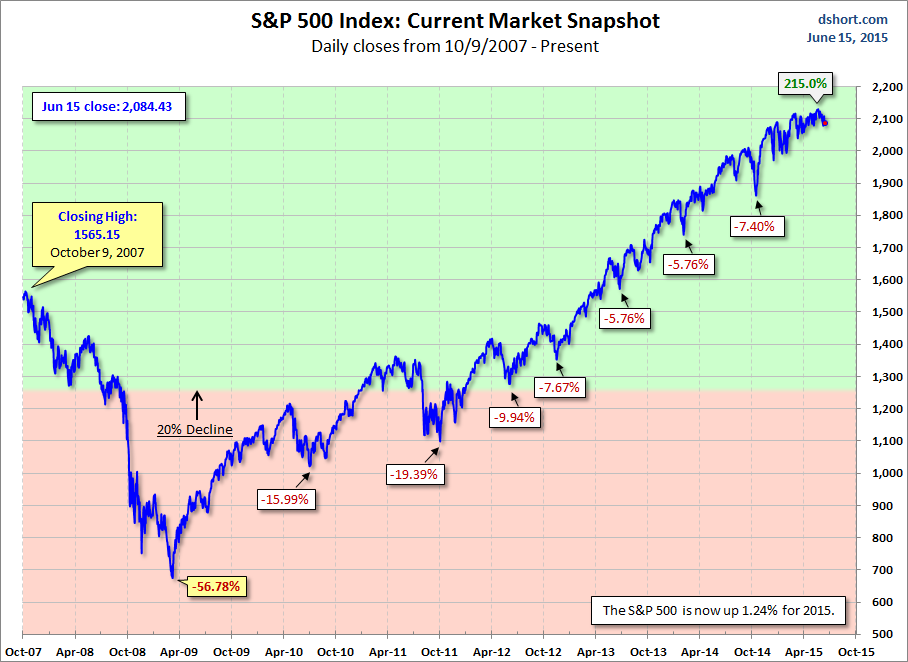

For a longer-term perspective, here is a charts base on daily closes since the all-time high prior to the Great Recession.