The vote by the United Kingdom (UK) to leave the European Union (EU), aka Brexit, kicked off a series of market events that collectively seem very surreal. First, there was the global rally in financial markets going into the vote. Relieved market participants appeared to anticipate a victory by the Remain side.

Next came two days of market shock, interrupted by the weekend, where sellers took complete control of the market in anticipation of a global economic calamity. After those two intense days, sellers apparently exhausted all their ammunition as buyers have barely stopped scooping up the “bargains” ever since.

One might think that the financial markets in the UK would suffer the brunt of the devastation. Instead, the biggest companies in the UK, as represented by the FTSE 100 (the London Stock Exchange), performed relatively well. The FTSE 100 recovered all its post-Brexit losses in just two days.

By the close of the week, the FTSE neared an 11-month high. That’s right – the Brexit vote has so far HELPED the UK’s biggest listings. The FTSE 100 says “thank you, Brexit.”

Once propelled by Brexit relief, the FTSE 100 now appears propelled by Brexit reality.

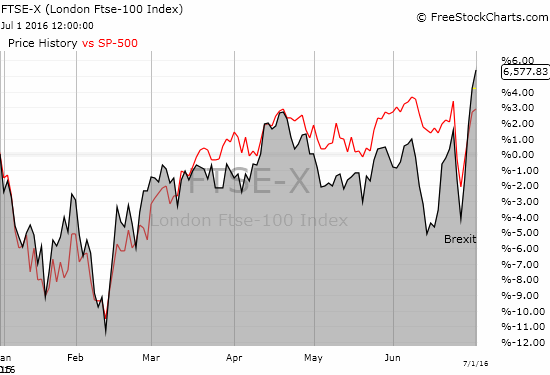

A comparison with the S&P 500 (via SPDR S&P 500 (NYSE:SPY)) also shows how the FTSE 100 has benefited from Brexit’s victory. The chart below shows how the FTSE 100 has out-performed the S&P 500 year-to-date in 2016.

Starting in March, the S&P 500 outpaced the FTSE 100. The post-Brexit swoon was the last time this outperformance held. In just two days, the FTSE 100 is well-ahead of the S&P 500 for the year, around 5% versus 3%.

Is Brexit even helping to propel the FTSE 100 over the S&P 500?!

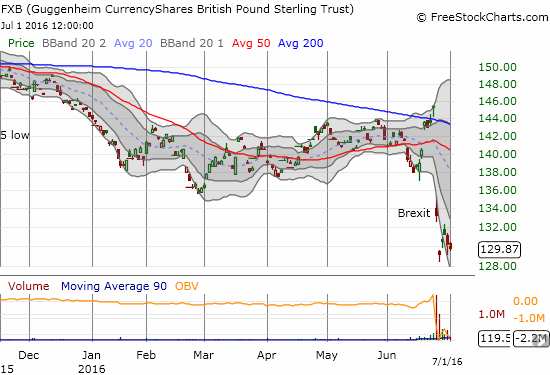

The FTSE 100 is stacked full of multi-national corporations, many of whom export goods from the UK to the rest of the world. The post-Brexit collapse in the British pound (via Guggenheim CurrencyShares British Pound Sterling (NYSE:FXB)) helps these companies, as the world can buy UK goods for a significant discount. Still, it took two days for that realization to kick in.

The CurrencyShares British Pound Ster ETF (FXB) struggles to reach a post-Brexit bottom.

Perhaps the influence of central banks is even more important. Since the financial crisis, central banks have played a prominent role in propping up financial markets and goosing stocks higher during trying times. This latest market shock seems to be no different.

The Bank of England (BoE) stepped into the breach of uncertainty as the United Kingdom struggles with a looming power vacuum and gropes for a concrete post-Brexit plan. Governor Mark Carney delivered a speech Thursday evening in the UK to provide markets a broad outline of how the BoE will attempt to provide stability and sustain liquidity in markets. This pronouncement of intervention should engender incrementally more confidence in the economy while the political process sorts itself out in the coming months and likely years.

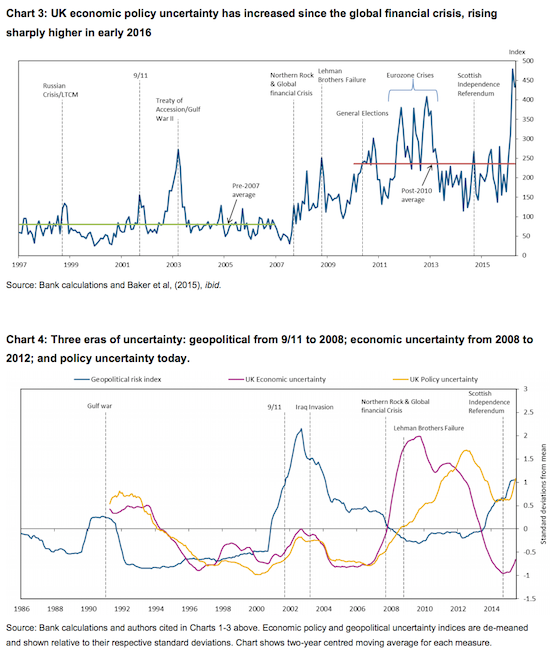

Carney’s speech started by describing the looming uncertainties and risks bearing down on the UK.

The UK faces down increasing uncertainties from policy, geo-politics, and now economics

Carney promised that the BoE stood ready and willing to do what it can to help the UK’s transition in a post-Brexit world:

“…in order to support market functioning, the Bank of England continues to stand ready to

provide more than £250bn of additional funds through its normal facilities.As a further precaution, reflecting the possibility that heightened uncertainty may last a while longer, today the Bank of England is announcing that it will continue to offer Indexed Long-Term Repo operations on a weekly basis until end-September 2016. This will provide additional flexibility in the Bank’s provision of liquidity insurance over the coming months.

…In my view, and I am not pre-judging the views of the other independent MPC members, the economic

outlook has deteriorated and some monetary policy easing will likely be required over the summer.…I can assure you that in the coming months the Bank can be expected to take whatever action is needed to support growth subject to inflation being projected to return to the target over an appropriate horizon, and inflation expectations remaining well anchored.

…we will relentlessly pursue monetary and financial stability.”

However, Carney also cautioned that the BoE cannot stand alone in this transition:

“…one uncomfortable truth is that there are limits to what the Bank of England can do. In particular, monetary policy cannot immediately or fully offset the economic implications of a large, negative shock. The future potential of this economy and its implications for jobs, real wages and wealth are not the gifts of monetary policymakers.

These will be driven by much bigger decisions; by bigger plans that are being formulated by others.”

So markets appear to be back in a phase where bad is good. Brexit was so bad for the market it was good. Currency depreciation will assist UK exporters. Economic uncertainty will force the Bank of England to provide more monetary accommodation and will likely extend the horizon of accommodation across the globe, including the U.S. Time will soon tell whether yet more months and years of central bank accommodation will stay ahead of economic headwinds. Certainly stock markets are betting on it.

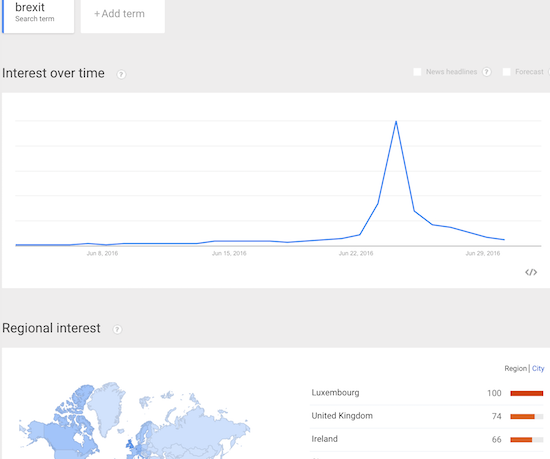

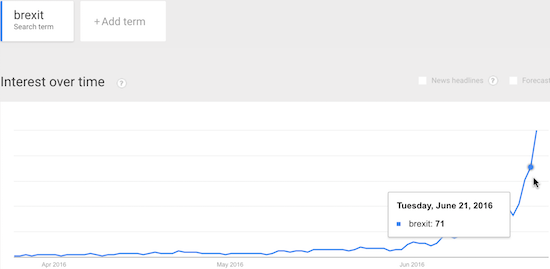

In the meantime, the immediate post-Brexit anxiety has quickly worn off. The chart below shows an update from Thursday, June 30, 2016 of Google Search trends for “Brexit.” Search interest has cooled off significantly from the recent high although it has only returned to the level from June 20th (index = 5); the maximum index of 100 occurred on June 24th, the day after the Brexit vote.

For perspective, recall that there was a significant run-up in search interest going into Brexit. I used that run-up to question the market’s rally going into the Brexit vote.

After a brief respite, anxiety over Brexit continued to soar to new heights. (Wedesnday is based on partial data).

Be careful out there!

Full disclosure: long SSO put options, long FXB, net long the British pound in forex (for more on my positioning in the British pound, see here)