Yesterday the US equity indexes echoed the gloom of its European counterparts, and it essentially did the same today. The Euro Stoxx 50 was close to flat when the US markets opened and then slowly rallied to its 0.47% closing gain just before the US lunch hour. The S&P 500 vacillated from the open through the late morning and then rallied to its 0.62% mid-afternoon high. It closed with a trimmed gain of 0.57%, ending a two-day selloff.

The yield on the benchmark 10-year note fell four bps to close at 2.32%.

Here is a 15-minute chart of the past five sessions.

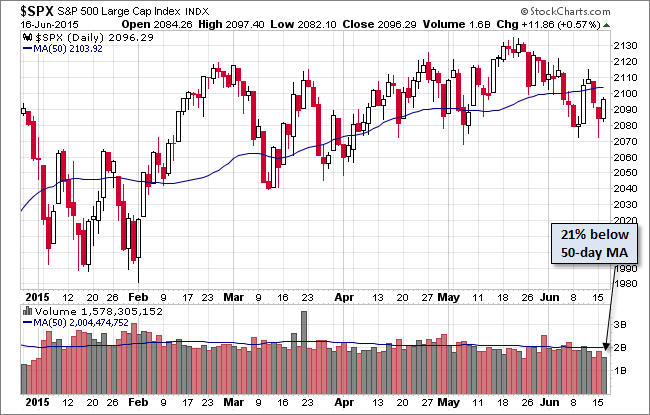

Here is a daily snapshot of the index, which remains below its 50-day moving average. Volume was light ahead of Wednesday's FOMC Statement, Press Conference and Projections Materials.

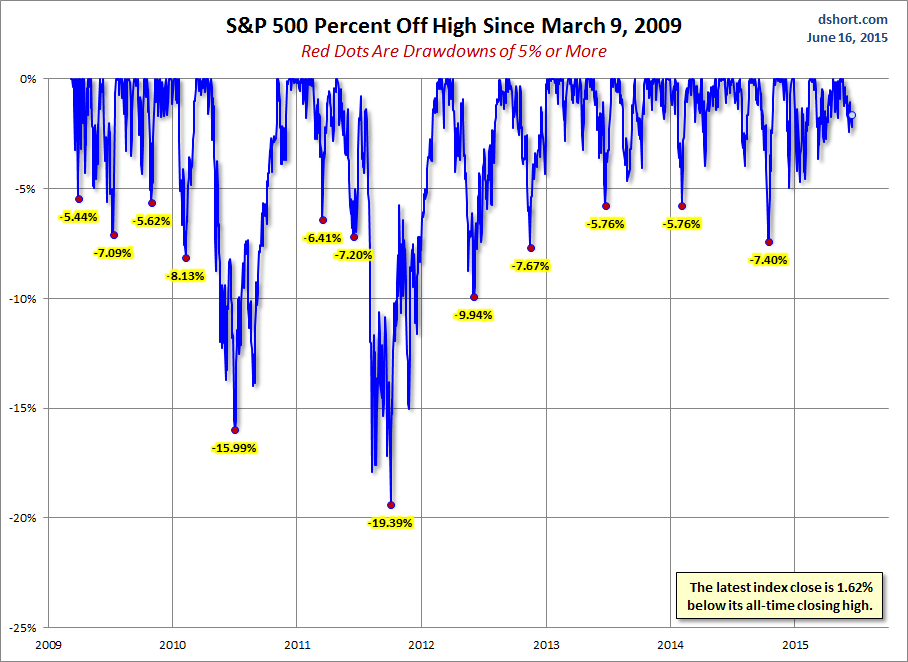

A Perspective on Drawdowns

Here's a snapshot of selloffs since the 2009 trough.

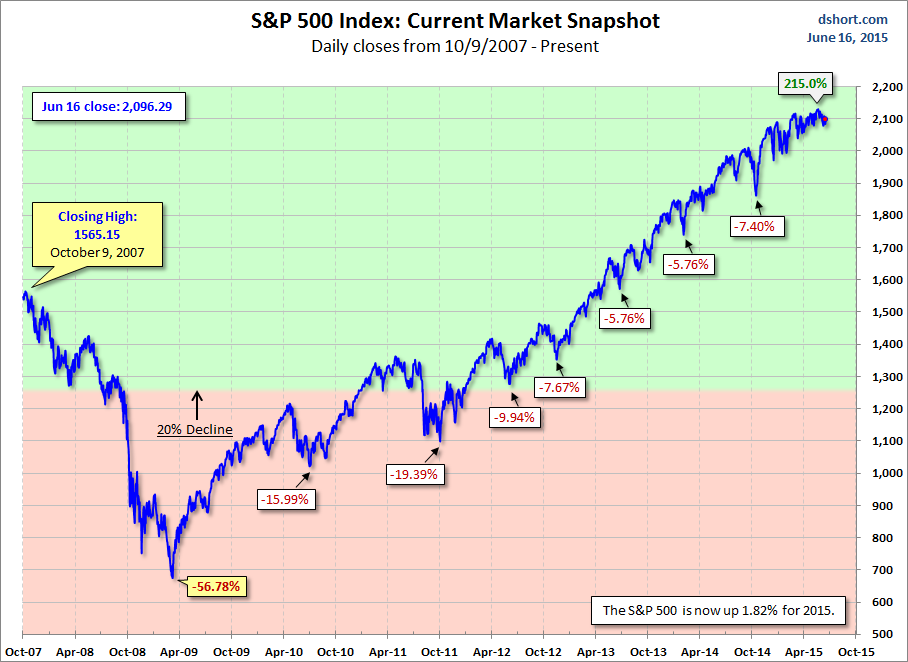

For a longer-term perspective, here is a charts base on daily closes since the all-time high prior to the Great Recession.