Yesterday, the S&P 500 futures sold off down to 2427.00 on Globex, opened at 2429.50 on the 8:30 CT open, double bottomed at 2427.00, and then traded up to 2434.25 at 9:26 am. After the push up, the ES ‘slowly’ sold off down to 2429.50, 5 ticks below the vwap, held there for a little while, and then popped back up to the early high at 2434.25. At 11:00 am CT total volume was only 630,000 contracts, which was higher than Monday at that time.

If only one thing is clear, it’s that less people are trading. Call it risk reverse, call it uncertainty, there are just not a lot of big bets going on. The public is stepping back, and as we get closer to July, I think it will be even worse. The only ones making money in these markets are the brokers and the machines.

At 12:00 yesterday, nothing had changed. In fact, the ES had been stuck in a 3 handle range since 10:30. I am befuddled by the total lack of trade. The S&P used to be the place where traders went to get action and volatility, but right now there is neither. Around 12:30, both the ES and CL started to come back down. The ES traded back down to 2430.00, and CL rallied up to 48.00.

After the pullback down to 2430.00, the afternoon march began. A few small buy programs came in, and the ESM17 traded up to a new daily high at 2435.75, only 4 handles off the all-time contract high at 2439.75. The lesson is:

Just before 2:00 the MiM start to show over $400 million to sell, and the (ESM17:CME) sold off back down to 2432.50. As the MiM continued to show more for sale, the ES continued its move lower, back down to 2427.75. The best trade of the day came from the MiM. The ES ended the day at 2430.75.

I keep thinking that I shouldn’t pay attention to what other people are doing. There’s a lot of bearish talk surrounding FBI director Comey’s testimony and the British election, but the fact of the matter is, nothing has happened yet, and trying to trade the news two days before the events just doesn’t work. It all comes down to timing, and playing it as you see it.

While You Were Sleeping

Overnight, most Asian equity markets closed lower, but very modestly lower. Meanwhile, in Europe, all but 1 major index (OMXC 20) is trading higher this morning. In the U.S., the S&P 500 futures (ESZ15:CME) opened the globex session at 2429.50, and traded sideways through most of the Asian session. The ESM saw some weakness on the Asian close, printing a low of 2428.25, but has since steadied itself during the European session. As of 7:15 am CT, the last print in the ES is 2432.25, up 1.5 handles, with 107k contracts traded.

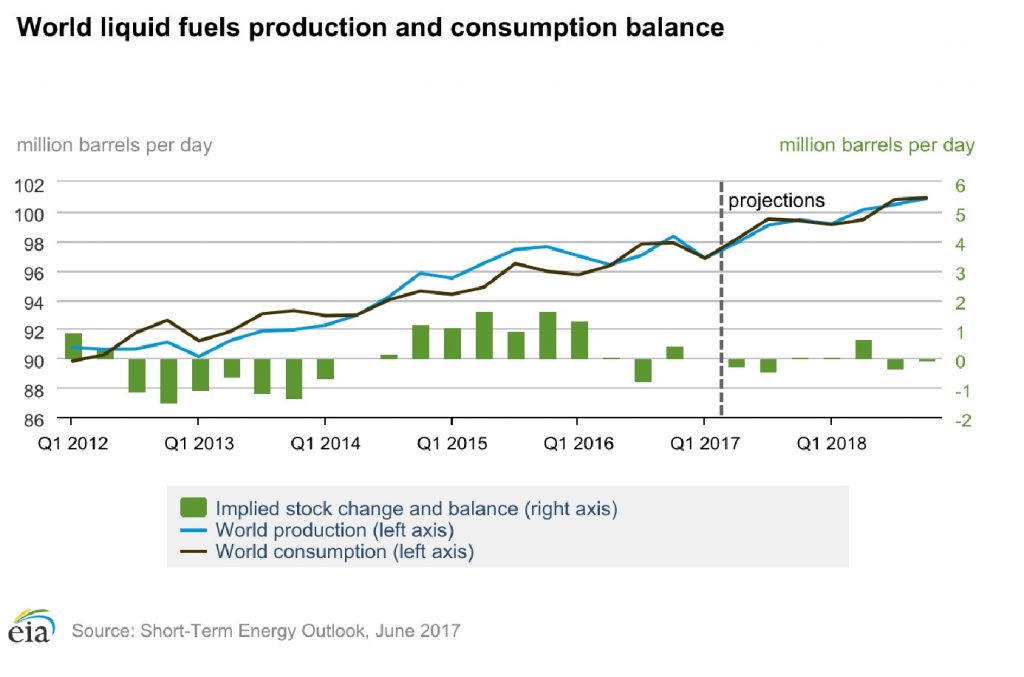

In Asia, 7 out of 11 markets closed lower (Shanghai +1.24%), and in Europe 11 out of 12 markets are trading higher this morning (FTSE +0.10%). Today’s economic calendar includes the Bank Reserve Settlement, MBA Mortgage Applications, Gallup U.S. Job Creation Index, and the EIA Petroleum Status Report.

Thomson Reuters Chart of the Day

Our View

It was pretty much a ping pong match all day. The ES chopped back and forth for most of the day until the MiM started showing ‘size’ for sale. Once the imbalance paired back, the ES held its late day low, and short covered a little going into the 3:15 futures close. Honestly, I am not sure what to think. It may all come down to Thursday’s events, and today’s trade maybe similar to yesterday’s trade. Our view is to sell the rallies and buy weakness.