There are thousand of occupations to choose from, but few put as much stress on you as trading. Many years ago, when the kids from college showed up on the CME floor for summer jobs, many of the people we hired would say things like, ‘when I get out of school I want to be a trader.’ And why not? The guys on the NYSE, CBOT and the CME were making money ‘hand over fist.’ It was not out of the ordinary to hear someone say ‘hey, did you hear Mike made $500,000 today?’ Nor was also out of the ordinary to hear something like ‘hey did you hear Joe blew up today?’ In many ways, trading is very much like the Wide World of Sports used to say, it was the thrill of victory and the agony of defeat.

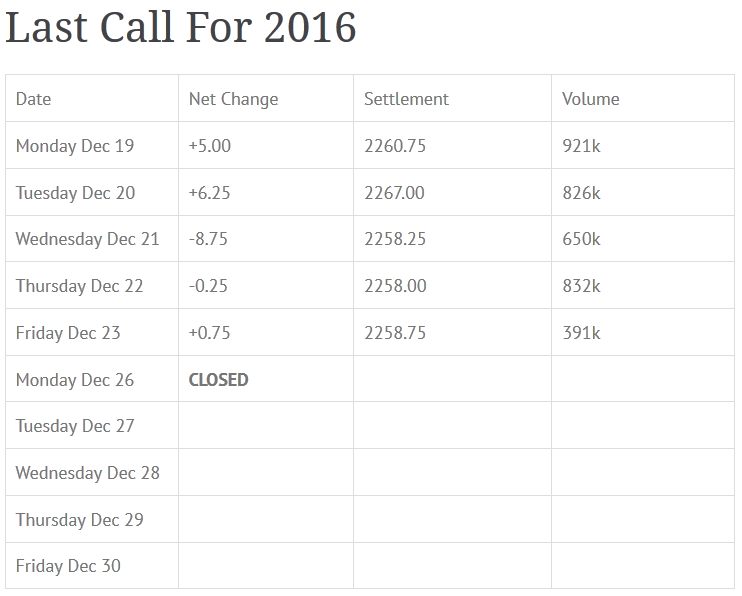

Last week we expected to see a quiet trade in the equity futures markets, but what we got was even lower volume than we expected. Every day was less than 1 million mini contracts traded, with Friday being less than 400k. The range from the week was from 2269.50 on Tuesday down to 2251.50 on Wednesday, in what was a very forgettable week. On Friday the S&P opened the regular session at 2256.50, down 2.25 handles, and made a low of 2254.25 just before the European close, and then made a high late in the day of 2260.25, just before the cash close.

There are a lot of factors helping move the S&P 500 futures (ESH17:CME), but the main one is the lack of ‘players.’ Despite rising hedge fund exposure, the public started cutting back last week, and as you can see, the volume in the futures fell off a cliff going into Thursday and Friday’s trade. With only four trading days left in the year, and the exchange closing early on Friday for the bonds and currencies, it could end up an awfully quiet week.

Thin-To-Win Takes Over

With most of the schools still closed until after new Years, it’s highly unlikely anything major will happen. What we do know about this week is that our trading rule ‘thin to win’ could play out, along with the Stock Trader’s Almanac’s Santa Claus Rally into the end of the year. Some traders we talk to say that Donald Trump has already supplied the year end rally, a period which is only four days. According to the Stock Trader’s Almanac:

“Since 1969 the Santa Claus rally has yielded positive returns in 34 of the past 45 holiday seasons — the last five trading days of the year and the first two trading days after New Year’s. The average cumulative return over these days is 1.4%, and returns are positive in each of the seven days of the rally, on average. Nevertheless, each year there is at least one day of declines. Alternative research over a longer period confirms the persistence of these trends: According to historical data going back to 1896, the Dow Jones Industrial Average has gained an average of 1.7% during this seven day trading period, rising 77% of the time.”

Only time will tell, my fellow traders, and with less than four full trading days left in the year, it won’t take long to figure out.

Asia and Europe

Overnight Asian equity markets were mostly higher, although some markets were still closed for the holiday. In Europe, the FTSE is closed, but the rest of the major Euro markets are trading modestly higher. The S&P 500 futures opened globex at 2258.75 and made an early session low of 2257.75. Since then the ES has traded up to 2261.50, up 1.50 handles, last printing 2261.00 at 6:15 am cst on total volume of only 24k.

In Asia, 6 out of 8 open markets closed higher (Shanghai -0.25%), and in Europe 10 out of 10 open markets are trading higher this morning (DAX +0.13%). This week’s economic calendar includes 17 reports, and 14 U.S. Treasury events. Today’s economic calendar includes S&P Corelogic Case-Shiller HPI, Consumer Confidence, Richmond Fed Manufacturing Index, State Street Investor Confidence Index, Dallas Fed Mfg Survey, a 3-Month Bill Auction, a 6-Month Bill Auction, a 4-Week Bill Auction, and a 2-Yr Note Auction.

Top Notch Trading Morning Bond Numbers

Our View

It’s 6:40 am CT and the ESH17 just traded up to 2261.50, and total volume is a mere 24,600 contracts traded. Last Fridays total volume was under 400,000. Let’s face it traders, people are on vacation, and while it may be the final trading days of 2016, it doesn’t look like very many people care. Our view is for a ‘thin to win type’ trade and higher prices… buy weakness.