Over the last two weeks there has been a lot of hype surrounding the statements former FBI director Comey was going to give to the senate hearing committee yesterday. Many thought it could be a market moving event, some thought the stock market would sell off… but it didn’t. Some traders think the news is not good for President Trump, while others don’t think he broke any laws. From the sound of the testimony on Capitol Hill, it really doesn’t sound like the president broke any laws, but some democrats have gone so far as to start impeachment proceedings.

In the early goings yesterday, the S&P 500 futures (ESU17:CME) were held to a 6 handle range overnight, but the bias was to the upside. The futures made the overnight low at 2428.50 just an hour into the session, then proceeded to drift higher, making a high at 2434.25 a little before 6am cst.

The main focus of the morning was the Comey testimony. As the former FBI director began answering questions, there was an initial ‘knee jerk’ reaction sell off down to a new low at 2425.00, 1.25 handles lower than Wednesday’s low, and then the buy programs showed up. The ensuing rally pushed the futures up to 2436.75 at 11:20am, that’s a 12 handle rally off the low in 2 hours, and also completed a MrTopStep 10 handle rule for the second consecutive day. Once the smoke cleared, the futures started to ease up a bit, and by 12:30 had sold off below the vwap, down to 2429.50. The funny thing; the VIX dropped below 10 during the Comey testimony.

It would later turn out that 2436.75 would be the high of the day. After a pullback to 2433.50, off of the 2429.50 low, the futures were hit by a sell program, and continued to break down to 2425.50, two ticks from the low of the day, and completing a second MrTopStep 10 handle rule. From there, the MiM came online showing decent size for sale, but flipped to the buy side, and the subsequent rally took the futures back up to 2432.00 on the 3:00 cash close.

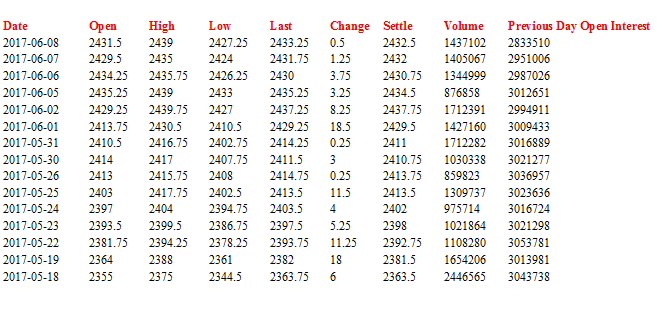

Because of the rollover, or ‘switch’, total volume in the ESU was just under 640,000 contracts, and part of that includes overnight Globex volume, along with the (ESM17/ESU17) spread. In other words, after all the ups and downs, outright trading volume was only 220,000 contracts. Volume in the ESM17 ended up being 1.4 million, with 150k coming from Globex, and 400k ESM/ESU spreads.

In the end, the (ESU17:CME) close up 2 handles or 0.09%, the Dow Jones futures closed up 37 points, or 0.17%, and the Nasdaq 100 futures closed up 12 points, or 0.18% percent.

The VIX 4 week Average Is The Lowest Since 1974

While You Were Sleeping

Overnight, equity markets in Asia traded mixed, with a slight bias to the upside. Meanwhile, in Europe, most majors are trading higher this morning, led by the FTSE. In the U.S., the S&P 500 futures broke out of its typical overnight pattern and traded in a 12.75 handle range. We haven’t seen a globex range that wide in a couple of weeks. The futures gapped 6.5 handles lower to 2425.25 on the globex open, and immediately began trading higher. By the time the Asian markets were closing, the ESU had filled the gap and printed a high at 2435.75. Since the European markets opened, the ESU has been trading sideways in a 4.5 handle range. As of 6:25 cst, the last print in the ES is 2432.00, down 1.75 handles, with just under 110k contracts traded.

In Asia, 7 out of 11 markets closed higher (Shanghai +0.27%), and in Europe 10 out of 12 markets are trading higher this morning (FTSE +0.50%). Today’s economic calendar is light, and includes Wholesale Trade, and the Baker-Hughes Rig Count.

Our View

The Comey hype didn’t live up to expectations, but the ESU did see some decent movement. We are supposed to be looking for the PitBulls Thursday / Friday low the week before the June options expiration, but if ‘thin to win’ has its way, we could see some type of pop. There are buy stops above 2436.50 that run straight up to 2443-44.

That said, all you have to do is look at the net change chart above. Clearly, less people are trading, and the ranges, with the exception of a few trading days, are extremely narrow. Despite the election results now out of England, and a big drop in the pound, I still think the ES wants to go higher. Our view is to sell the early rallies and buy weakness, or just wait for the ES to sell off a little and be a buyer.