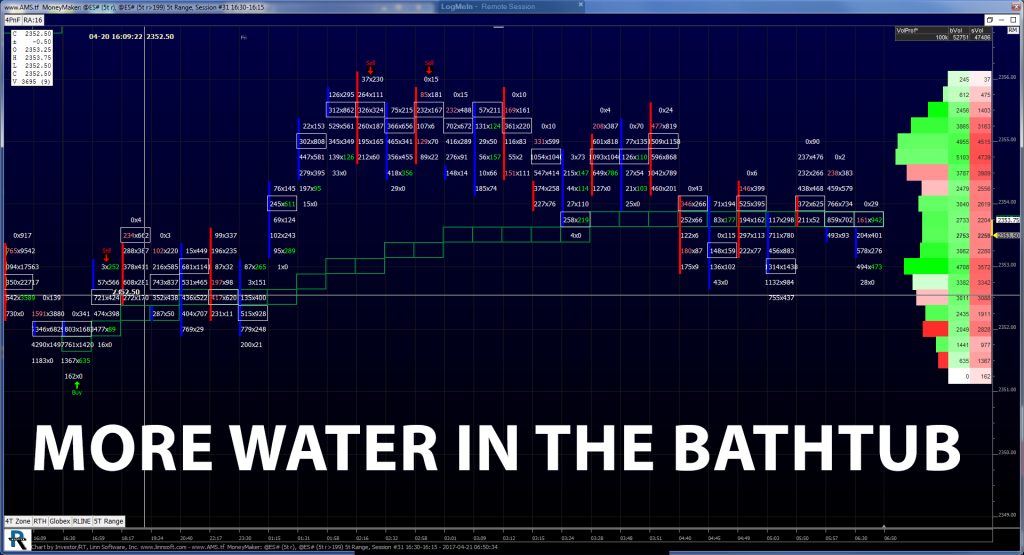

In its usual ‘take no prisoners’ style, the S&P 500 futures (ESM17:CME) was up over 1% at 1:00 pm CT yesterday. After falling 19 handles from high to low on Wednesday, U.S. indices were all sharply higher. The Dow Jones futures that closed down 109 points Wednesday, closed up 211 points yesterday. The Nasdaq, which was the firmest of the indices, closed up 2.75 points Wednesday, and up 49.75 points yesterday. It is exactly as the Pit Bull says; the S&P is like water in the bath tub, push the water one way then push it the other way.

We talked a lot about what drives the S&P from selling off to going back up so quickly, and I think it has a lot to do with how the algos. Once the selling in the ES dries up, the big investment firms and mutual funds start buying. There are five main concerns right now, the first one being whether or not Q1 earnings will support the lofty prices of stocks. Will the economic numbers show weak economic expansion? Also, the French election and geopolitical strife, and lastly, signs that the Trump trade may have run its course for now.

Whenever you have so many different ‘events’ going on, the S&P tends to swing wildly, and that’s what it has been doing for the last several weeks. The ES sells off for several days, then rallies hard for a few days, and then goes right back down. The main question is, will yesterday’s strength signal an end to the short term momentum for bears and propel the futures back up to 2400?

It’s hard to think that it will be that easy, especially as the stock markets brace for the slow and seasonally weak period of May. Sure, “sell in May” has not showed up the last couple years, but with all the risk that seems to be keeping a lid on the equity markets, combined with whatever new risks may occur over the course of the months to come, it won’t be easy for the S&P 500 to push above and find support at 2400. For now, it seems the personality of this market is two sided, and we expect to see volume decrease greatly above 2350 as the market becomes sluggish, and then increase below 2350.

While You Were Sleeping

Overnight, Asian equity markets saw modest rallies, and nearly all markets closed higher. In Europe, however, stocks markets have seen a slight sell off, as most of the indices modestly lower. The S&P 500 futures opened the globex session at 2352.75 and held the low of 2351.75 several times. The high at 2356.00 was printed just after the Euro open, giving the S&P’s a quiet overnight range of 4.25 handles, with just over 110k contracts traded at 7:20 am cst.

In Asia, 9 out of 11 markets closed higher (Nikke +1.03%), and in Europe 10 out of 12 markets are trading lower this morning (CAC -0.47%). Today’s economic calendar includes Neel Kashkari Speaks, PMI Composite Flash, Existing Home Sales, and the Baker-Hughes Rig Count.

Our View

The April options go off the board today. I can’t speak for everyone, but it’s been a long 3 weeks of drops and pops. Based on the overall price action of the S&P, it looks like the index still has room to run on the upside, but the French election and the U.S strike force heading to the Korean Peninsula can, and will, create a lot of uncertainty.

Our view is that the 2360 area, or a little higher, should be a ceiling. The ES rallied sharply yesterday, and that could mean most of the buying has been used up. Sell the early rallies and buy weakness with tight stops.

PitBull: CLM osc -22/16 turns up on a close above 5339, ESM osc -5/-2 turns down on a close below 232699, VIX osc 1/8 turns up on a close above 1556.

As always, please use protective buy and sell stops when trading futures and options.