Wait, not that Russell. After the 4th of July all of the Indexes and their ETF’s started to move higher. By Monday July 9th the S&P 500 ETF (SPY) was testing the June highs, the NASDAQ100 ETF ($QQQ) was a hair away from an all-time high, and the Russell 2000 ETF ($IWM) was also testing its all-time high. But from there the SPY and QQQ continued to move up. The QQQ achieved that new all-time high and then another two days later and is now consolidating the gains. The SPY moved to its higher level since February 1st.

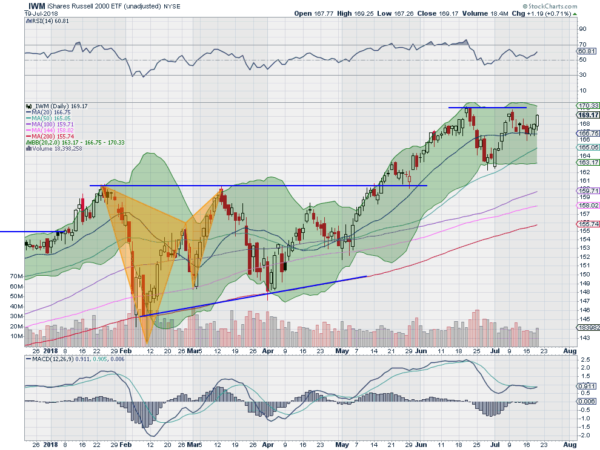

But the Russell 2000 ETF did not continue higher. Instead it pulled back and consolidated. The consolidation took place over the flat 20 day SMA. This is not a bearish phenomenon by any means, but certainly was a rotation from the Russell to the other Indexes. That may be changing now though. Thursday the IWM moved up out of that consolidation. It is not yet at the July high but looks strong in the short term, as shown in the chart below.

With the price turning back up it sets at target on a Measured Move to about 174.25, well above the all-time high. Momentum shifted with price as the RSI has move back up off of the mid line in the bullish zone and the MACD is positive and about to cross up. A perfect picture would see the Bollinger Bands® open as price starts to touch the upper band. But even without that, the IWM has taken the lead as the SPY and QQQ consolidate gains. Take notice.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.