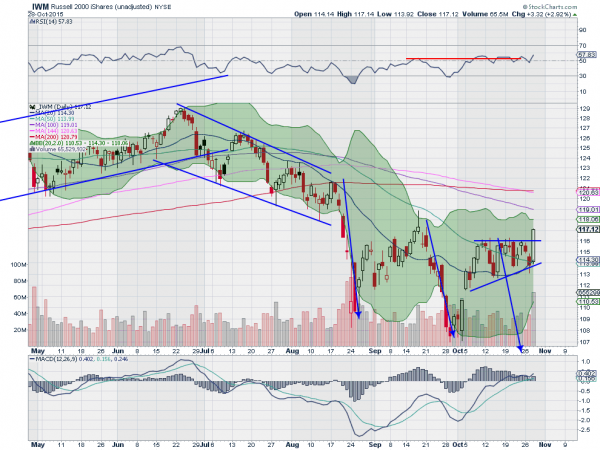

Two weeks ago the RiShares Russell 2000 (N:IWM)had a strong move off of a lower low. That was promising. But it could not make a higher high and started back lower. This set up a 3 Drives pattern to the downside, targeting 104. But as soon as the ink on our trade plan dried it found support and began to consolidate.

It has still been the weakest index as the S&P 500 and Nasdaq 100 have risen steadily. But then Wednesday happened. The Russell 2000 bolted higher in the morning, breaking the consolidation range. After the FOMC statement it pulled back retracing the entire move of the morning. And just when you thought you had it figured out as a failed rally it reversed in “V” bottom to rise and close the day at new highs. In all the index traveled over 6% Wednesday.

That is more back and forth than my tween son when I ask him to clean his room. What is next for the Russell 2000? Is this a confused market or just one with ADHD that we need to focus? Whichever the Russell 200 sets up for a move out of the bottoming pattern heading into the end of the week.

The chart above shows a break of the ascending triangle with a Marubozu candle Wednesday. This would give a target of 120. Momentum indicators are supportive with the MACD rising and the RSI turning higher and over the mid line. Pre-market action Thursday shows some consolidation and pullback, but with the index remaining over the break out level. If that continues to hold up look for more upside over the next few days. A move over the September high would then create a constructive environment and over 120 a strong case for the reversal longer term.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.