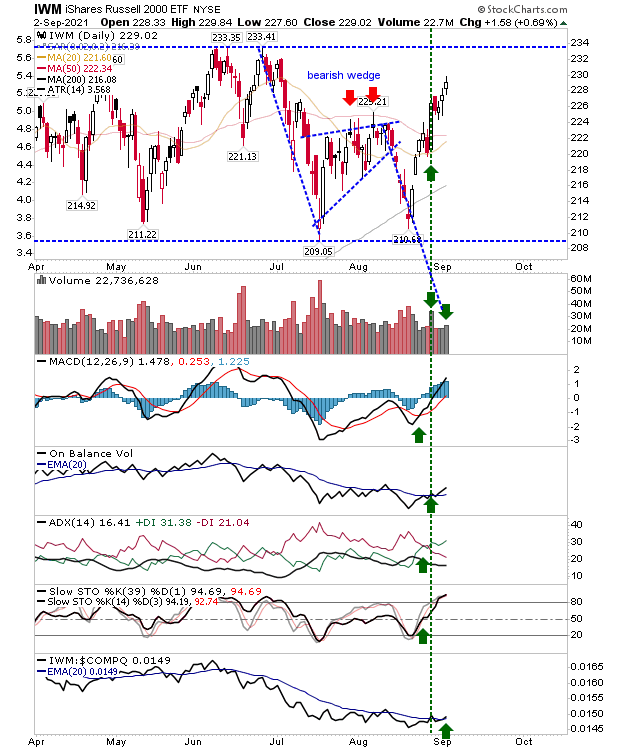

The Russell 2000 hasn't yet cleared its trading range but it has regained its relative leadership role versus the NASDAQ and S&P. Yesterday's trading also came with higher volume accumulation. While seasonal factors would offer a more pessimistic outlook, if the Russell 2000 (IWM) was able to push beyond $234 it would deliver a whole new (bullish) market outlook. Supporting technicals are net bullish.

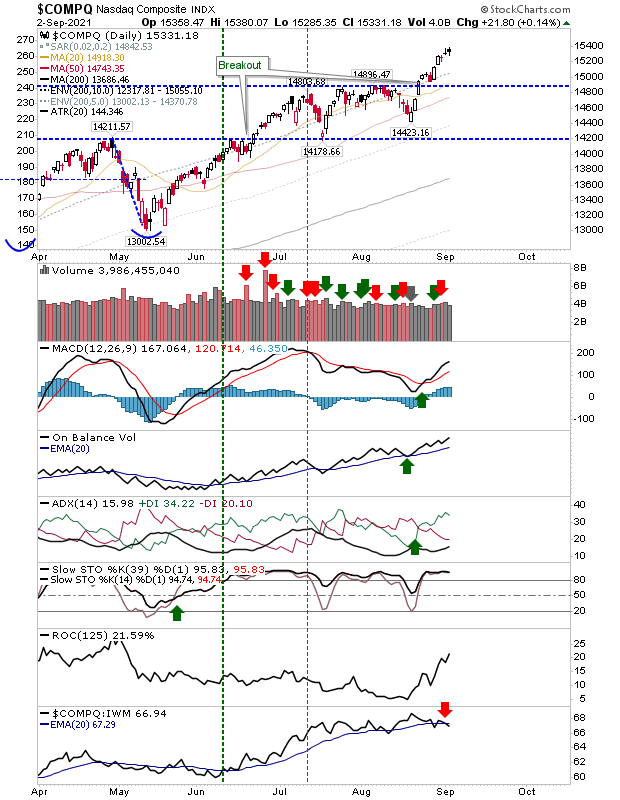

The NASDAQ is the next most bullish index as it managed a small gain, but only enough to finish with a (neutral) 'black' doji. In the context of the bounce over the last couple of weeks it feels bearish, but this is an index which has clearly broken resistance. As with the S&P it's at an all-time high, so has no overhead resistance. Technicals are net bullish, although it has begun a period of underperformance relative to the Russell 2000.

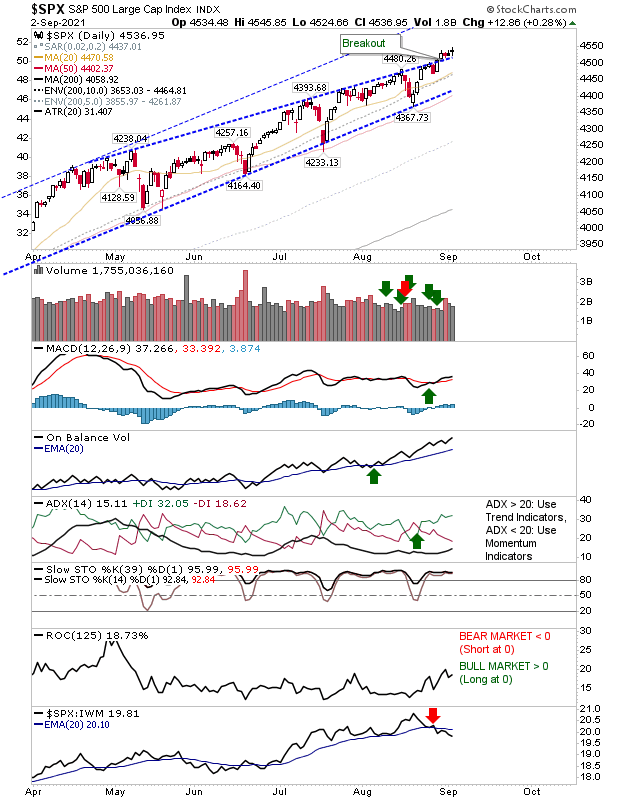

The S&P has already begun a period of underperformance to peer indices, but still holds its wedge breakout. Relative volume was below that of lead indices.

All eyes should be on the Russell 2000 as it looks to take on the leadership roll from the NASDAQ and S&P.