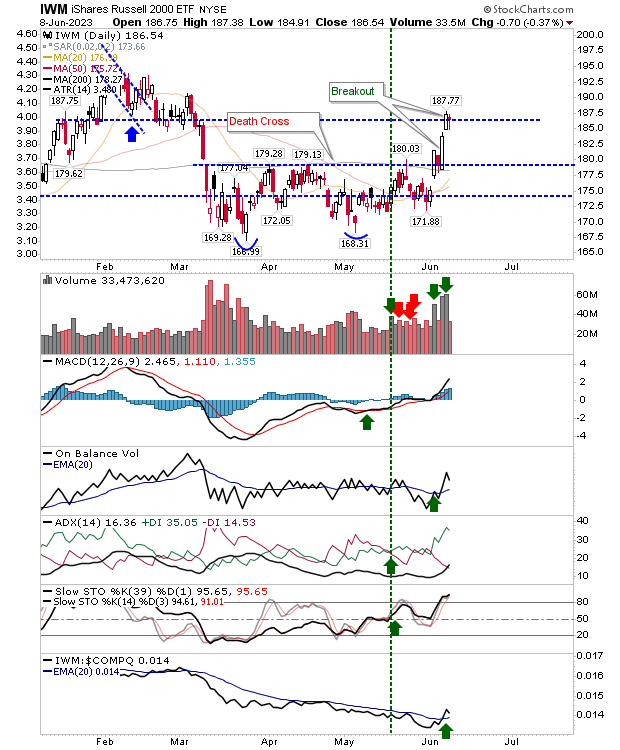

It would have been nice to see some volume to go with today's buying, but we don't always get what we want. The Russell 2000 pushed into the early year consolidation, breaking well away from the spring/early summer consolidation that had threatened something a lot worse. Technicals for the index are net positive, and after a long period of relative underperformance to the S&P 500 and Nasdaq, it's now the lead index.

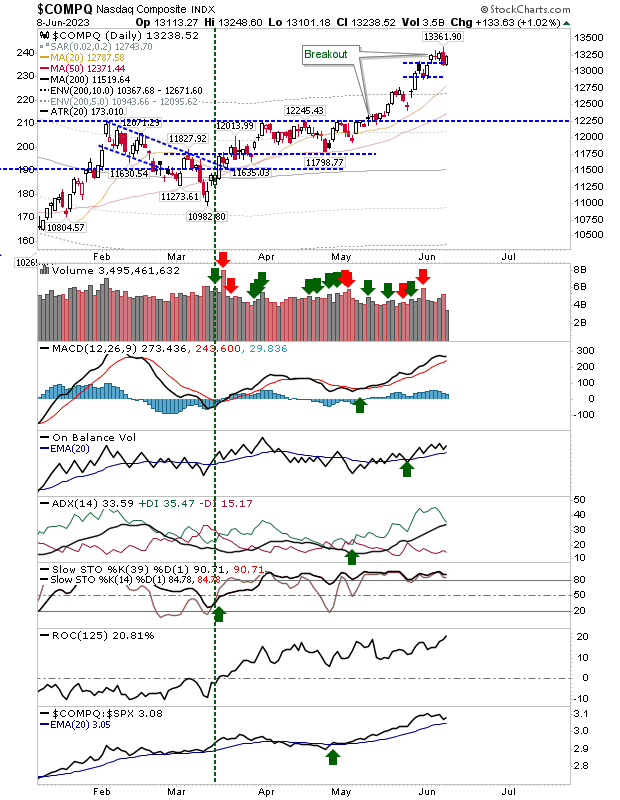

The Nasdaq has been enjoying a step-by-step advance since breaking out in May. We need to be a little careful with the relationship of the index to its 200-day MA; at today's close, it's 14.9% above this moving average, if it reaches 17%, it will then be trading at a level above 90% of historic price action dating back to 1971. If it gets there, it will be an area where taking some profits is often prudent (one can add again on a retest of its 50-day MA).

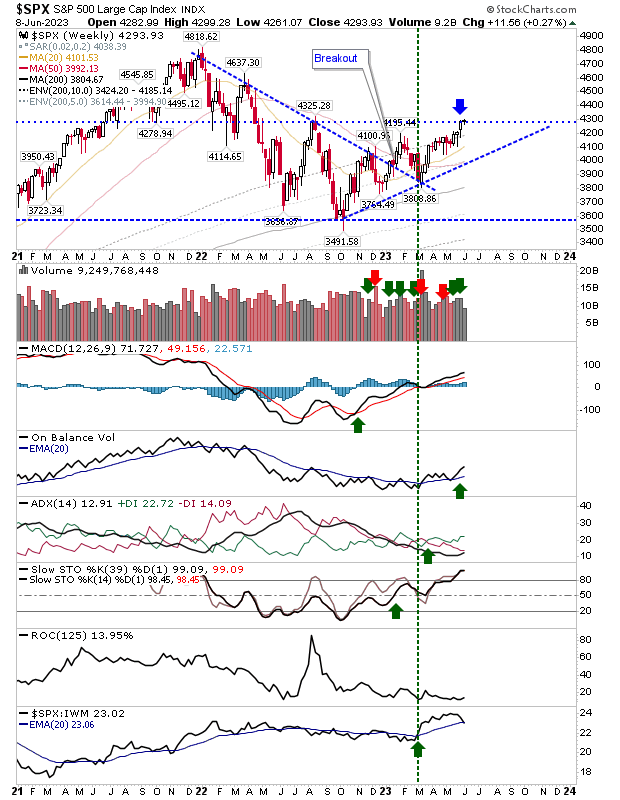

The S&P 500 managed to close at a new daily high, but the real battle for this index is on the weekly chart. If the index can maintain this level by tomorrow's close, it will finish the week bang on resistance, setting up an opportunity for a breakout next week.

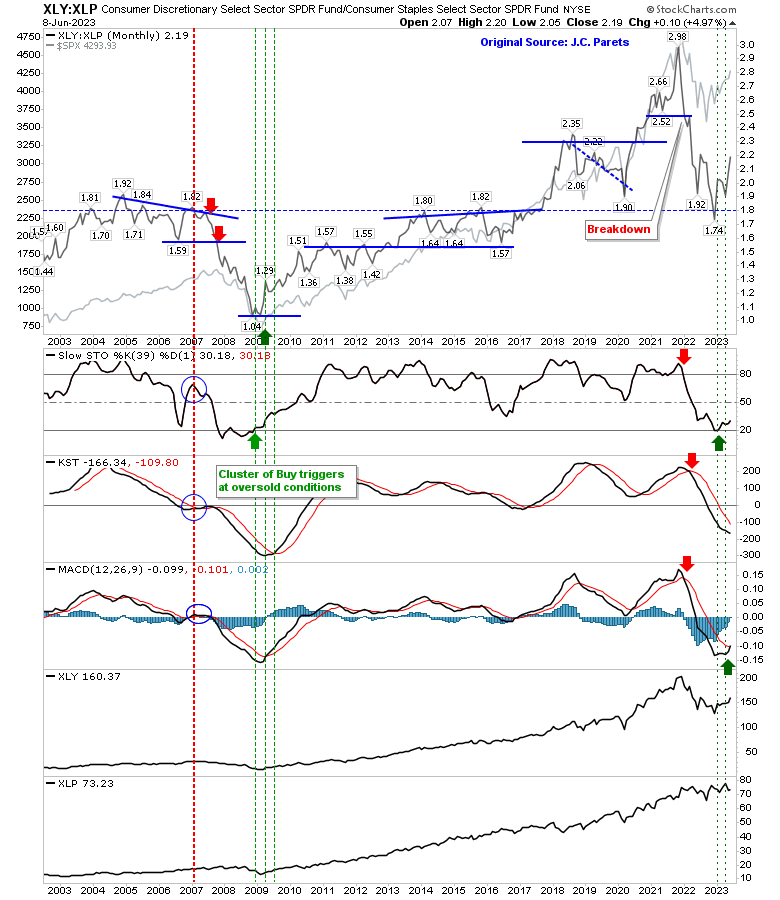

One chart I'm watching is one previously offered by J.C. Parets. This looks at the relationship between Discretionary and Staples ETFs. From this chart, we are entering a period comparable to 2009 when supporting technicals were emerging from an oversold state with an existing 'buy' signal in the MACD, just waiting for one in the KST. Just as a note, this is a monthly chart, so it may be the latter part of the year before we see the signal.

Tomorrow's close is important for both daily and weekly timeframes. We don't need a big gain, just one to hold the gains of today.