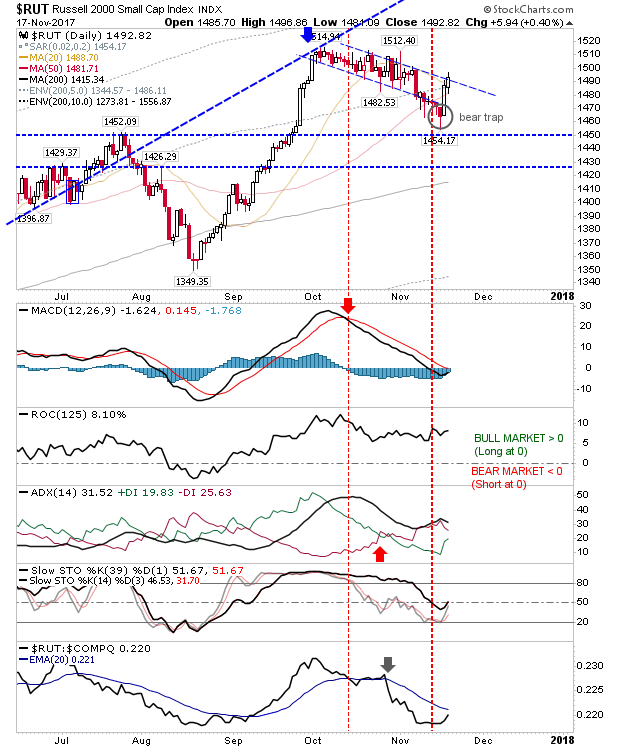

Over the course of Thursday and Friday the Russell 2000 reversed what had looked like a runaway breakdown into a counter rally and potential breakout. Now's the time for shorts, FOMO longs and existing longs to pressure resistance.

Action over the last two days of the week was particularly tasty, especially if you are looking for an extension of the August-October rally. Better still, there isn't a whole lot of competition from other indices for trading opportunities. Long risk measured from a stop below 1,454.

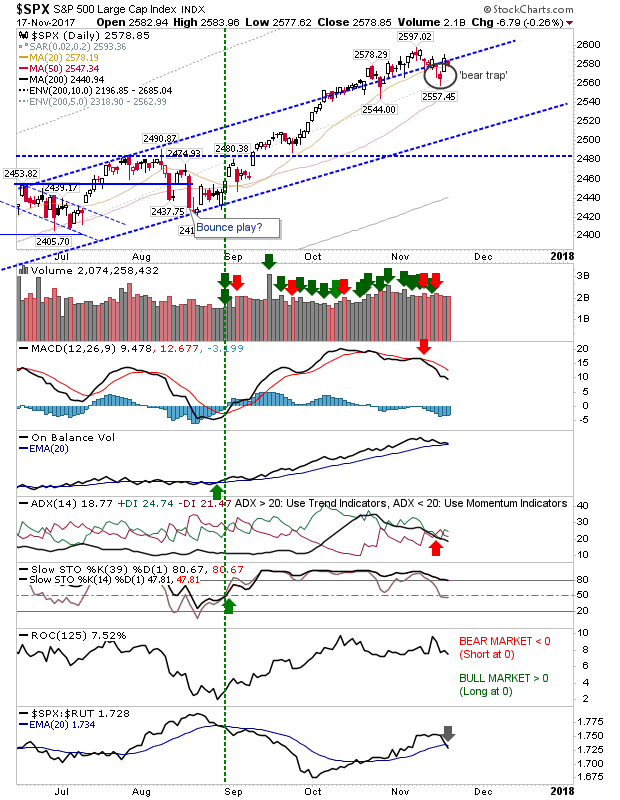

The S&P is up against channel resistance as Friday's action held to the upper range of Thursday's intraday spread. The index will have an opportunity to confirm the 'bear trap' today, Monday, as any gain will push it above channel resistance. Technicals are mixed with the MACD trigger 'sell' competing with a strong - if fading - On-Balance-Volume accumulation trend. There is also a significant relative performance loss against Small Caps.

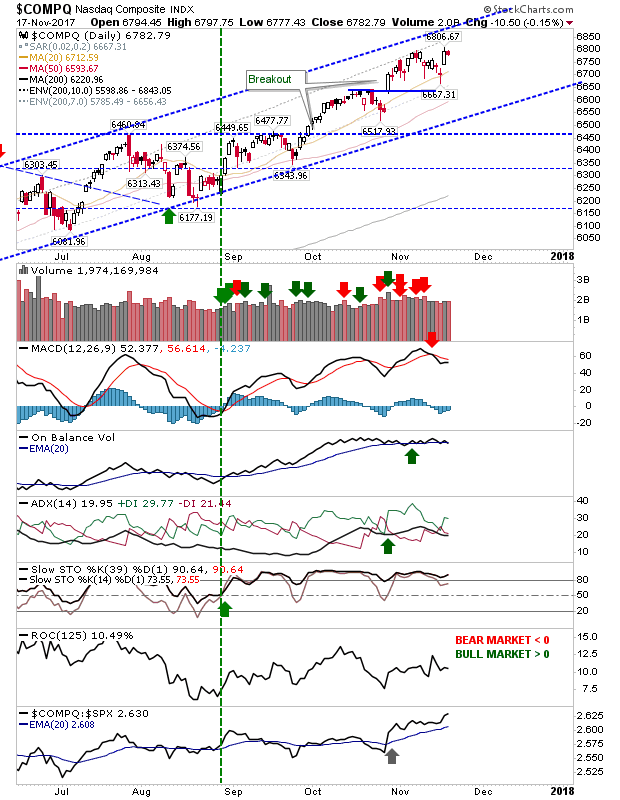

The NASDAQ is caught in the middle. Good relative performance, decent technicals but trading neither at support nor resistance. The prior trend suggests this will make it to channel resistance so longs have little reason to sell.

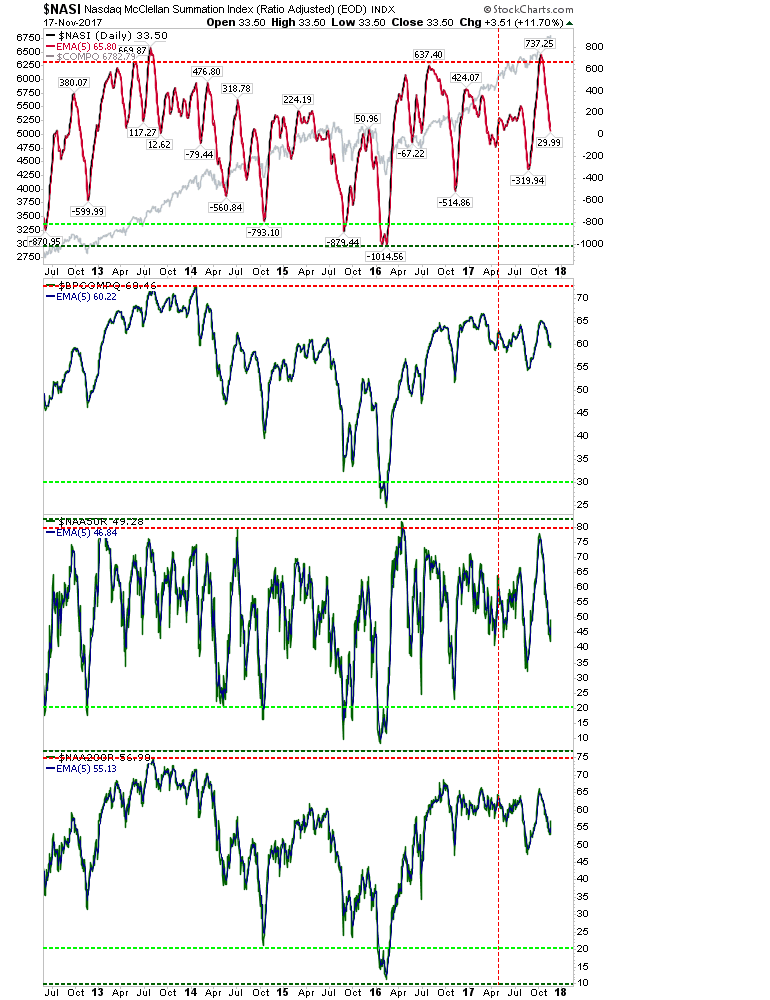

Tech breadth is attempting a swing low but not from an oversold position. However, a rally from here has plenty of room for upside before it becomes overbought.

For Monday, look to the Russell 2000 to break resistance and perhaps for the S&P too.