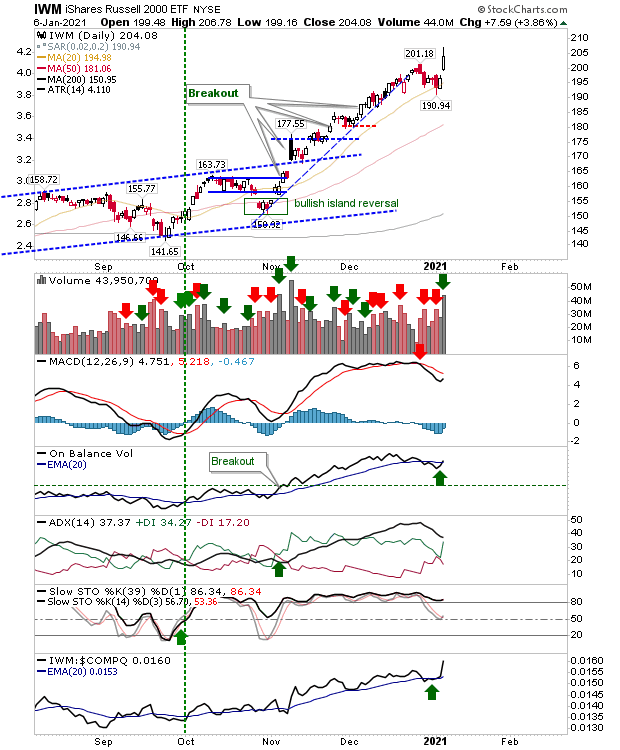

A big divergence in markets yesterday as the Russell 2000 (via IWM) below) awoke from its slumber to close at a new high while the NASDAQ was busy testing its lows. The Dow Industrials joined the Small Caps party, while the S&P was caught in the middle.

It's an odd juxtaposition given the divergence between the indices, with the Russell 2000 so far extended beyond its 200-day MA. Maybe it's the start of a blowoff top, but there was good volume with yesterday's buying—registering it as confirmed accumulation.

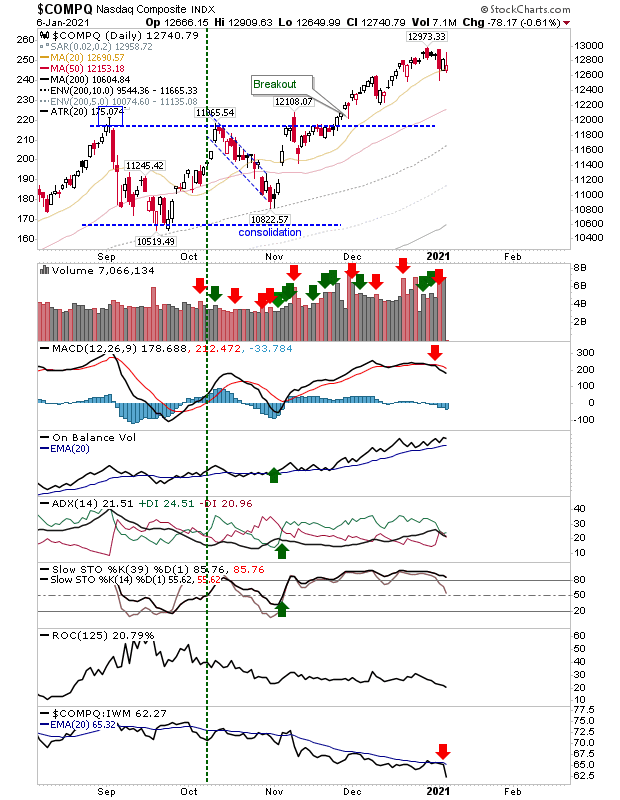

The NASDAQ is back in trading at its 20-day MA after rallying from this moving average yesterday. Given the upper spike of yesterday's intraday range I would expect this to fall further—perhaps as far as its 50-day MA. It would appear money is cycling away from Tech stocks into Small Caps.

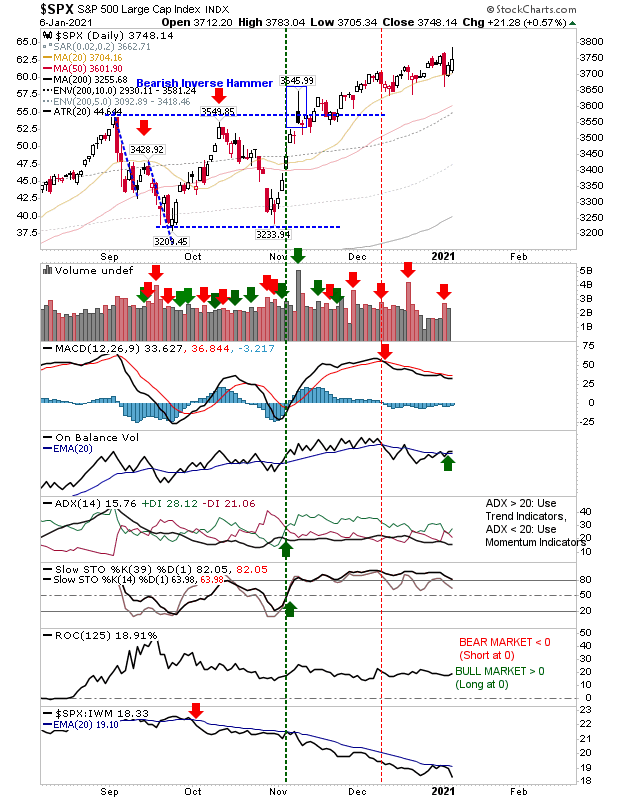

The S&P remains dominated by Monday's selling. While yesterday's volume didn't register as accumulation it was enough to generate a new 'buy' signal for On-Balance-Volume. Wednesday was still a good day for the index, but clearing Monday's high by the end of the week would seem to be a minimum requirement.

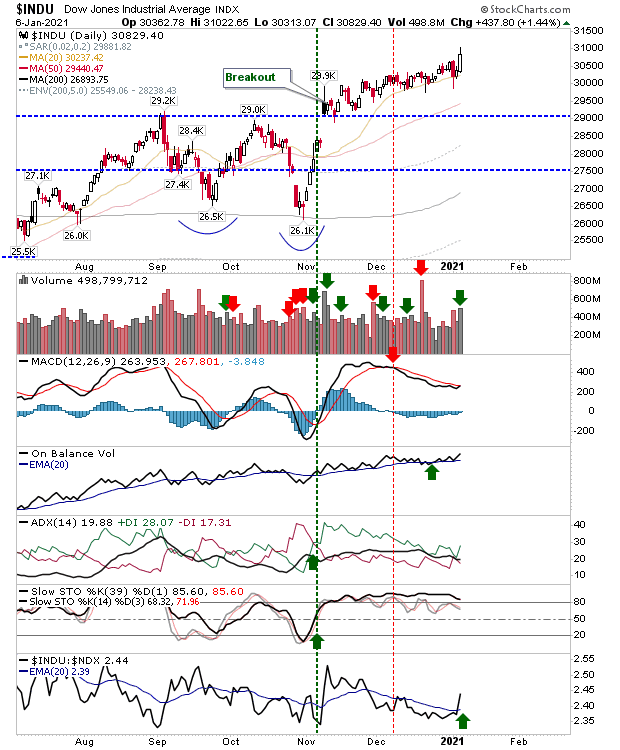

The Dow Jones was a bit of an exception as it was able to close at a new high on higher volume accumulation—unlike the S&P. It's also close to a new MACD trigger 'buy.'

For the rest of the week it will be about indices undoing the damage from Monday's selling. Some indices are already there. Other are still getting there.