Investing.com’s stocks of the week

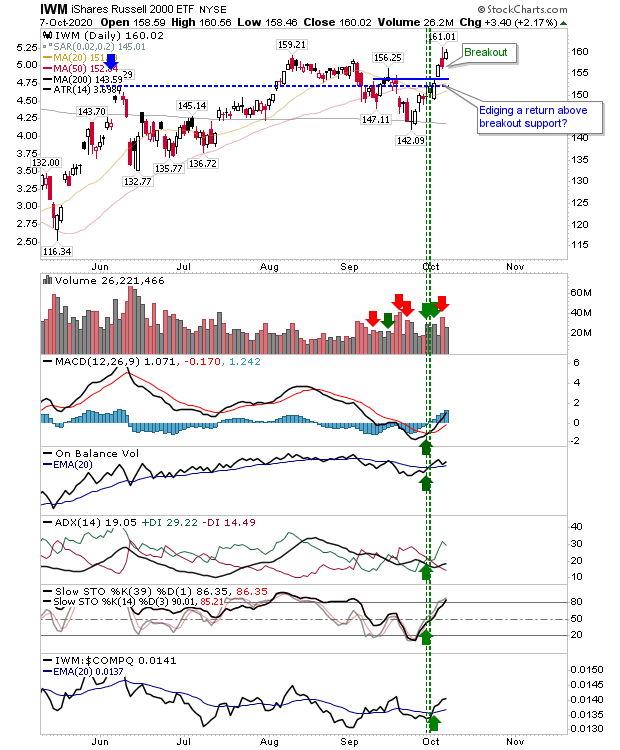

Tuesday's selling was a flash in the pan quickly undone by Wednesday's trading. The Russell 2000 (via IWM) sharply advanced, taking out the August swing high with technicals all firmly in the green. The only negative was the lower volume, but this is a marked advance after the successful test of the 200-day MA.

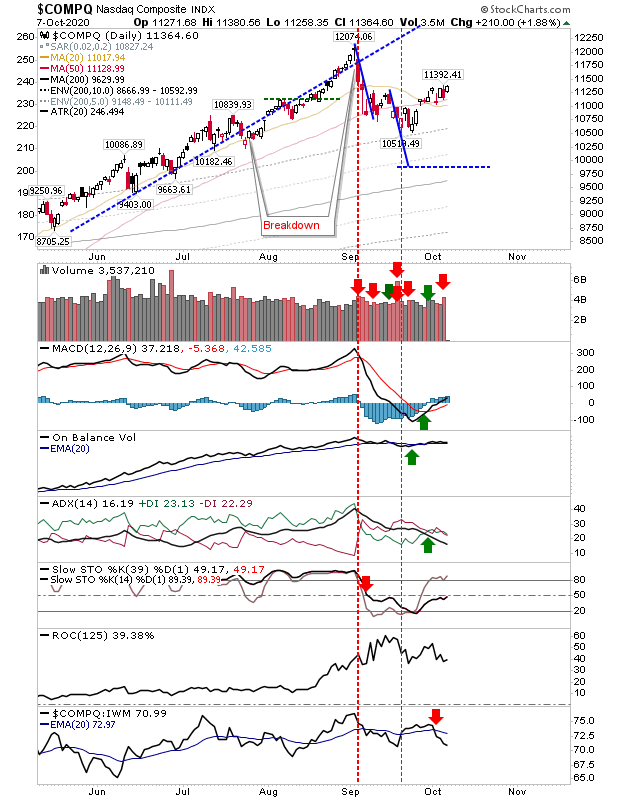

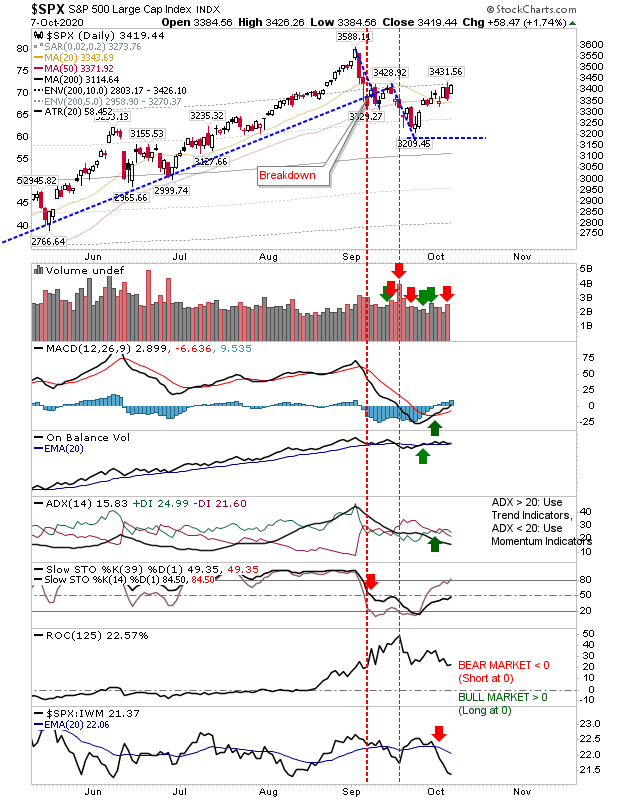

The gain in the Russell 2000 yesterday is an indication markets are steering towards a more sustainable rally, despite the negative news and proximity of the election. The NASDAQ and S&P are both offering long-side trade opportunities for those willing to take on risk at this time.

The S&P sits in a similar predicament to the NASDAQ with only stochastics left to turn bullish for key indicators. The S&P (and NASDAQ) are significantly underperforming the Russell 2000, but this is bullish for markets overall as long as the Russell 2000 can maintain its current form.

The NASDAQ, S&P and Russell 2000 all have 50-day MAs to lean on should the need arise, but until then, each index is building on a rally started after the Russell 2000 successfully tested its 200-day MA. Better still, the indices have shrugged off damaging news with consumate ease—so the election should hold no fear.