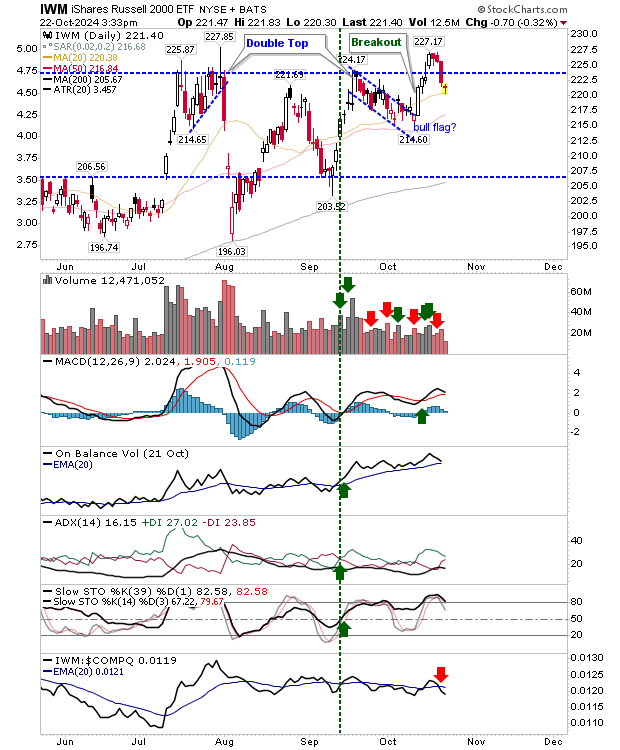

At its simplest, the Russell 2000 (IWM) breakout to new highs has faded back to its 20-day MA on low volume.

This could be considered a "bull trap", but I would be prepared to give the 20-day MA a chance for bulls to mount a defense given the narrow range of yesterday's candlestick.

Technicals remain net positive - another reason for optimism - although the index continues to underperform relative to the Nasdaq.

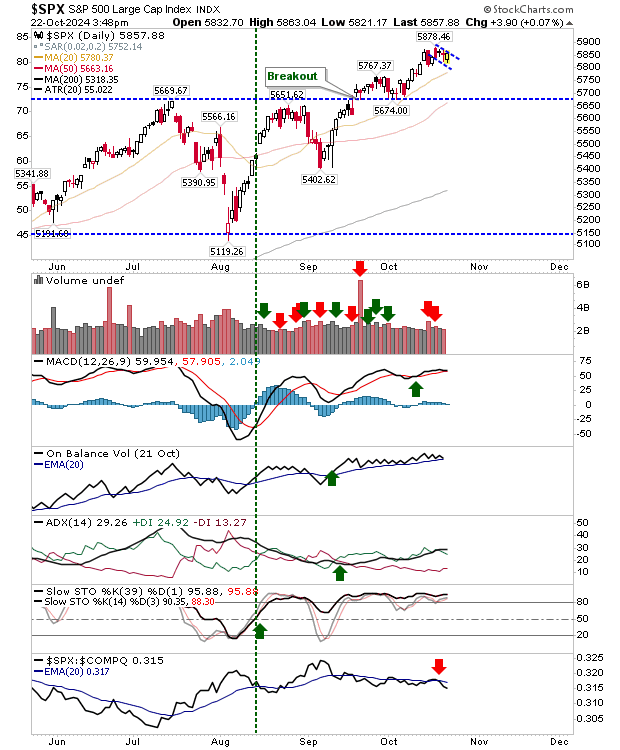

The S&P 500 performed better, opening low but gaining through the day, albeit at a very modest rate.

The index has managed to close above yesterday's close in what could be considered a small 'bull flag'. Technicals are net bullish, but as with the Russell 2000 ($IWM), it's underperforming relative to the Nasdaq.

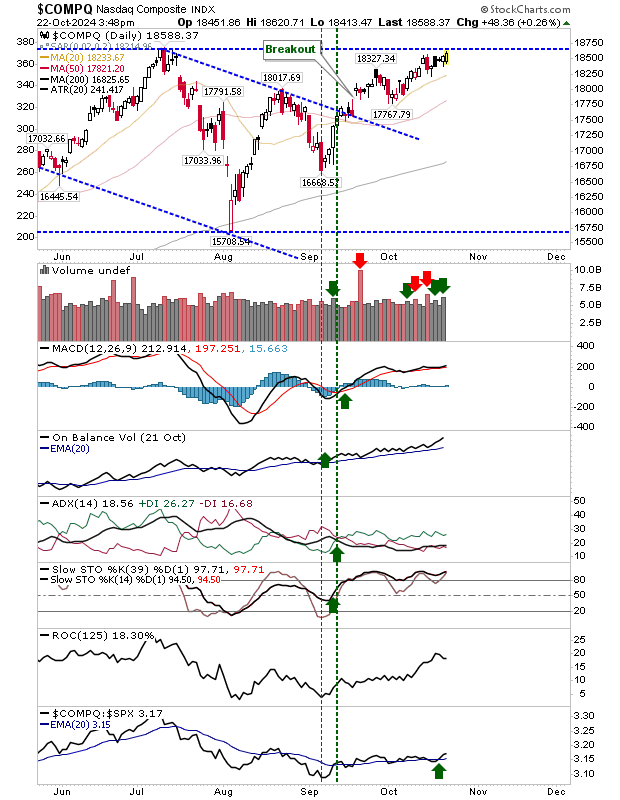

The Nasdaq is moving in bulls favor. Unlike losses in the Russell 2000 ($IWM) on light volume, the Nasdaq is moving higher on increased volume.

While the July peak has yet to be breached, there is a good chance it will have succeeded by end of week. Traders have a chance to participate before it hits the breakout scan radar.

There is developing contradiction from what looked to be the start of something good in the Russell 2000 ($IWM), to the reassertion of leadership in the Nasdaq. Bulls have the advantage, it's just difficult to know which index will be the one to lead into the latter part of the year.