Investing.com’s stocks of the week

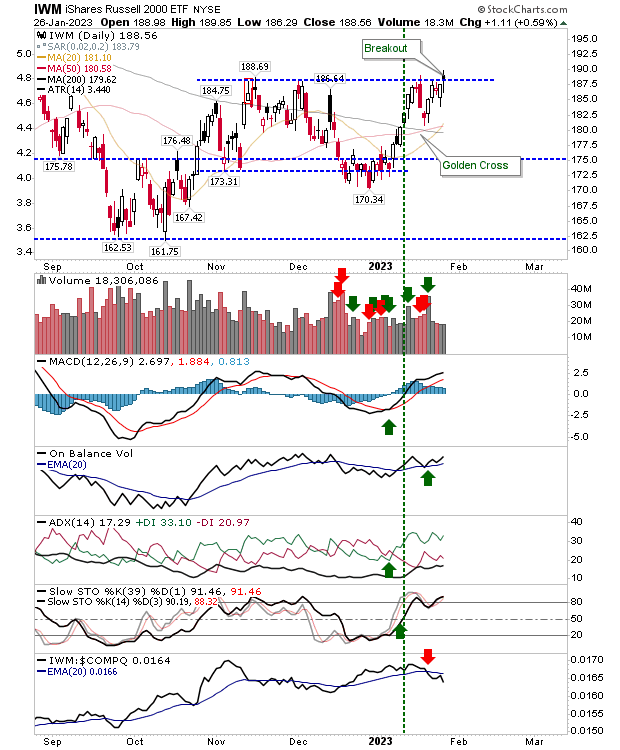

I'm not entirely convinced by the Russell 2000 resistance break, primarily because it has triggered on a 'black' candlestick, typically a bearish candlestick pattern. Volume wasn't great, but there is a significant 'golden cross' between 50-day and 200-day MAs that should bring some bullish momentum with it. Technicals are good, but there is relative underperformance against the Nasdaq.

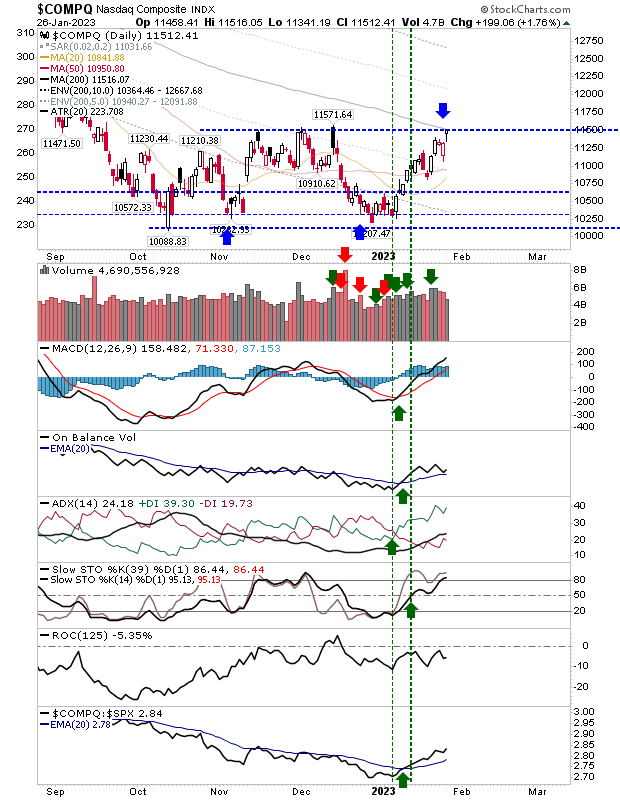

The Nasdaq gapped higher, and lost ground through the day, but finished a little higher and bang on resistance. There was no breakout, but it's primed to move higher. The one catch is the added resistance at its 200-day MA. Technicals are excellent, including relative outperformance against the S&P 500 and Russell 2000.

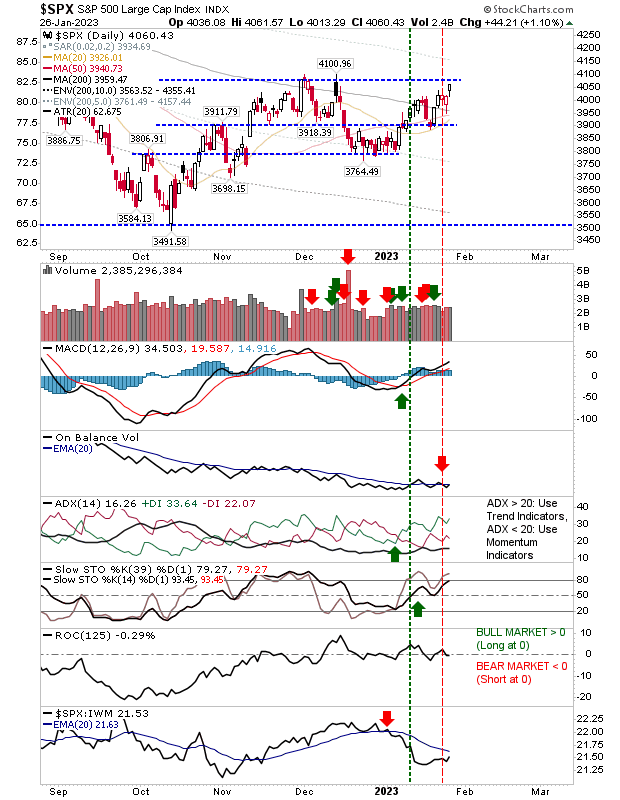

The S&P 500 also edged towards resistance but isn't quite there yet. It does have the benefit of trading above its 200-day MA. If there is a catch it's that On-Balance-Volume has been trending lower while the index has moved sideways. There is also a 'sell' signal in the indicator, but this is flip-flopping around, so I wouldn't worry too much about that - the bearish trend is more worrisome (and the sharp underperformance against the Russell 2000 is not great either).

For today, eyes are on the Russell 2000. It's a key index to drive secular bull markets and it will be the lead out. I don't see too much concern, despite the bearish flags I mentioned earlier. I think the overall momentum is very much on the bull's side. The fact there is still plenty of bearish chatter in the social media world will be to the benefit of the markets.