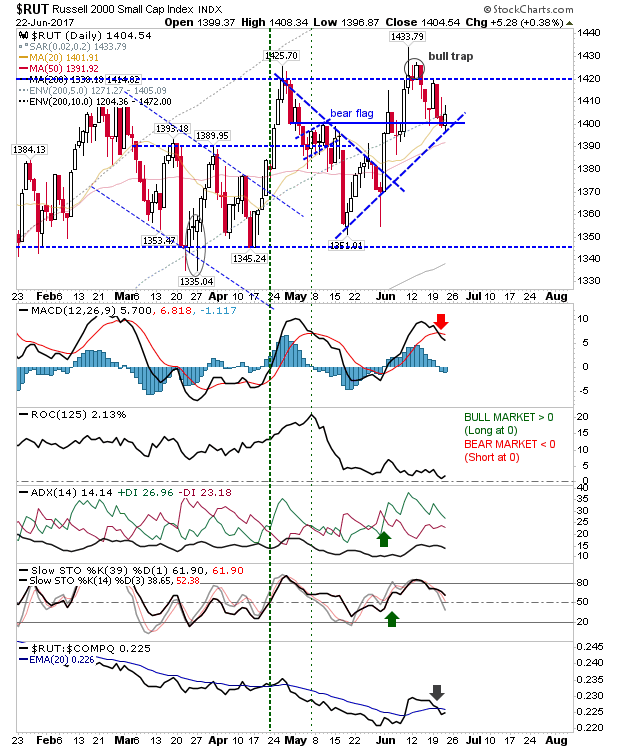

There wasn't much to say about Thursday, but the one index which caught my attention was the Russell 2000. The index caught a bounce in demand at the rising trendline and also did enough to recover the 20-day MA. Traders looking for pullback opportunity could take a look at the Russell 2000. Stops on a loss of 1,397.

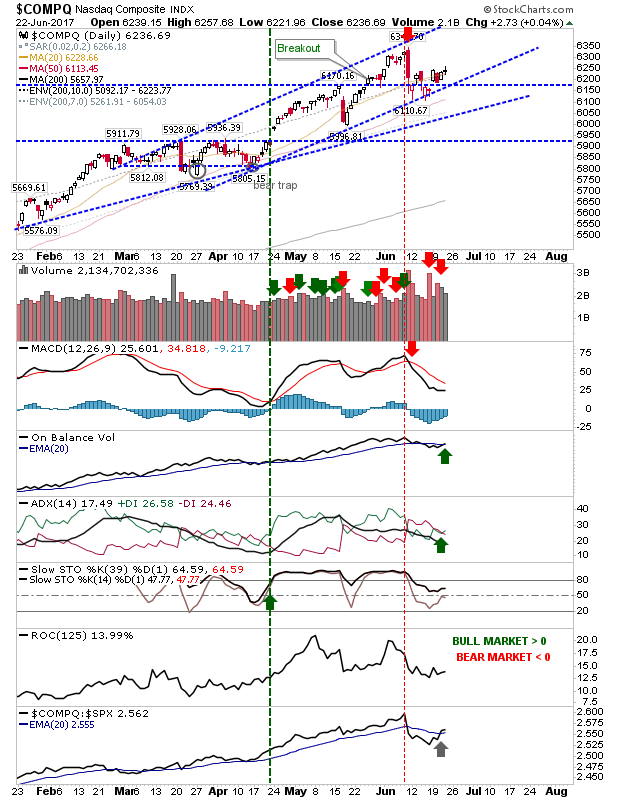

The NASDAQ is primed for a move to challenge 6,350. Thursday's doji marks indecision just below 6,250 but if it can push above this price level it would likely trigger a spate of short covering. Technicals have seen an improvement with an On-Balance-Volume 'buy' trigger and relative performance gain against the S&P.

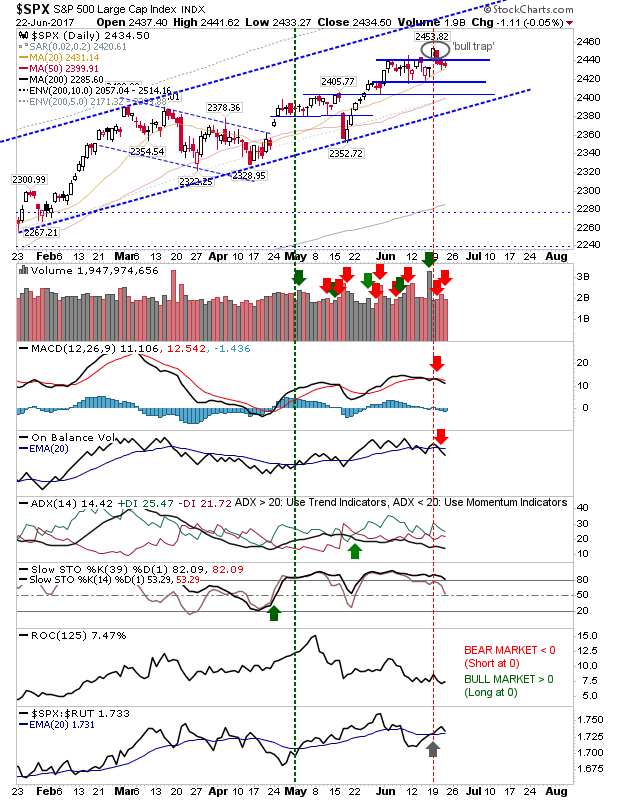

The S&P stuck around its 20-day MA, a moving average which has played as support over the last couple of weeks and has a chance of doing so again on Friday. Having said that, opportunities in the NASDAQ and Russell 2000 look better.

For Friday, keep an eye on the Russell 2000. If it can regain some momentum it will bring the other indices along with it.