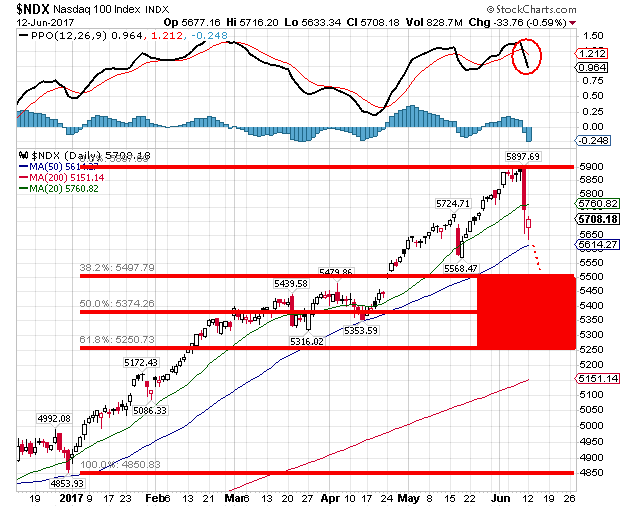

The decline of the tech sector that started on Friday, June 9th, 2017, continued into Monday, June 12th, 2017. I expected the NDX to test the range, as illustrated within the red box in the below chart, before continuing higher, but not closing below the red box.

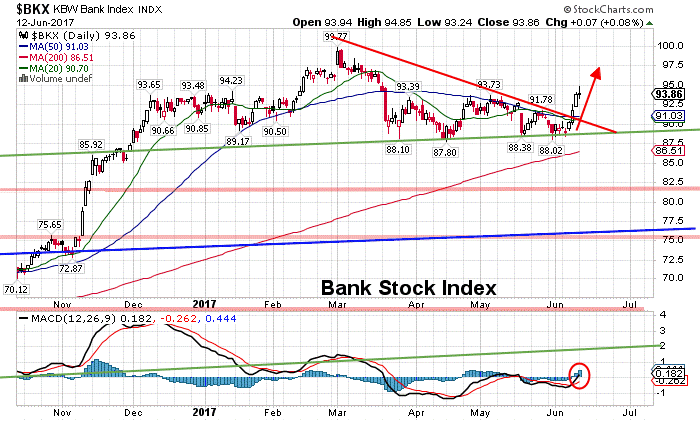

The banking stocks were among the beneficiaries of the tech slump, with Bank of America Corp (NYSE:BAC), Goldman Sachs (NYSE:GS) and JPMorgan Chase (NYSE:JPM) all defying their head and shoulders break-down setups.

The volume in the QQQ fund has been excessive. On Friday, June 9th, 2017, it was 8 standard deviations above its’ normal average volume. On Monday, June 12th, 2017, it was more than 6 standard deviations above its’ normal average volume. It set a new record since back in 1999.

Goldman Sachs) sent a memo out to it’s clients late last week. Goldman worries that the boom has created an “valuation air-pocket,” similar to the ridiculously high valuations for tech stocks during the Dot-Com boom.”

The SPX Trade

The market is in a very bullish posture if we remain over 2420 in the SPX. There is NO market crash in sight.

As this bullish pattern continues to rise throughout the summer, we should then prepare for the next correction in the SPX. This next pullback can take us from the 2500 – 2550 SPX region and potentially back down towards the 2300 SPX. The next buying opportunity should occur in the fall of 2017, approximately sometime during the Thanksgiving Day holiday.

How A ‘Market Crash’ Stops:

‘Circuit breakers’!

Stock exchanges attempt to ease ‘panic selling’ by taking certain steps to halt trading. These moves are called ‘market circuit breakers’.

The purpose is to prevent a market or stock price ‘free-fall’ by trying to rebalance buy and sell orders. ‘Circuit breakers’ halt trading on the nation’s stock markets during dramatic drops and are set at 7%, 13% and 20% of the closing price for the previous day. The ‘circuit breakers’ are calculated daily.

Level 1 halt (7%):

Trading will halt for 15 minutes if the drop occurs before 3:25 p.m. (ET)

At or after 3:25 p.m. (ET) — trading shall continue, unless there is a Level 3 halt.

Level 2 halt (13%):

Trading will halt for 15 minutes if the drop occurs before 3:25 p.m. (ET)

At or after 3:25 p.m. (ET) —trading shall continue, unless there is a Level 3 halt.

Level 3 halt (20%):

At any time during the trading day—trading shall halt for the remainder of the trading day.

The De-regulation of ‘RED TAPE’ in the Financial Industry Will Place the Markets at a Greater Risk.

The Trump Administration hopes that by unshackling businesses from all the ‘RED TAPE’ regulations, renegotiating trade deals and by cutting tax rates, that this will help the economy to grow faster. The administration hopes that these changes will create new jobs.

On Thursday, June 8th, 2017, The House of Representatives approved legislation to erase the core financial regulations implemented in the Dodd-Frank Act of 2010. Republicans moved a step closer to delivering on their promises to eliminate rules that have been perceived as strangling small businesses and stagnating the economy. The non-partisan Congressional Budget Office estimated that the bill would reduce federal deficits by $24.1 billion over the next decade.

This bill will reverse most of the protections put in place since “The Great Financial Crisis Of 2017”.

The Choice Act would exempt some financial institutions which meet capital and liquidity requirements from many of Dodd-Frank’s requirements that limit risk taking. It would also replace Dodd-Frank’s method of dealing with large and failing financial institutions. This is known as the orderly liquidation authority — which critics say reinforces the idea that some banks are too big to fail — with a new bankruptcy code provision.

This new legislation would weaken the powers of the Consumer Financial Protection Bureau. The bill would also eliminate the Labor Department’s fiduciary rule which requires brokers to act in the best interest of their clients when providing investment advice about retirement.