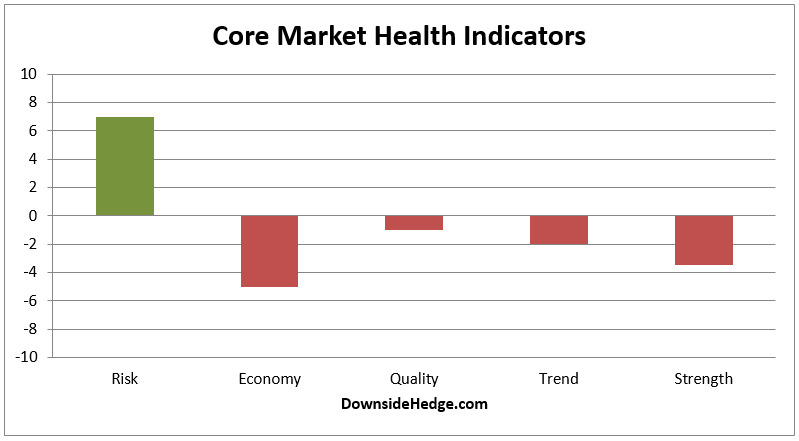

We’ve got an interesting situation in the markets where perceptions of risk are extremely low, but my core indicators show an unhealthy market profile. This suggests that the unhealthy internals are most likely a result of rotation, and not the start of a longer term top. Of course, that’s not to say that mere rotation can’t turn into mass selling. But, for now, I’m not too concerned.

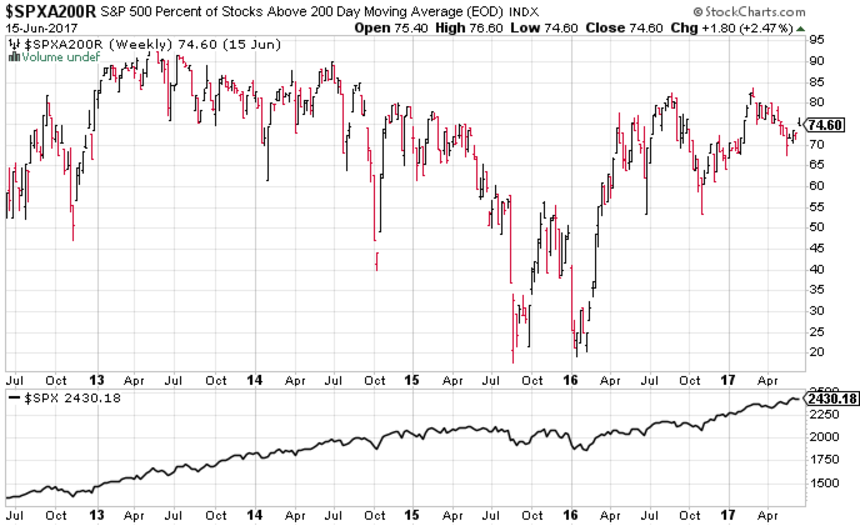

One of the reasons I’m not to concerned is that even with the Nasdaq 100 (NDX) weakness over the past week, the percent of stocks in the S&P 500 Index (SPX) above their 200 day moving average is rising. This tells me that investors are rotating into beaten down stocks. This isn’t the way tops are usually made. Tops are made when leaders and beaten down stocks are being sold at the same time.

As I mentioned above, my core indicators are showing weakness in underlying technical support. Most notably, is the market quality category which fell below zero this week. That changes our core portfolio allocations as noted below. As always, use your own risk tolerance to structure your portfolio.

Long / Cash portfolio: 20% long and 80% cash

Long / Short Hedged portfolio: 60% long high beta stocks and 40% short the S&P 500 Index — or use the ETF with symbol SH

Volatility Hedged portfolio: 100% long (since 11/11/2016)

Conclusion

Even though my core indicators are showing weakness, market participants aren’t showing any real fear. Beaten down stocks are being bought and moving them above their 200 day moving averages. This looks more like normal rotation ahead of a move higher than the start of a longer term top.