Equity indices rebounded yesterday, perhaps as investors decided to increase their bets over a global economic recovery due to further loosening of the restrictive measures imposed to prevent the coronavirus from spreading at a fast pace. In the FX world, the pound was the main loser following the disappointing UK CPIs for April, as well as fresh comments over the adoption of negative interest rates by the BoE.

EQUITY MARKET REBOUND ON RECOVERY HOPES

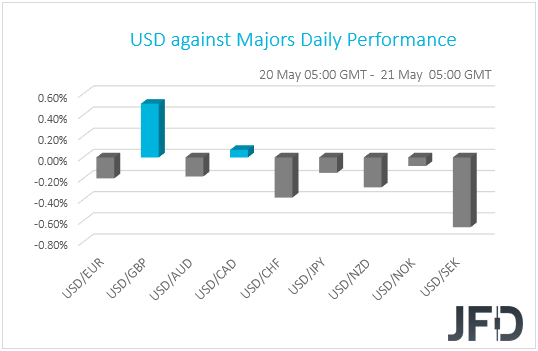

The dollar continued trading lower against the majority of the G10 currencies on Wednesday and during the Asian morning Thursday. It underperformed the most against SEK, CHF, and NZD in that order, while it gained only versus GBP and slightly against CAD.

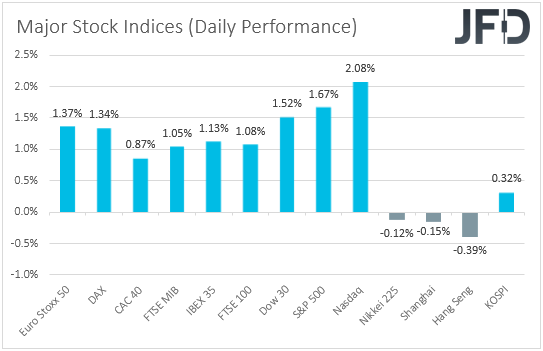

The weakening of the dollar and the strengthening of the risk-linked Kiwi suggests that risk appetite rebounded again at some point. However, the fact that the Swiss franc was among the top performers points otherwise. Thus, given the blurry picture painted by the FX performance, we prefer to turn our gaze to the equity world in order to clear things up. There, major EU and US indices were a sea of green, with investors forgetting the reports that cast doubts over a coronavirus vaccine. It seems that they preferred to increase their bets on a recovery in global economic growth as major economies continued to loosen their restrictive measures.

An upbeat start for Wall Street due to new records by Facebook (NASDAQ:FB) and Amazon (NASDAQ:AMZN) may have also helped the broader sentiment. That said, risk appetite softened during the Asian session today, with Japan’s Nikkei 225 and China’s Shanghai Composite sliding 0.12% and 0.15% respectively. Maybe this was due to headlines suggesting more tensions between the US and China. Yesterday, US Senators decided unanimously to pass a bill which makes it hard for Chinese firms to stay listed in the US, while overnight, US President Trump accused China over disinformation in order to hurt his reelection chances.

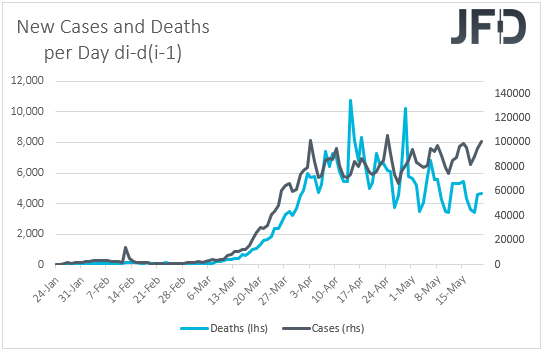

As for our view, it has not change. Remember that yesterday, we noted that we would treat Tuesday’s retreat in equities as a corrective move, and yesterday’s recovery adds some credence to that view. We repeat that with headlines suggesting that more fiscal and monetary stimulus around the globe is underway, and with the virus curve being much flatter than a couple of months ago, investors may keep increasing their risk exposures, as they divert flows out of safe havens. One of the risks to that view is further escalation in the tensions between the US and China, which may revive fears that the world’s two largest economies are unlikely to secure a final trade deal, and even jeopardize the already-agreed Phase One accord.

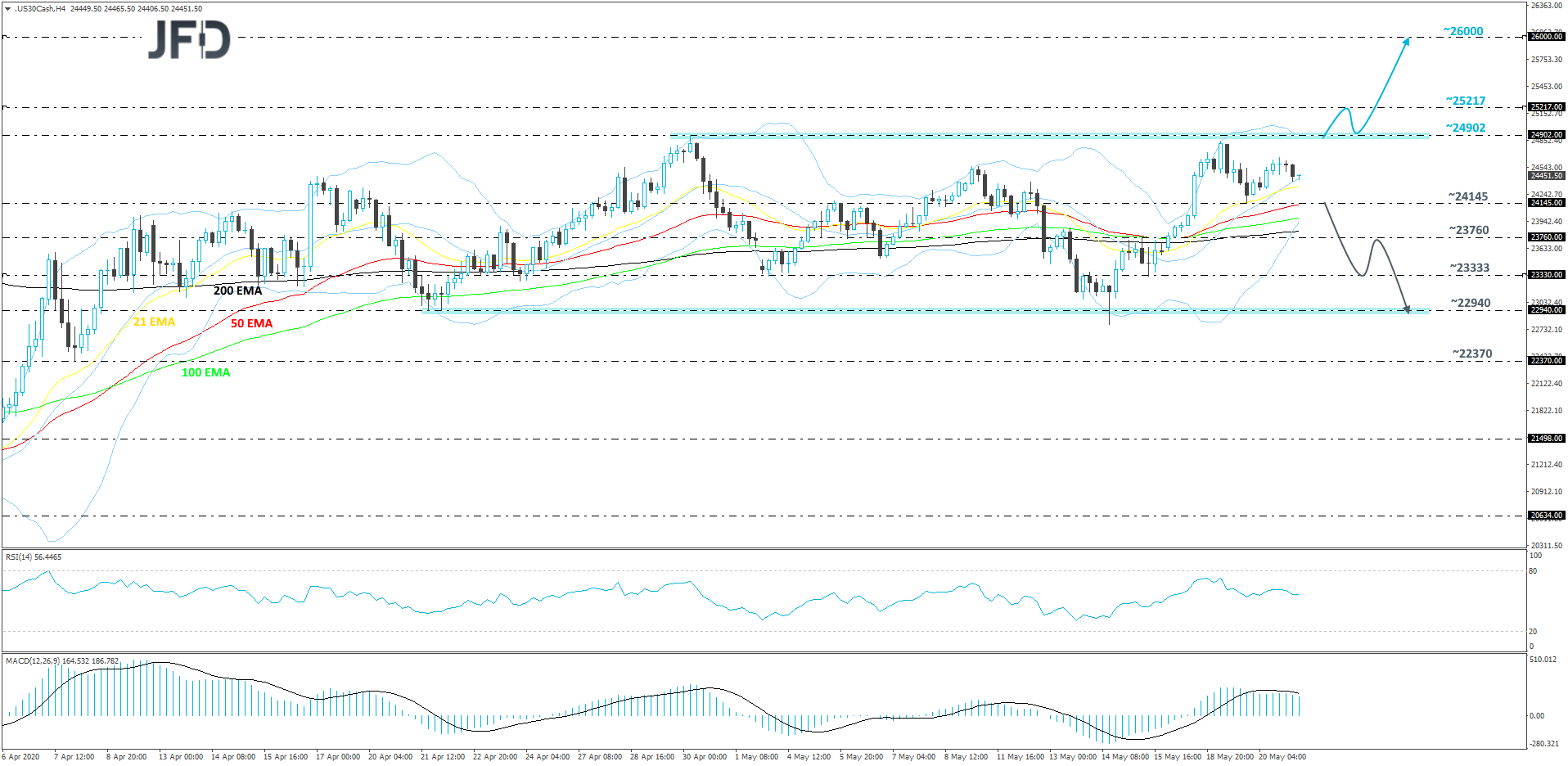

DJIA – TECHNICAL ANALYSIS

The Dow Jones Industrial Average index continues to move sideways, roughly between the 22940 and 24902 levels. The cash index is currently closer to the upper side of the range, which may increase its chances of overcoming that barrier. That said, a break of the 24902 hurdle would still be needed, in order to get comfortable higher areas. Until then, we will take a neutral stance.

If DJIA gets a strong push above the 24902 barrier, this would confirm a forthcoming higher high, this way potentially attracting more bull-power. The index might then drift to the 25217 obstacle, marked by the low of March 6th, which if broken could send the price even further north. That’s when we will consider a possible test of the psychological 26000 area, marked by the high of March 6th.

Alternatively, if the index struggles to overcome the upper bound of the range, and instead, drops back below Tuesday’s low, at 24145, this could temporarily spook the buyers from the arena. The price may slide to the 23760 obstacle, a break of which might clear the way to the 23330 zone, which is the low of May 15th. DJIA may stall there for a bit, or even retrace back a bit. However, if the price remains below the 23760 barrier, or the 200 EMA on the 4-hour chart, this could result in another round of selling. If this time the index breaks the 23330 hurdle, the next possible support area could be the lower side of the aforementioned range, at 22940.

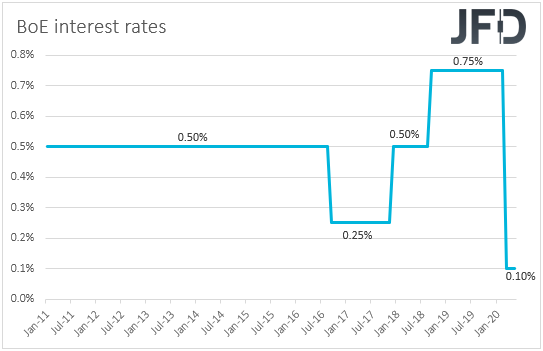

POUND SLIDES ON MORE NEGATIVE-RATES TALK

Back to the currencies, the pound was the main loser among the G10s. This may have been due to the miss in the UK CPIs for April, but also due to fresh comments around negative interest rates in the UK. Following the disappointing inflation data, BoE Governor Andrew Bailey noted that he and his colleagues do not rule out anything for policy and that negative interest rates are under active review. His comments come after BoE’s Chief Economist Andy Haldane said on Friday that the Bank is looking more urgently at negative interest rates, increasing the chances for the Committee to proceed with such an action in the months to come.

At their latest meeting, BoE officials kept their policy unchanged, but noted that the current QE is set to reach its target at the beginning of July. This, combined with their readiness to take further action if needed, suggests that a QE expansion may be on the cards at the June meeting. That said, the big question now is whether such a decision will be accompanied by negative interest rates, or whether they will decide to wait for a while before they proceed with cutting rates. In our view, the prospect of further easing by the BoE, combined with the risk of a no-deal Brexit by the end of the year, may keep the currency under selling interest for a while more. Conditional upon further recovery in risk appetite, we would prefer to exploit any pound losses against currencies that tend to benefit during periods of market optimism, like the risk-linked Aussie and Kiwi.

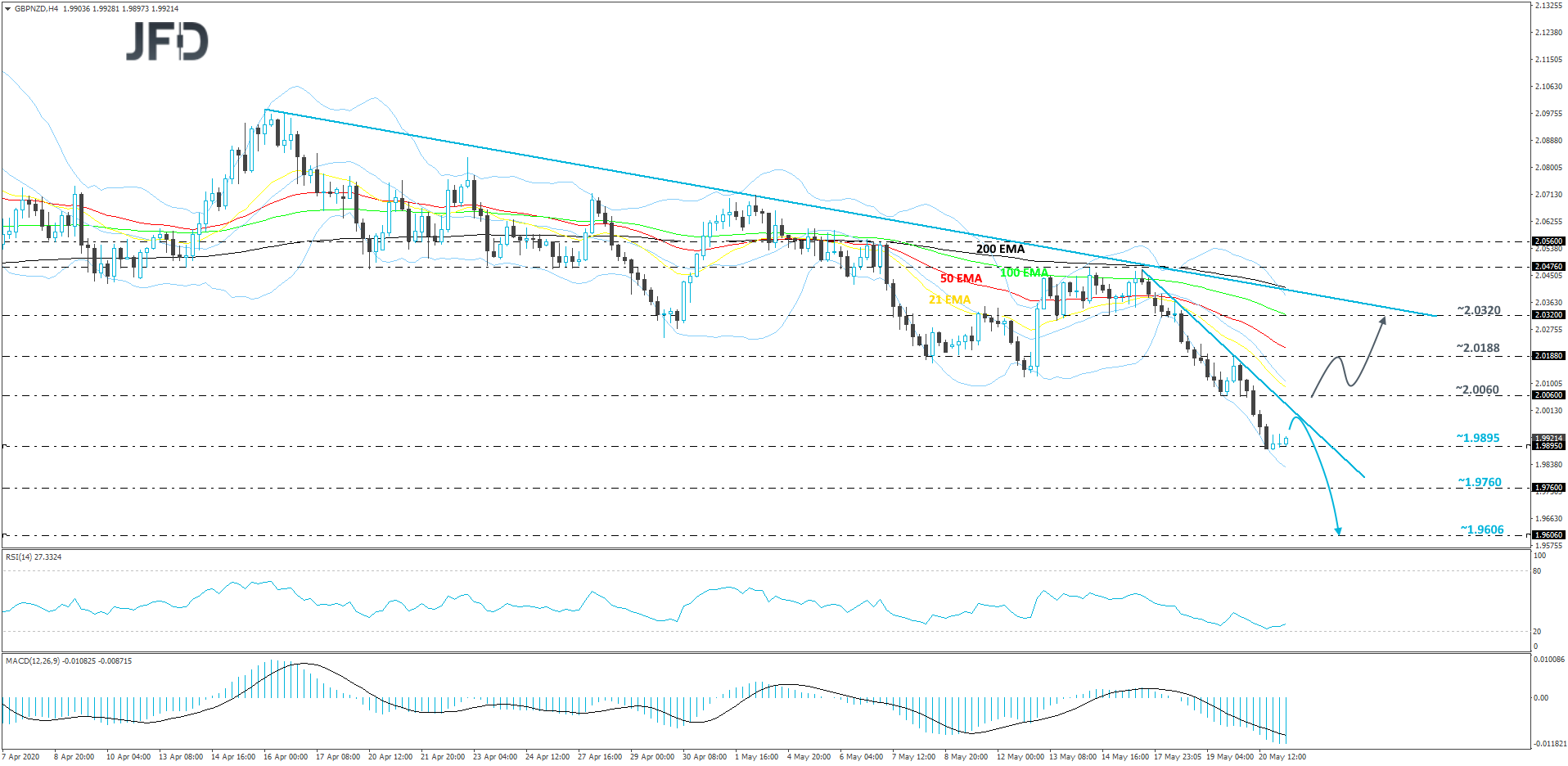

GBP/NZD – TECHNICAL OUTLOOK

GBP/NZD has been moving lower from the beginning of this week. Because of this down move, we can draw a short-term downside resistance line taken from the high of May 15th. Yesterday, the pair overshot slightly the March low, at 1.9895, but this morning the rate is back above that hurdle, which may help the bulls to lift the pair up a bit. However, if GBP/NZD stays below that downside line, the near-term outlook will remain bearish.

As mentioned above, a small push higher could result in a test of the aforementioned downside line. If it stays intact, the bears could take advantage of the higher rate and drive GBP/NZD south. A strong move below the 1.9895 zone might just make the sellers stronger and more confident. They could then easily push the pair towards the 1.9760 obstacle, a break of which may clear the way to the 1.9606 level, marked by the low of January 20th.

On the other hand, if the aforementioned downside line breaks and the rate gets lifted above the 2.0060 barrier, marked near the low of May 19th, that might strengthen the position of the bulls and allow them to dictate the rules for a bit longer. The pair could then drift to the 2.0188 hurdle, a break of which may send GBP/NZD to test the 2.0320 zone, marked by the inside swing low of May 14th. But let’s not forget that this whole move higher might still be seen as a temporary correction, because the rate would still be below another short-term downside resistance line drawn from the high of April 16th.

AS FOR TODAY’S EVENTS

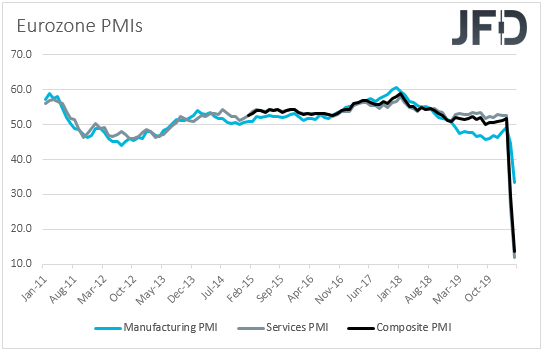

During the European morning, we get the preliminary PMIs for May from several Eurozone members and the bloc as a whole. Both Eurozone’s manufacturing and services indices are expected to have rebounded to 38.0 and 25.0, after hitting record lows at 33.4 and 12.0 respectively. This will drive the composite PMI up to 25.0 from 13.6. Although this data would point to an improvement, all readings would still be well below the boom-or-bust barrier of 50.0, and thus, they are unlikely to provide a massive boost to the euro.

When they last met, ECB policymakers eased the conditions of their TLTROs and introduced a new series of non-targeted pandemic emergency long-term refinancing operations (PELTROs), staying ready to adjust all of their instruments, as appropriate, to ensure that inflation moves towards their aim in a sustained manner. With that in mind, we believe that the PMIs could keep the door for further stimulus wide open.

We get the preliminary PMIs for May from the UK and the US as well. No forecast is available for the UK numbers, while in the US, both the manufacturing and services indices are expected to have rebounded, to 38.0 and 30.0 from 36.1 and 26.7 respectively. The US existing home sales for April and the initial jobless claims for last week are also coming out. Existing home sales are expected to have tumbled 18.9% mom after declining 8.5% in March, while jobless claims are forecast to have surged by another 2.4mn.

As for tonight, during the Asian morning Friday, we have New Zealand’s retail sales for Q1 and Japan’s National CPIs for April. No forecast is available for New Zealand’s data, neither for Japan’s headline CPI. The core rate is expected to have slid to -0.1% YoY from +0.4%.

We also have three Fed speakers on today’s agenda: Chair Jerome Powell, Vice Chair Richard Clarida, and Board Governor Lael Brainard.