Equities were a sea of red yesterday and today in Asia, as US Treasury yields continued to rise, highlighting increasing expectations over a faster rate-hike path. Today, we already got the UK CPIs, which accelerated further, adding to the chances of another rate hike by the BoE at its upcoming gathering.

Later in the day, we get inflation data from Canada, while tomorrow, during the Asian session, Australia releases its employment report for December.

US Treasury Yields Continue to Hurt the Stock Market

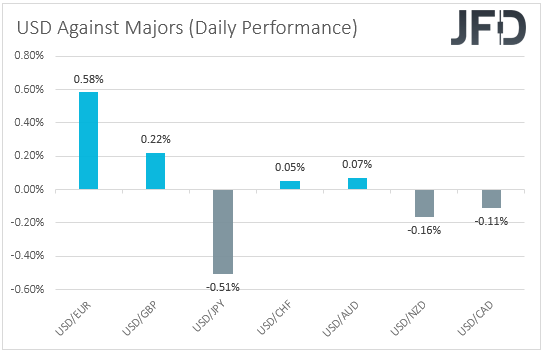

The US dollar traded mixed against the other major currencies on Tuesday and during the Asian session Wednesday. It gained versus EUR and GBP, while it underperformed against JPY, NZD, and CAD. The greenback was found virtually unchanged against CHF and AUD.

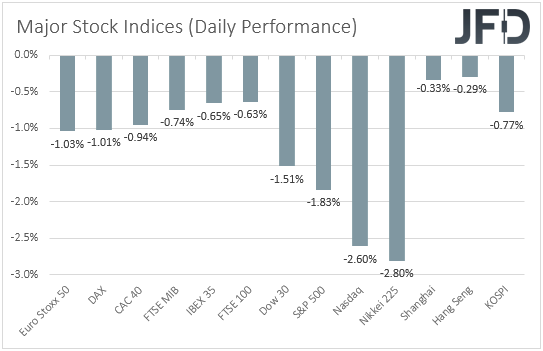

The performance in the FX world does not paint a clear picture with regards to the broader market sentiment, and thus, we prefer to turn our gaze to the equity world. There we see that major EU and US indices were a sea of red, with the risk aversion rolling into the Asian session today as well.

The main loser was Japan’s Nikkei 225, but the NASDAQ was not far behind, with Wall Street experiencing deep losses on its first trading session for the week. Remember that US markets were closed on Monday to celebrate Martin Luther King Jr. Day.

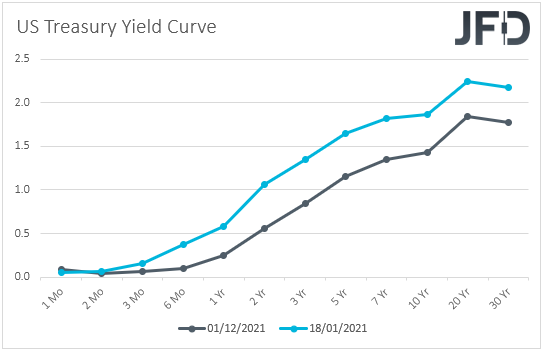

It seems that market participants kept selling equities on the fear that the Fed may proceed with a faster tightening path than previously estimated, and this is evident by the fact that US Treasury yields kept climbing higher, with the 2-Year yield breaching 1% for the first time since February 2020.

Weak results from Goldman Sachs (NYSE:GS) may have also weighed on sentiment. Its stock tumbled 7% after it missed quarterly profit expectations amid weak trading activity. As for our view, we prefer to take the sidelines for now regarding the broader market sentiment and wait for next week’s Fed gathering, which is the one before the March meeting.

Following some talk regarding a double hike, we will closely monitor the outcome for clues and hints on whether and how policymakers are thinking to act in March. According to the Fed funds futures, investors are confident that we will get a quarter-point lift-off.

UK Inflation Accelerates Again, Canada CPIs and AU Jobs Data Enter the Limelight

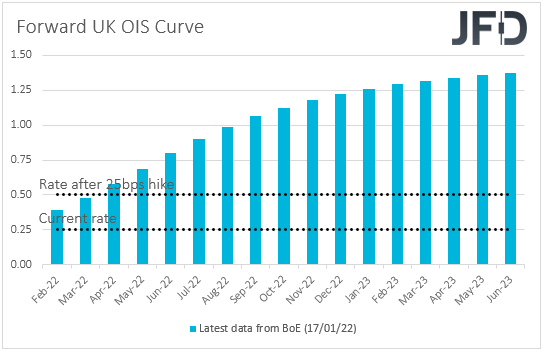

Now passing the ball from the Fed to the BoE and the UK, today, during the early European session, we already got the UK CPIs for December. The headline rate rose further above the BoE’s objective of 2%, to +5.4% YoY from +5.1%, at a time when the forecast was for an uptick to +5.2%.

The core CPI also accelerated, to +4.2% YoY from +4.0%, beating expectations over a slowdown to +3.9%. This added more credence to market participants’ view that the BoE is very likely to push the hike button again at its upcoming gathering, and that’s why we saw the pound rebounding somewhat at the time of the release.

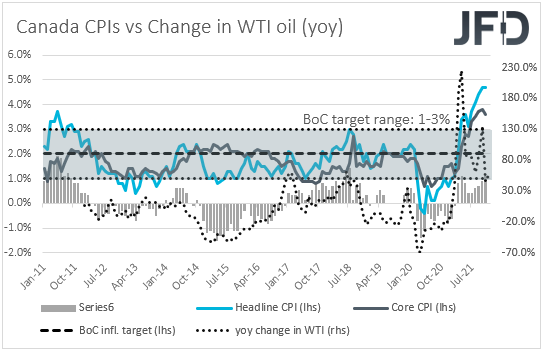

Later in the day, we get more December CPIs from Canada. Both the headline and core rates are forecast to have held steady at +4.7% YoY and +3.6% YoY, well above the upper end of the BoC’s target range of 1-3%.

The BoC kept interest rates untouched at 0.25% at its latest meeting. In the statement accompanying the decision, the language was more cautious than previously, with officials expressing concerns over the economic impact of the Omicron coronavirus variant.

That said, the new strain proved to be milder than initially estimated, and with the economy improving notably, traders currently assign a strong chance for a rate increase this month. Thus, elevated inflation is likely to keep that probability high and perhaps support the already strong Loonie, which has also been bought on the back of rising oil prices.

Yesterday, oil prices hit their highest since 2014 amid outrage on a pipeline from Iraq to Turkey, as well as political tensions. Supply concerns mounted this week after Yemen’s Houthi group attacked the United Arab Emirates.

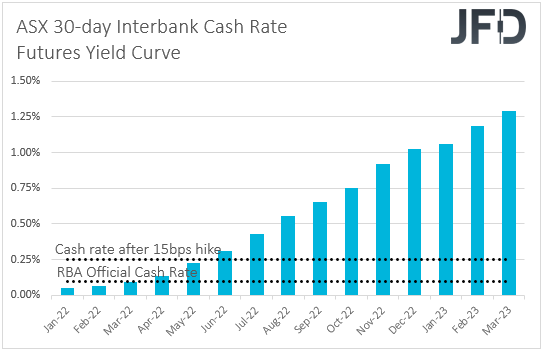

Tonight, during the Asian session Thursday, we have Australia’s employment report for December. The unemployment rate is expected to have ticked down to 4.5% from 4.6%, while the net change in employment is forecast to show that the economy has added much fewer jobs than it did in November. Specifically, it is expected to have added 43.3k jobs after adding 366.1k in November.

According to the ASX 30-day interbank cash rate futures yield curve, market participants are nearly fully pricing in a rate hike by the RBA to be delivered in May, while they see the OCR exceeding 1.00% by the end of the year.

That said, at its December gathering, the RBA reiterated the view that they are unlikely to touch the hike button in 2022, hinting that this could happen in 2023. Thus, with market participants being overly optimistic, there is ample room for disappointment. Therefore, weaker-than-expected numbers have the potential to result in a decent slide in the Aussie.

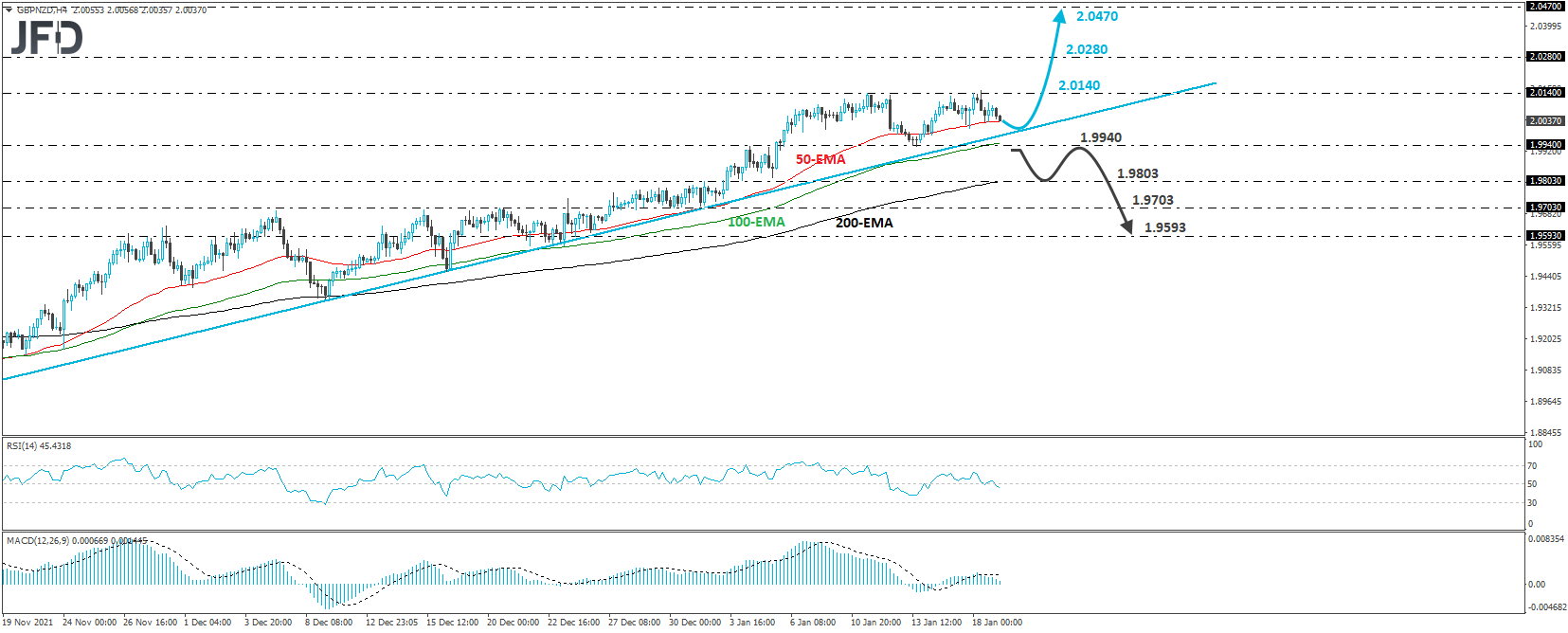

GBP/NZD – Technical View

GBP/NZD traded lower yesterday and today in Asia, after hitting resistance near the 2.0140 zone, marked by the high of Jan. 11. The rate rebounded somewhat after the UK CPIs, but it quickly gave back those gains. Overall, it remains above the upside support line drawn from the low of Nov. 8, and thus, we would see decent chances for another, more robust rebound.

If the bulls are strong enough to take charge from near the upside line, we could soon see them targeting the 2.0140 zone once again, and if they are strong enough to overcome it, we may experience advances towards the peaks of August 20th and 21st, 2020, at 2.0280. If they are not willing to stop there either, we could see them sailing towards the peaks of May 14th and 15th, 2020, at 2.0470.

We will abandon the bullish case upon a dip below 1.9940, support marked by the low of Jan. 13. This will confirm the break below the upside support line and a forthcoming lower low. The bears could then get encouraged to dive towards the 1.9803 barrier, the break of which could aim for the 1.9703 zone, which provided decent support between Dec. 28 and 31.

Another break, below 1.9703, could extend the fall towards the 1.9593 level, defined as support by an intraday swing low formed on Dec. 23.

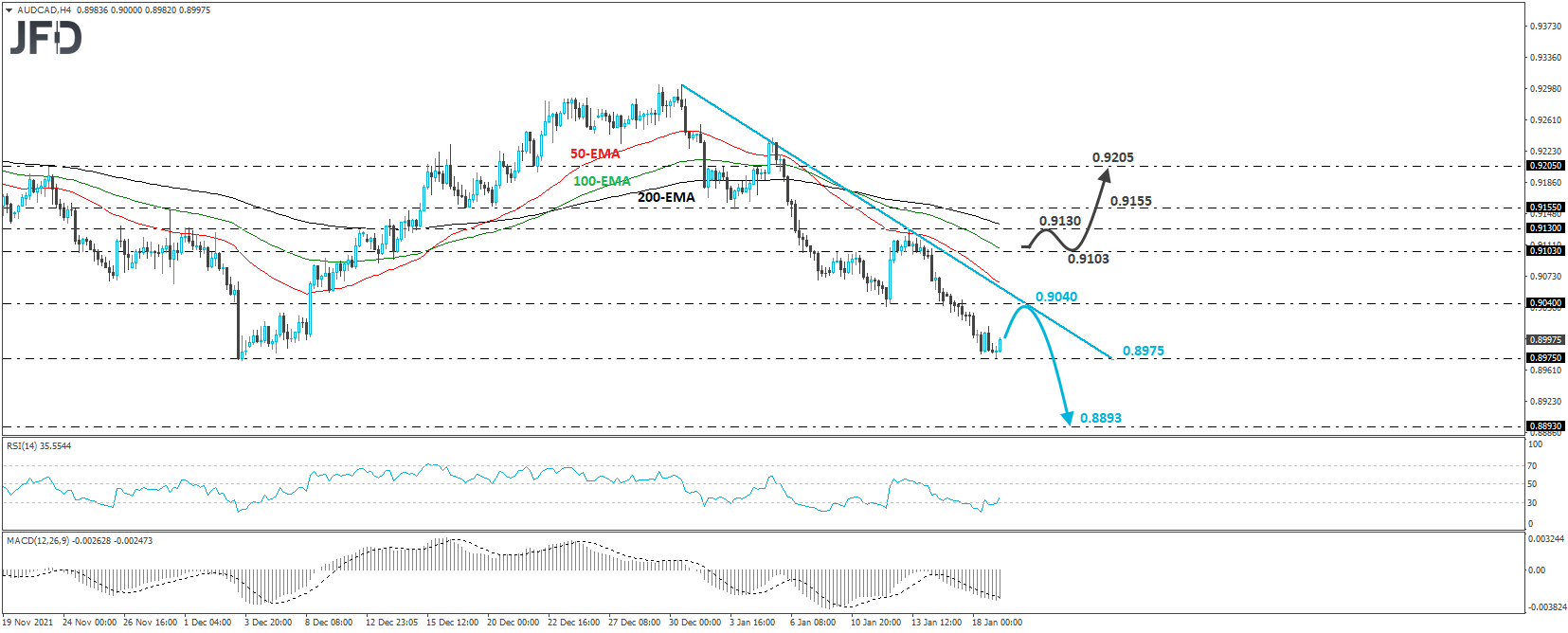

AUD/CAD – Technical View

AUD/CAD has been trading in a tumbling mode since Jan. 13, when it hit resistance at the downside line taken from the high of Dec. 30. That said, yesterday, the rate hit support at 0.8975. Overall, the rate is printing lower highs and lower lows below that downside line, and thus, we will consider the short-term outlook to be negative.

A clear and decisive break below 0.8975, which provided decent support on Dec. 3, could also see scope for declines towards the 0.8893 territory, marked by the low of Apr. 21, 2020. However, before that happens, we could see a slight rebound towards the aforementioned downside line, from which the bears could retake charge.

On the upside, we would like to see a clear rebound above 0.9103 before we start examining the case of a trend reversal. This could trigger advances towards the 0.9130, or 0.9155 zones, marked by the high of Jan. 13 and the inside swing low of Jan. 3, the break of which could extend the advance towards the 0.9205 zone marked by the high of that day.