Here in Colorado, the kids are already rising early for school, and the bears are rising early to forage. As Congress considers returning to Washington D.C. to begin their fall session, maybe it’s time for them to rise early in order to get some work done.

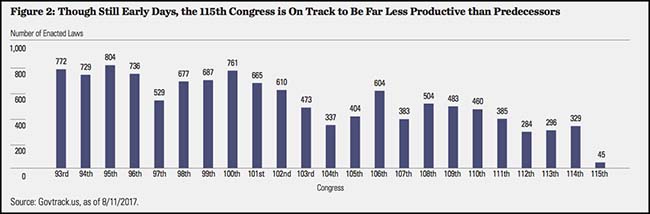

In the last two weeks, both Corporate America and the Financial Markets have ripped up their bets on the White House. (Did you take note of the two negative volatility events in one week?) But last time I checked Wikipedia, it said that Congress can still pass legislation without the White House’s blessing. Now is the time for Congress to lead and pass some legislation that will help infrastructure, healthcare, taxation, immigration, and more. There are so many loose ends and easy fixes. Just get in your back rooms and negotiate your way to some wins.

If Congress thinks that everything is fine, then they should pull up a chart of the 10% decline in the US dollar. Or the underperformance in Small Cap versus Large Cap stocks. Or the outperformance of International stocks. What the charts are saying is that they are disappointed in the lack of any political achievements or fixes in Washington D.C. And if Congress continues to play politics like the Cleveland Browns play football, then voters will bench them in 2018. It won’t matter if the incumbent has an R or a D on their back, no leadership will mean no return for more fun in 2019.

There was plenty of news to digest over the last two weeks. Even with the uptick in volatility, as you look through the market, it is still fairly obvious as to what investors want to own and don’t. International stocks are still most desired for their lower valuations, higher growth potential and US Dollar avoidance. Bonds continue to gather interest as future US economic growth trends are becoming less certain. And as interest rates fall, Financial stocks become less interesting. Credit for the most part is stable, but there are a few tacks appearing in the road ahead. Energy remains absolutely abysmal. So bad that even I am confusing the short-term Exxon (NYSE:XOM) Mobile chart for that of Snapchat.

By the end of the month, I bet that portfolio exposures to risk will be lower than last month as cash levels and hedges have risen. And we should see a continued shift of risk to the international markets. The long-term trend of the US equity market is still up, so there will continue to be plenty of long US stock exposures. But if Congress would like to help the S&P 500, they could set their alarm clocks to go off an hour earlier each day starting on September 5th.

The White House has seen a complete turnover of the Oval Office inner circle. But the financial markets are most concerned with Gary Cohn…

Corporate America’s no confidence vote in the President yesterday left financial markets with a lingering hangover today. New questions about the President’s leadership emerged. Early in the day, there was speculation that the President’s National Economic Council Director Gary Cohn may resign. Cohn is the leading contender and likely candidate to replace Janet Yellen as Chair of the Federal Reserve Board. By late morning, White House officials quelled the speculation asserting that Cohn planned to continue remain NEC Director. As uncomfortable as Cohn might be in his current situation, it is widely believed that he wants and will likely get the top position at the Federal Reserve.

The Trump Administration has already been a revolving door with all of the firings and resignations. To this point, no key economic personnel have departed. The Cohn false alarm prompted concern among investors that should high profile Administration officials leave, the President will have a very hard time attracting qualified replacements. This thinking was only reinforced by comments from other public officials. Republican Senator Bob Corker who is generally perceived to be pragmatic remarked that “The President has not yet been able to demonstrate the stability nor some of the competence that he needs to demonstrate in order to be successful…And we need for him to be successful.”

(Jones Trading)

The Chief Strategist left on Friday and he quickly dropped his thoughts that evening…

“The Trump presidency that we fought for, and won, is over,” Bannon said Friday, shortly after confirming his departure. “We still have a huge movement, and we will make something of this Trump presidency. But that presidency is over. It’ll be something else. And there’ll be all kinds of fights, and there’ll be good days and bad days, but that presidency is over.”

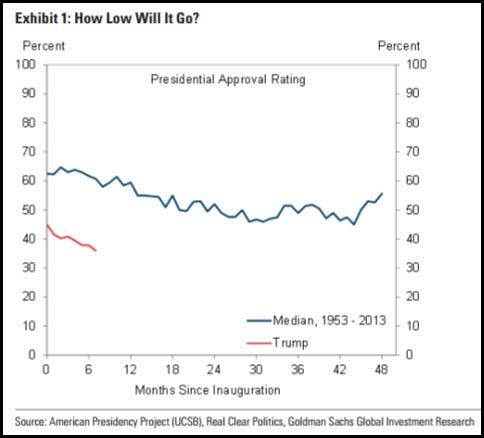

As Goldman Sachs (NYSE:GS) charts below, the POTUS approval rating is broken…

Time for Congress to step up…

The long-term trend of the market is still up and to the right…

But, it is going to be challenged for the next month.

(@johnscharts)

I can’t find a major equity breakdown signal in the TICK yet…

I love watching the tick. It makes me feel like I am on the floor of the old NYSE. It counts the buying and selling pressure of all stocks. In looking at this chart, I fail to see a breakdown yet.

(@OptionsHawk)

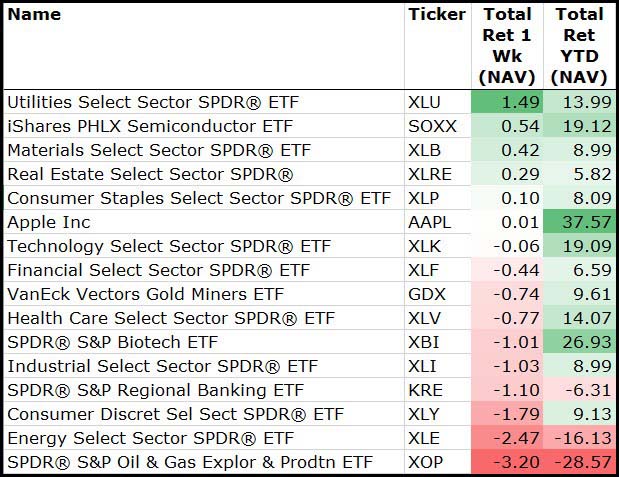

This chart shows the US sector returns from the recent market peak…

First notice that even the worst YTD performer, Energy is continuing to fall the most through the two volatility quakes in the market. Also note that the cyclicals (Consumer, Financials, Industrials) were terrible performers as investors became anxious in US growth potential. Finally, Utilities and Staples outperformed as they should in a bumpy environment.

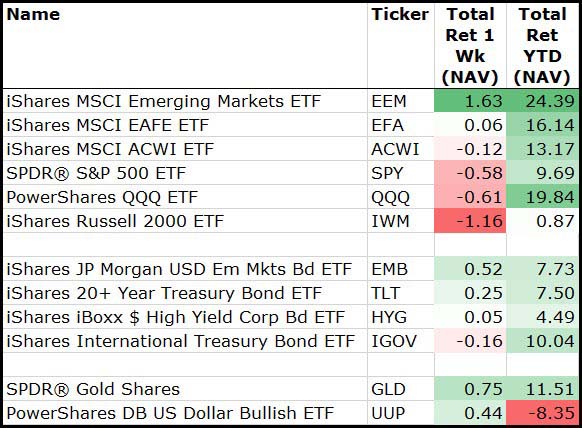

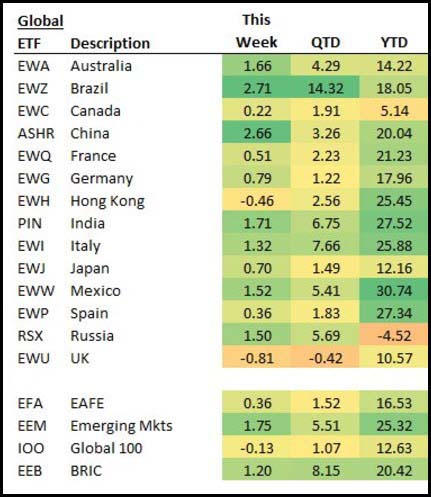

For the week, international equities were the place to gain or hide…

(priced 8/18/17)

This chart of long-term Treasury Bonds is shaping up nicely…

Not what you want a Global Macro investor to be saying if you are long risk.

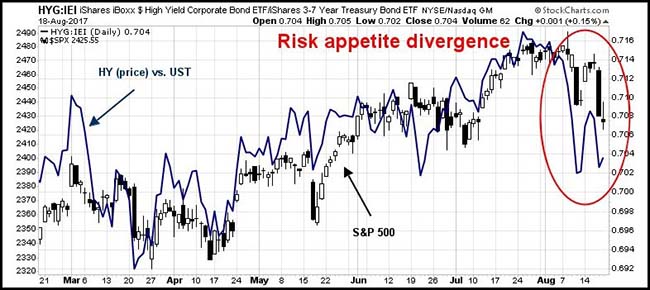

Going one further step, junk bonds are having a tough month versus Treasuries…

(@Humble Student)

A credit data point: Barry Sternlicht sees cracks in high-end, NYC residential real estate…

“We are beginning to see the cracks of the high-end residential market in Manhattan,” he said. “The building on 57th Street just went through it’s B-lender. Those deals, and the building going up next to MoMA, those deals are going to be a disaster. So high-end resi in New York really is in trouble.”

Sternlicht, who was quick to point out that Starwood is not exposed to that market, said it won’t be banks licking their wounds in the event of a luxury condo slump. Rather, it’s the hedge funds, private equity firms and alternative lenders chasing high returns who backed projects asking prices of $7,000 to $10,000 a foot.

“There’s a hedge fund that made $1 billion mortgages against some of these properties out of Europe and we will see how that fares,” said Sternlicht, appearing to refer to the Children’s Investment Fund, which has backed the likes of 432 Park Avenue and 76 Eleventh Avenue. “Maybe they like the return, but they will lose capital. They can’t get paid off and they find out their basis is accreting because they are not getting paid currently, obviously….That is not going to end well.”

A glance at the US sectors last week showed a flight to safety and growth…

(priced 8/18/17)

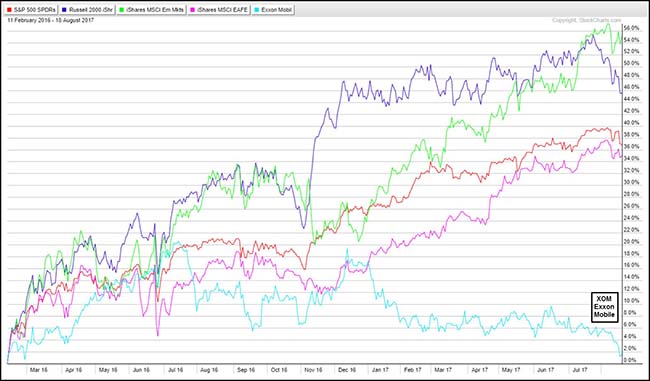

Energy stocks are bad. So bad that you have to go back to February 2016 to find a positive price return on the Exxon Mobil (NYSE:XOM) chart…

For comparison, the major ETF indexes have returned 35-55% over the same timeframe.

Quick: Which has performed better in 2017?

The NASDAQ 100 or base metals?

Again, while US equities were down last week, most of the major international equity ETFs gained…

(@bespoke)

And with Brazil recovering from political woes, the Latin American ETF (NYSE:ILF) is breaking out of its wedge…

(@allstarcharts)

Need help making emerging markets a top weighting? Go read some interviews with GMO…

I was surprised to see that Home Depot (NYSE:HD) is now spending 50% of its advertising on digital…

“Our overall advertising spend is up, lower single digits, but as we’ve essentially made more significant pivot to digital marketing it’s over half our marketing right now. That’s a medium that you can get good insight on the return on your spend and as Craig said, the team just done a great job continuing to increase the return on that spend, so leveraging that low single digit to a much more productive return on overall ad spend”

—Home Depot EVP Ted Decker

Over in the shoe and athletic apparel space, digital disruption is giving Foot Locker (NYSE:FL) shin splints…

The disruption taking place today in our industry and in retail in general is the most significant I’ve seen. The fact is that we’re seeing mobile technology drive shifts in consumer behavior and spending patterns at a faster pace than our industry has been able to keep up with.

With constant access to new influences, trends, information, and ideas, consumers’ attention spans are getting shorter, and we’re seeing that they’re moving from one style to the next faster than ever before.

And not just Foot Locker, as the entire retail industry remains under assault from a stock perspective…

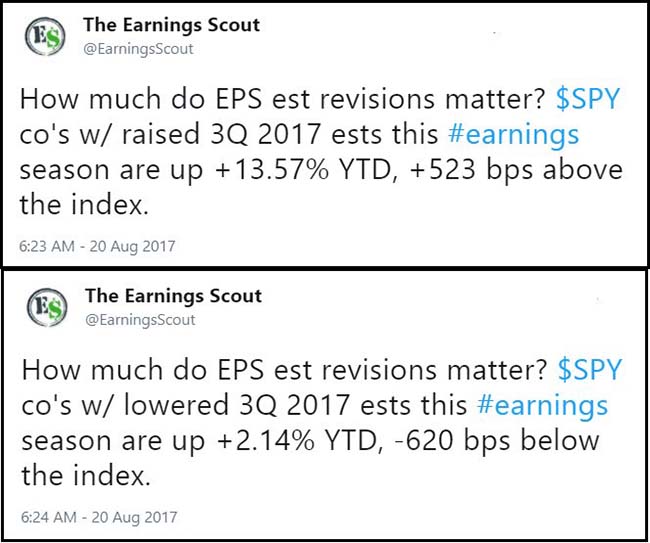

You know that stocks follow earnings…

If you are looking for an earnings strategy to invest into, send me an email.

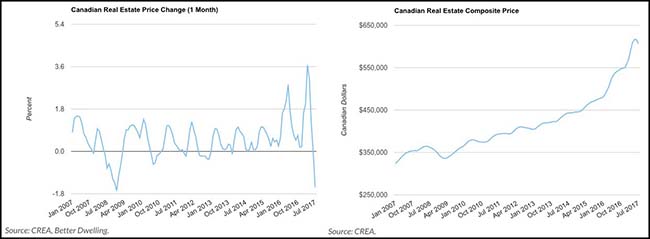

Back to real estate, it’s getting a little tight under the flannel collars north of our border…

Canadian real estate prices made the largest single-month decline in years. The Canadian Real Estate Association (CREA) numbers show that the price of homes are falling across the country. While it’s too early to call it a trend, it’s definitely something worth noting if you’re looking for a home, or you’re in the industry.

In other words, a full Brexit or not, the U.K. has severely cracked one of its golden eggs…

And that is the real challenge of Brexit for the City: the process of preparing for Brexit has highlighted to many firms how inefficient and expensive it is to have so many support staff who could be based elsewhere taking up space in some of the most expensive real estate in the world.

As one senior banker said a few weeks back, once you have seen that you can never unsee it. Brexit will increasingly provide the occasion — if not the cause — for the industry to make radical changes to its structure and business model. Some firms may even use Brexit as cover for this restructuring.

In future, a lot more business will be conducted in the City with far fewer people being paid far less for actually doing it. And that will make the changes in recruitment from one month to the next look like a rounding error.

This is a great overview on blockchain if you need to get up to speed…

Contracts, transactions, and the records of them are among the defining structures in our economic, legal, and political systems. They protect assets and set organizational boundaries. They establish and verify identities and chronicle events. They govern interactions among nations, organizations, communities, and individuals. They guide managerial and social action. And yet these critical tools and the bureaucracies formed to manage them have not kept up with the economy’s digital transformation. They’re like a rush-hour gridlock trapping a Formula 1 race car. In a digital world, the way we regulate and maintain administrative control has to change.

Blockchain promises to solve this problem. The technology at the heart of bitcoin and other virtual currencies, blockchain is an open, distributed ledger that can record transactions between two parties efficiently and in a verifiable and permanent way. The ledger itself can also be programmed to trigger transactions automatically.

With blockchain, we can imagine a world in which contracts are embedded in digital code and stored in transparent, shared databases, where they are protected from deletion, tampering, and revision. In this world every agreement, every process, every task, and every payment would have a digital record and signature that could be identified, validated, stored, and shared.

Intermediaries like lawyers, brokers, and bankers might no longer be necessary. Individuals, organizations, machines, and algorithms would freely transact and interact with one another with little friction. This is the immense potential of blockchain.

Thanks to the N.Y. Times for time machining me back to high school…

This joke from “Delirious,” Eddie Murphy’s 1983 breakthrough television special, is all about that summer moment when one drippy cone could make your world right. It’s comedy about pure joy — innocence mixed with profanity.

(NY Times)

Finally, it was World Photo Day over the weekend and Meredith Frost gathered up the best…

So many great images but this one was my favorite.

The information presented here is for informational purposes only, and this document is not to be construed as an offer to sell, or the solicitation of an offer to buy, securities. Some investments are not suitable for all investors, and there can be no assurance that any investment strategy will be successful. The hyperlinks included in this message provide direct access to other Internet resources, including Web sites. While we believe this information to be from reliable sources, 361 Capital is not responsible for the accuracy or content of information contained in these sites. Although we make every effort to ensure these links are accurate, up to date and relevant, we cannot take responsibility for pages maintained by external providers. The views expressed by these external providers on their own Web pages or on external sites they link to are not necessarily those of 361 Capital.