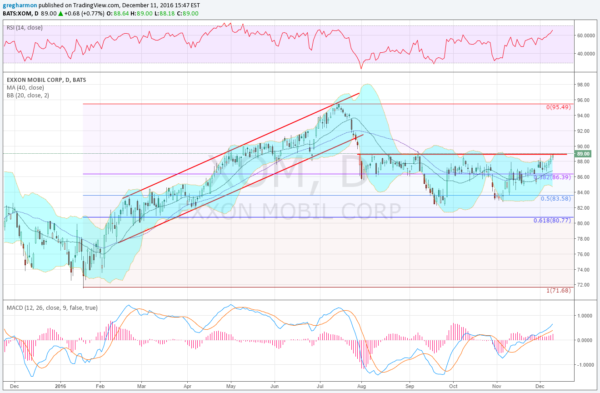

ExxonMobil (NYSE:XOM) started higher off of a low in January. It ran higher in a steady channel for 6 months until it found resistance in mid-July and pulled back. The pullback was steep at first, retracing 38.2% of the move higher within 2 weeks. It settled from there consolidating for 6 weeks before a second push down, reaching a 50% retracement. The bounce from there made it back to resistance and then failed and consolidated again. Another drop and bounce finds the price at resistance again into the coming week.

The RSI is strong and rising in the bullish zone while the MACD is also bullish and improving. The Bollinger Bands® are turning to the upside to allow a move higher as well. A break above resistance would look for a move higher and set a target on a Measured Move to near 110. There is resistance at 89 and then at 92 before the prior top at 95.50. Support lower comes at 86.50 and 82.75. The company is expected to report earnings next January 31st, and short interest is low at 1%.

Options chains show concentrated Open Interest (OI) in December at 85 and 87.5 on the Put side and 87.5 and 90 on the Call side. There is a lot more OI on the call side this week which could draw it higher. In the January chain OI is spread from 60 through to 90 on the Put side increasing at the higher strikes. On the Call side the big OI is focused from 85 to 95 and again much bigger than the Put side. February options, the first beyond the next earnings report, are still building OI.

ExxonMobil, Ticker: XOM

Trade Idea 1: Buy the stock on a move over 89 with a stop at 86.

Trade Idea 2: Buy the stock on a move over 89 and add a December 30 Expiry 89/84 Put Spread ($1.10) and sell a January 92.50 Covered Call (56 cents) for low cost protection.

Trade Idea 3: Buy the January 27 Expiry 86/89/92.5 Call Spread Risk Reversal (50 cents).

Trade Idea 4: Buy the February 90/95 Call Spread ($1.60) and sell the sell the February 85 Put ($1.39).

After reviewing over 1,000 charts, I have found some good setups for the week. This week’s list contains the first five below to get you started early. These were selected and should be viewed in the context of the broad Market Macro picture reviewed Friday which heading in to December Options Expiration and the FOMC meeting sees US Equities looking strong but perhaps extended on the short term.

Elsewhere look for Gold to continue its downtrend while Crude Oil continues to move higher. The US Dollar Index also looks better to the upside while US Treasuries continue to be biased lower. The Shanghai Composite and Emerging Markets both are biased to the upside with risk Emerging Markets being only a short term move.

Volatility looks to remain subdued and abnormally low keeping the bias higher for the equity index ETF’s SPDR S&P 500 (NYSE:SPY), iShares Russell 2000 (NYSE:IWM) and PowerShares QQQ Trust Series 1 (NASDAQ:QQQ). Their short term charts suggest possible exhaustion as they are over sold, but longer term they look very strong. The exception is the QQQ which has been stuck in a range but is now at the top end. Perhaps it will benefit from a pullback in the other index ETFs. Use this information as you prepare for the coming week and trad’em well.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.