European and US shares traded in the green yesterday, with the positive appetite rolling into the Asian session today. Appetite, especially in the retail sector, was boosted after the UK revealed a new stimulus plan. At the same time, later, US retailers revised their economic outlooks, easing concerns over the performance of the US economy.

There was also some speculation that the Fed could take a break after delivering two double hikes in June and July, but in our view, it is still too early to arrive at such conclusions.

USD Slide, GBP Gains on Stimulus, Equities in the Green on Retailers

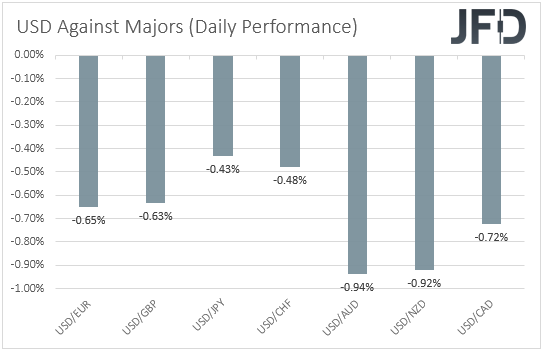

The US dollar traded lower against all the other major currencies on Thursday and during the Asian session Friday, losing the most ground versus the commodity-linked currencies AUD, NZD, and CAD. The greenback underperformed the least against the safe-havens CHF and JPY.

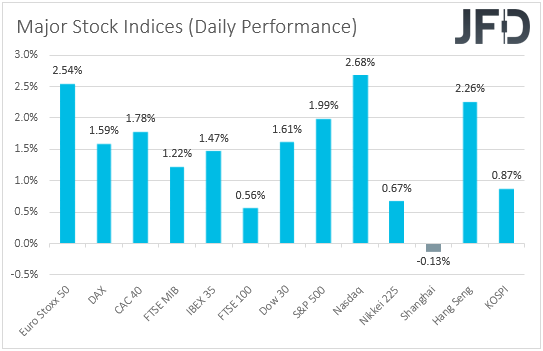

This points to risk-on trading activity, and indeed, turning our gaze to the equity world, we see that all EU and US indices traded in the green, with the positive morale rolling into the Asian session today. Among the indices under our radar, only China’s Shanghai Composite traded slightly negative.

Despite the UK FTSE 100 gaining the least, European markets were led by gains in the retail sector after the UK government revealed a new fiscal stimulus plan to support the economy. Specifically, they announced a GBP 15bn package of support to households struggling with energy bills, as well as a 25% windfall tax on oil and gas producers’ profits.

Pound sterling has been hit hard in the recent past by increasing fears that the UK economy is headed towards a recession, with the BoE projecting a contraction next year. Thus, the support may have eased such concerns, and that’s why we saw the pound adding gains.

This could also make the BoE’s job much easier, as officials are in a situation where they need to keep raising rates to contain inflation, but also be careful not to harm the economy more. So, the government’s stimulus announcement could allow officials to keep raising interest rates more freely, at least for now, allowing the British currency to enjoy some more gains.

Sentiment remained supported during the US session due to optimistic retail earnings outlooks, which added to the confidence by Fed officials expressed in the minutes of the latest FOMC gathering. Perhaps market participants also started thinking that the Fed could take a break after delivering double hikes in June and July.

In the minutes, it was noted that several officials said data had begun to indicate that inflation may no longer be worsening. However, they also agreed that it is too early to be confident that inflation has already peaked.

We agree with them, and with Fed Chair Powell saying, in the aftermath of that gathering, that they are willing to do more if inflation does not slow to desired levels, we are not so convinced over a pause in rate increases after summer.

We prefer to wait for more data suggesting that inflation is cooling. Yes, the core PCE index today could reveal a slowdown for April. Still, in our view, this is something already expected as the core CPI for the month, which is decently correlated to the core PCE metric, has already revealed a slowdown.

With that in mind, equities could continue gaining more on the easing economic concerns and some hopes over a break by the Fed after summer, but with the first sign of inflation turning back up, we would expect a turnaround. The US dollar could continue correcting lower due to the Fed speculation.

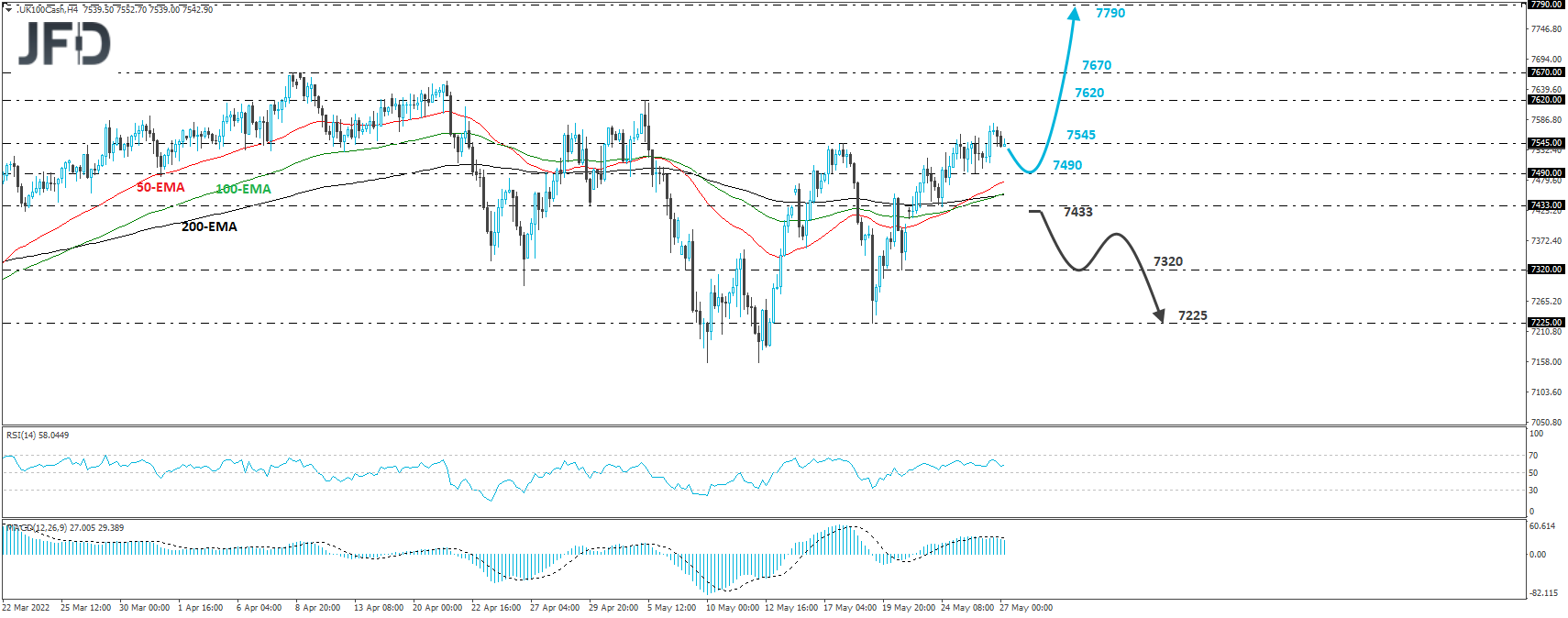

FTSE 100 – Technical Outlook

The UK FTSE 100 cash index traded slightly higher yesterday, breaking temporarily above the 7545 zone, marked by the high of May 17. That said, today, later, the index pulled back again, and today in Asia, it fell back below it. Overall, the price structure has been higher lows and higher highs since May 19, and thus, even if the retreat continues for a while more, we see decent chances for another leg north.

The bulls could retake charge from near the 7490 zone, marked by the low of May 25, with the rebound perhaps aiming for the high of May 5, at 7620. If they are unwilling to stop there, we could see them challenging the 7670 zone, marked by the high of Apr. 8, where another break could carry larger bullish implications, perhaps paving the way towards the 7790 territory marked by the high of Aug. 8, 2018.

We will abandon the bullish case and start considering a decent slide only if we see the index falling below 7433, support marked by the low of May 24. This could allow declines to the low of May 20, at 7320, the break of which could extend the fall towards the low of May 19, at around 7225.

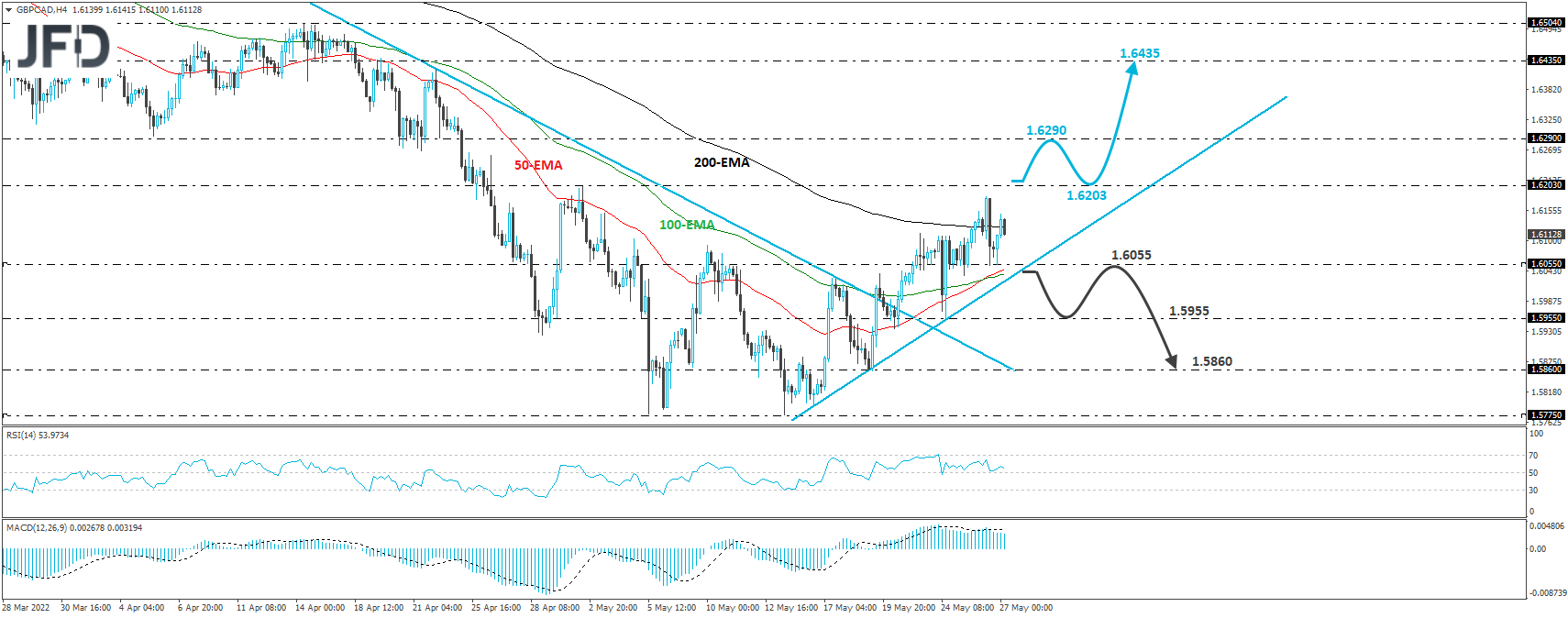

GBP/CAD – Technical Outlook

GBP/CAD traded higher yesterday after it hit support at the 1.6055 area. Overall, the pair remains above the newly-drawn upside support line, taken from the low of May 16, and thus, we will consider the short-term picture to be positive.

The bulls could recharge and perhaps aim for the 1.6203 level, marked by the high of May 2, the break of which may carry advances towards the 1.6290 zone, which provided support between April 5th and 22nd. Another break above 1.6290 could allow extensions towards the 1.6435 zone, marked by the high of Apr. 19.

We will start examining whether the bears have stolen all the bulls’ swords when we see a dip below 1.6055. This could also signal the break below the aforementioned upside support line and may initially pave the way towards the low of May 24, at 1.5955. If that barrier fails to hold as well, we could experience extensions towards the low of May 19, at 1.5860.