Chip stocks have been laggards of late. While the S&P 500, Russell 2000 and Nasdaq 100 have all broken out of ranges, the Semiconductor Index has just consolidated. Since topping out in March, is has moved mainly sideways in a narrowing range. That might be about to change though. After the latest move higher in mid-August, the Chips consolidated and then started to move higher again. Continuation higher could be a big thing.

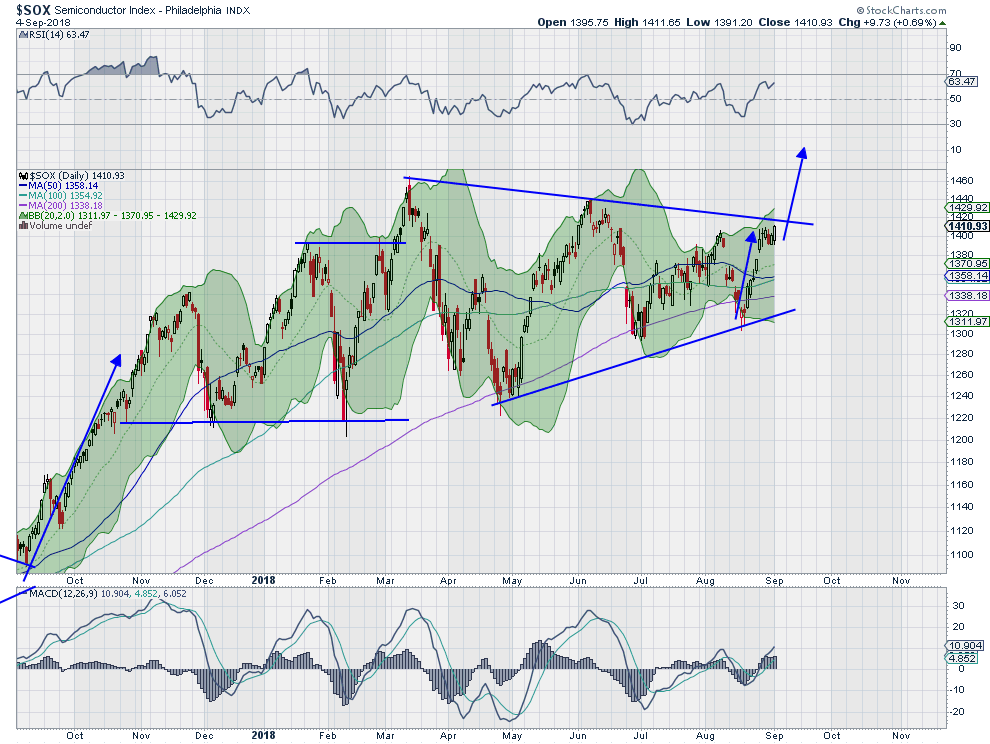

The chart below shows the recent action. It has not been a bad consolidation, with the Index holding mostly over its 200 day SMA. No deep corrections. The first drop was nearly 17% but it still held over prior support. Now moving higher it has falling trend resistance just above. And a push through that gives a target to about 1525. That woul dbe a new all-time high.

Momentum is building as the Index rises. The RSI is strong in the bullish zone and turning back higher. The MACD is rising and positive. Neither one are overbought. In fact the MACD has a lot of room to move up to the prior highs near 30. Even the Bollinger Bands® are set up for a continued move higher. After squeezing into August, they shifted higher and started to open. A move over 1420 should seal the deal. this gives you a couple of days to re-stock the chips in your account.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.