The Q2 earnings season has started off on an encouraging note with multiple companies reporting better earnings and revenue growth compared with the last few quarters.

Per the latest Earnings Preview, total earnings for the 97 S&P 500 members that have reported results (as of Jul 21) are up 8.4% from the year-ago period, courtesy of a 5.1% rise in revenues. Notably, 78.4% of the companies that have posted their quarterly numbers have surpassed earnings estimates, while 72.2% have exceeded top-line expectations.

Restaurant Stocks in Focus

The restaurant industry belongs to the broader Retail-Wholesale sector and the space is expected to deliver mixed performance this earnings season. Overall Q2 earnings for the sector are expected to be down 0.2% year over year, though revenues are expected to rise 3.9%.

It is to be noted that the restaurant industry’s sales trends in recent quarters have been very challenging, given soft consumer spending on dining out, which has resulted in low consumption. Declining comps due to sluggish traffic trends along with rising costs, are thus taking the sheen out of restaurant companies. Nevertheless, the to-be-reported quarter is set to witness improvement over the recent quarters, given improving economic indicators, such as growing income and solid employment numbers.

Evidently, on one hand, the second quarter of 2017 marked the sixth consecutive quarter of negative comparable sales (comps) for the restaurant industry as a whole, per TDn2K’s Black Box Intelligence. On the other hand, the quarter posted the best results for the industry since the second quarter of 2016.

Notably, besides improving economic conditions, easy year-over-year comparisons also seem to have aided the results.

Thus, though the overall scenario is still bordering on the negative and the earnings picture also seems to be less enticing, innovative operators with strong fundamentals are likely to continue exhibiting strength even in a not-so-favorable environment, and are expected to fare well this earnings season.

Three restaurant companies are set to report their second-quarter 2017 results on Jul 25. Will these companies manage to put up a decent performance? Let’s take a look at what might be in store for these companies:

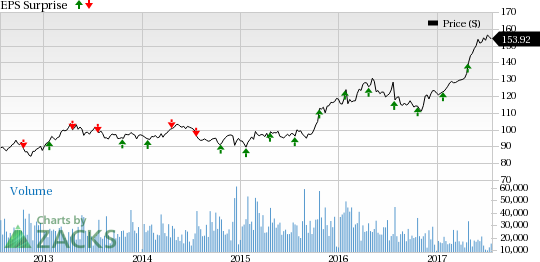

McDonald's Corp. (NYSE:MCD) pulled off a positive earnings surprise of 11.36%. In fact, the company’s earnings surpassed the Zacks Consensus Estimate in each of the last eleven quarters, with the trailing four-quarter average earnings surprise coming in at 7.01%.

Notably, our proven model shows that an earnings beat is likely for McDonald's this time around. This is because the company has the right combination of the two key ingredients – a Zacks Rank #3 (Hold) or better and a positive Earnings ESP – to increase its odds of an earnings surprise.

For the quarter, McDonald’s has an Earnings ESP of +0.62% and a Zacks Rank #3. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

The Zacks Consensus Estimate for the bottom line is pegged at $1.62. Global comps at McDonald’s have been positive for the last seven quarters, marking a trend that is likely to continue in Q2 as well. Still, soft industry growth could somewhat hurt sales, whereas negative currency translation might dent the quarter’s profits (read more: McDonald's Buckles Up for Q2 Earnings: A Beat in Store?).

Chipotle Mexican Grill, Inc. (NYSE:CMG) came up with a positive earnings surprise of 25.00% in the last quarter. However, the trailing four-quarter average earnings surprise is a negative 8.59%.

We note that Chipotle is unlikely to post a beat in the quarter due to the combination of its Zacks Rank #4 (Sell) and Earnings ESP of -2.32%. The Zacks Consensus Estimate for the quarter’s earnings is pegged at $2.16.

Note that we caution against stocks with a Zacks Rank #4 or 5 (Strong Sell) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Chipotle’s new brand-management efforts, along with various sales-building should drive its top- and bottom–line performance in the quarter. However, costs associated with marketing and promotional initiatives to connect with its customers, implementation of food safety measures and higher labor expenses are likely to thwart the quarter’s profitability. Meanwhile, overall choppiness in the U.S. restaurant space is likely to limit revenue growth (read more: Chipotle to Report Q2 Earnings: Will it Disappoint?).

Domino's Pizza, Inc. (NYSE:DPZ) delivered a positive earnings surprise of 8.62% in the previous quarter. In fact, the company pulled off positive earnings surprises in each of the last four quarters, with an average beat of 6.04%.

The company has an Earnings ESP of -0.82% and a Zacks Rank #3, thereby making it difficult to conclusively predict an earnings beat this quarter. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for the company's bottom line is pegged at $1.22. Domino's solid brand positioning should continue to boost sales in the to-be-reported quarter. In fact, initiatives on the digital front, focus on re-imaging and other sales boosting strategies are expected to help sustain the comps momentum. Yet, higher costs and negative currency translation are likely to hurt profits while soft industry backdrop might restrict revenue growth.

Stay tuned! Check back on our full write-up on earnings releases of these stocks.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020. Click here for the 6 trades >>

Chipotle Mexican Grill, Inc. (CMG): Free Stock Analysis Report

Domino's Pizza Inc (DPZ): Free Stock Analysis Report

McDonald's Corporation (MCD): Free Stock Analysis Report

Original post