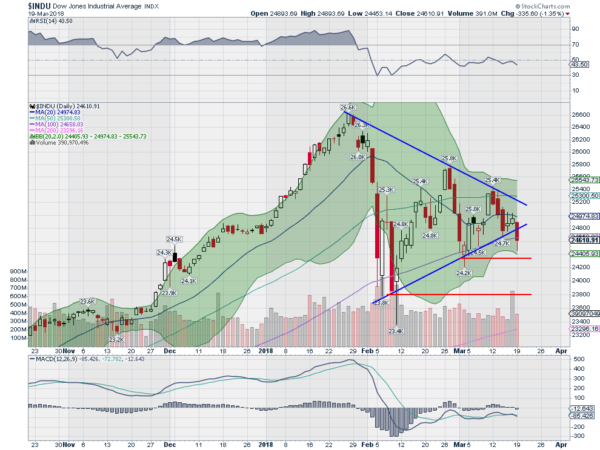

Last week I wrote about the Diamond Triangle in this space. A consolidation pattern that had been building for weeks and approaching some resolution. Monday that pattern did resolve to the downside. This triggers a target 2700 points below, or to 22050 on the Dow Jones Industrial Index. As the Index broke below the twitter DM’s and emails started to flood in about getting short to ride the path lower.

Here is what was not said in that piece last week. First, the break of the triangle usually results in the most powerful move and best chance to achieve the target when price is about 2/3 of the way through the triangle. That would have been 3 days before the first piece on March 12th. A breakdown Monday came 86% of the way through the triangle.

Also there are intermediate lows that may give support at 24400 and 23600. What makes these levels important is not that they touch the triangle but that they are spots where actual battles between buyers and sellers were fought. Money changed hands at these price levels and buyers overcame sellers to reverse downtrends. A point on a diagonal line can have some significance, but actual reversal lows carry more weight.

Of course at the end of the day none of this may matter. It is a set of tools to assess a situation and measure risk. It is all about risk management. How you manage your position in this environment will determine your success.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.