Markets lost ground on Tuesday, with the S&P reversing off trend resistance and the Russell 2000 doing a tag repel from converged 20-day and 50-day MAs. Selling volume only ranked as distribution for the Russell 2000, but was not particularly heavy.

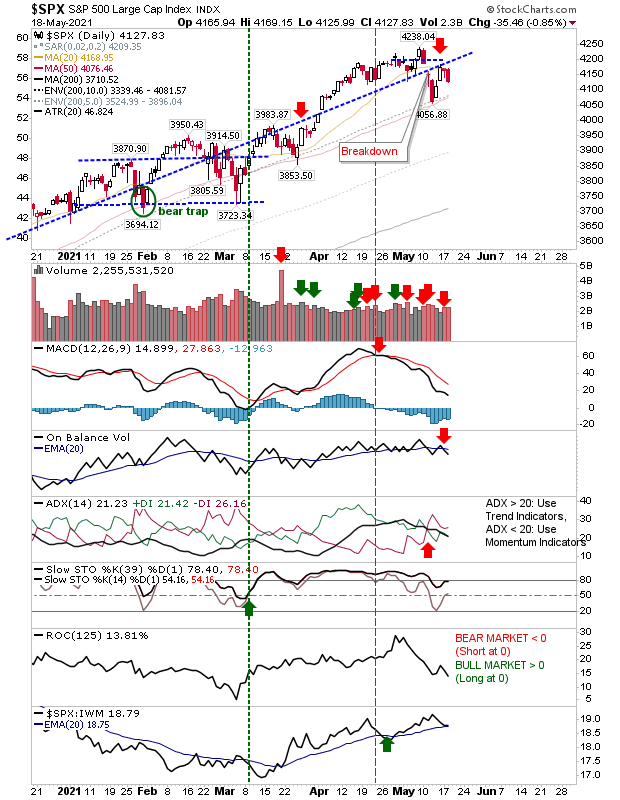

The S&P marked a picture perfect reversal with bearish technicals for the MACD, On-Balance-Volume and ADX. Bulls will look to the 50-day MA, an area of past support in March and more recently in May, but each repeated tag of this support level increases the opportunity for it breaking.

Markets lost ground, with the S&P reversing off trend resistance and the Russell 2000 doing a tag repel from converged 20-day and 50-day MAs. Selling volume only ranked as distribution for the Russell 2000, but was not particularly heavy.

The S&P marked a picture perfect reversal with bearish technicals for the MACD, On-Balance-Volume and ADX. Bulls will look to the 50-day MA, an area of past support in March and more recently in May, but each repeated tag of this support level increases the opportunity for it breaking.

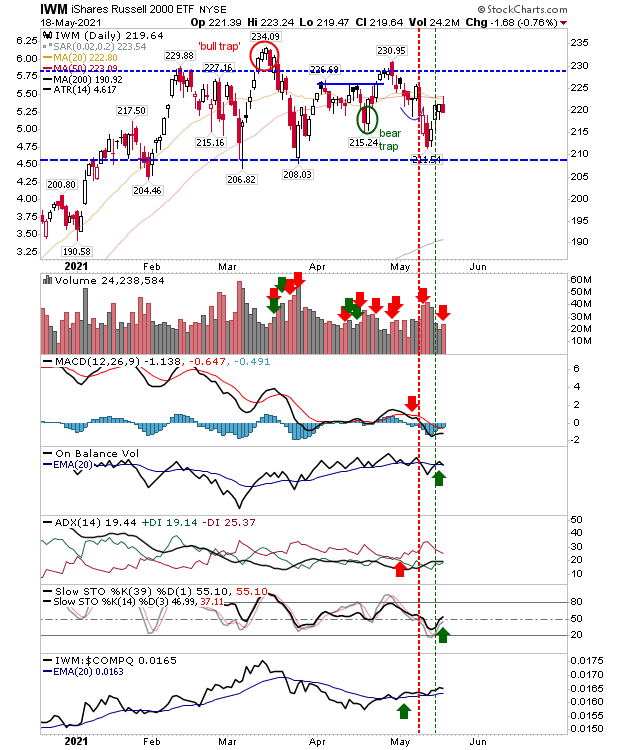

The Russell 2000 (via IWM) did tag its 20-day and 50-day MA, but as it's range bound the test is not as significant as it was for the S&P. Technicals are a mix of bullish and bearish elements.

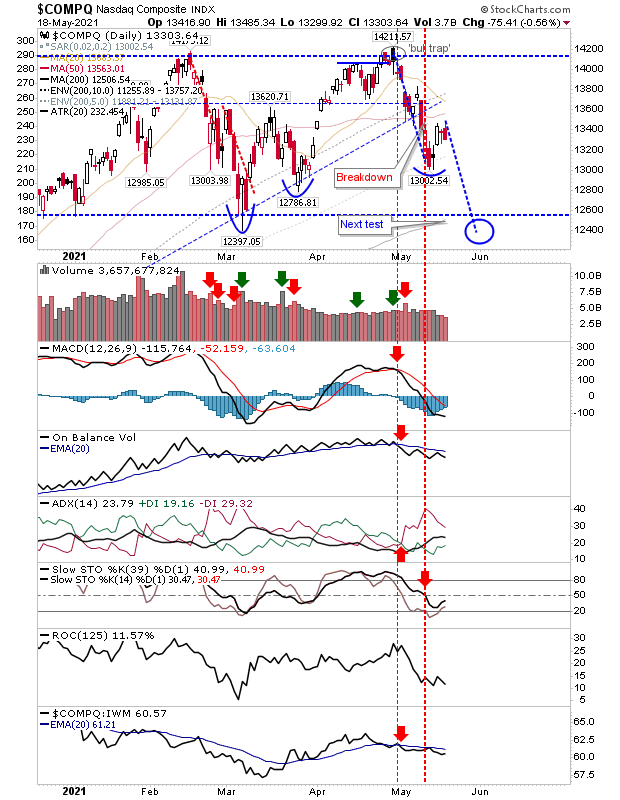

Yesterday's selling may be the start of a larger move down, but what it does do for now is pause the relief bounce—a bounce which has had little chance to get much traction. From a trading perspective there is little on offer; aggressive traders may want to look at a short in the S&P, but the risk:reward for the NASDAQ and Russell 2000 isn't great.