The bounce is struggling to attract buyers with Friday's close registering as a small gain with low volume.

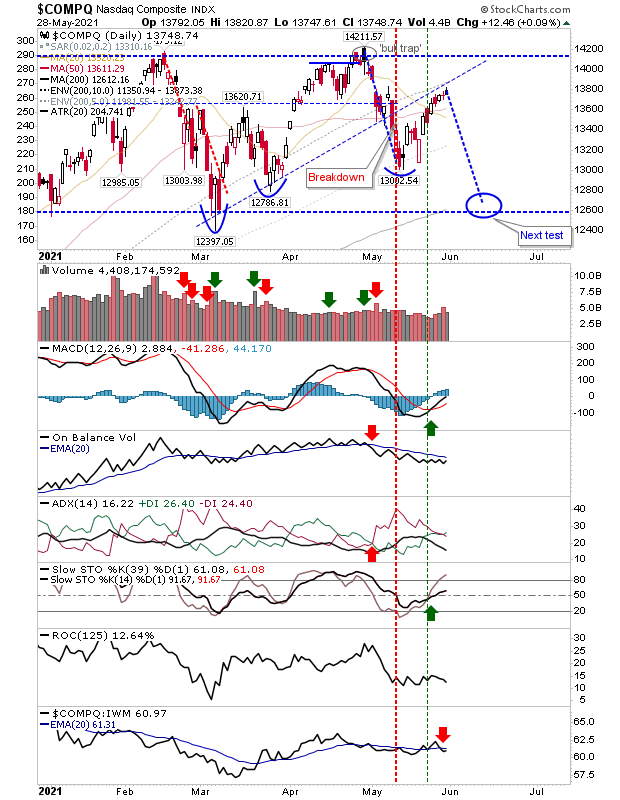

In the case of the NASDAQ, the measured move lower would deliver a tag of the 200-day MA, making it an attractive forecast. Technicals are mixed with 'buys' for the MACD and Stochastics, offset by relative performance shifting back in favor of Small Caps.

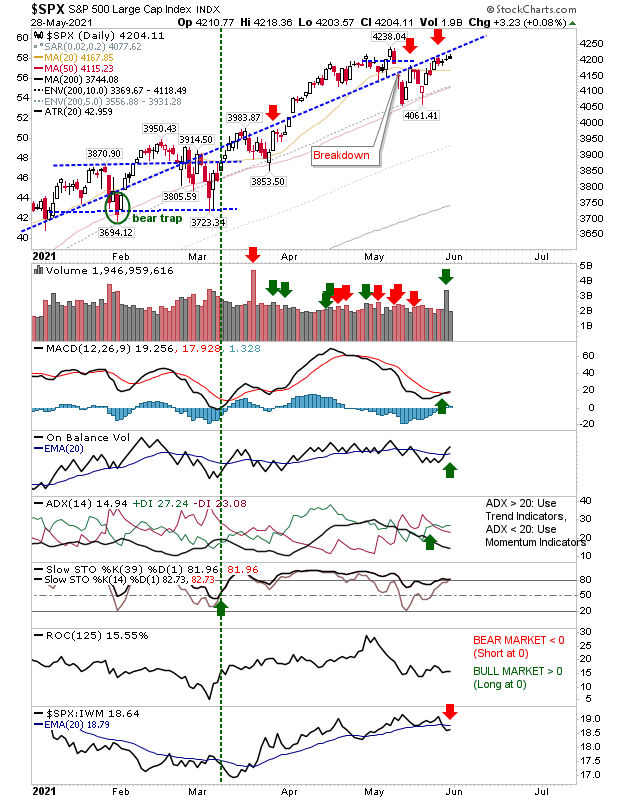

The S&P is also limping higher, but is close enough to all-time highs such that one strong day would return the index to new highs. Technicals are net bullish, although Large Caps are underperforming relative to Small Caps.

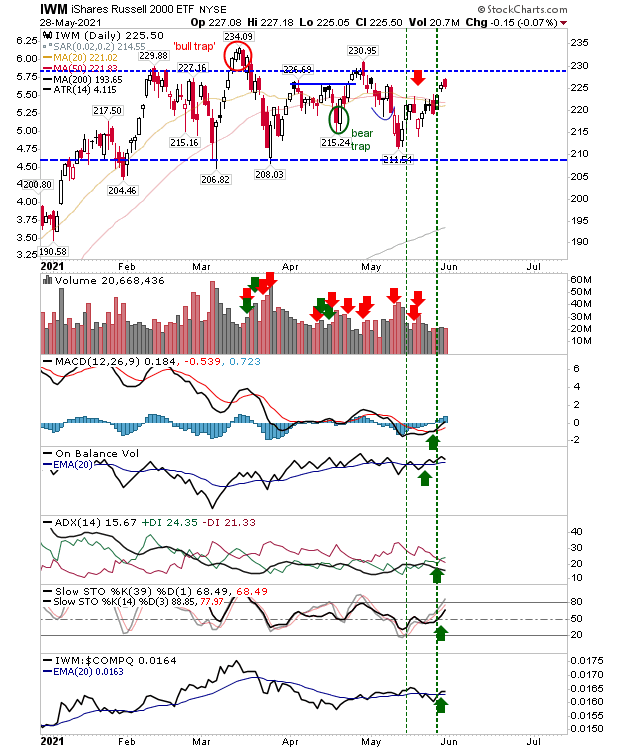

Of the Russell 2000 (via (NYSE:IWM), the index did manage to get past converged 20-day and 50-day MAs, but it has yet to clear the consolidation. However, technicals for the Russell 2000 are net bullish, and it's enjoying a relative performance advantage to peer indices. All it has left to do is challenge its March 'bull trap,' but it's still range bound—and range action remains dominant for now, but I like what I see (for bulls).

All eyes should be on the Russell 2000 for next week as there was little going on for other indices, and it looks to hold the key as to what will happen next.