Shock and horror grip the entire world. Yesterday's events in Las Vegas have set a new record for human brutality and is a reminder that no matter how far we've come as a society, we need to do better.

My humble request is that each reader of today's market update does one thing today to help somebody else. Any act of kindness that you can think of. This is the only way to change the world for the better.

Today's Highlights

Gerrymandering

Dollar Drive Continued

Goldman Considers Crypto

Please note: All data, figures, and graphs are valid as of October 3rd. All trading carries risk. Only risk capital you can afford to lose.

Market Overview

We all know that most politicians don't like to play by the rules. Or rather, they like to rewrite the rules in order to suit their own purposes.

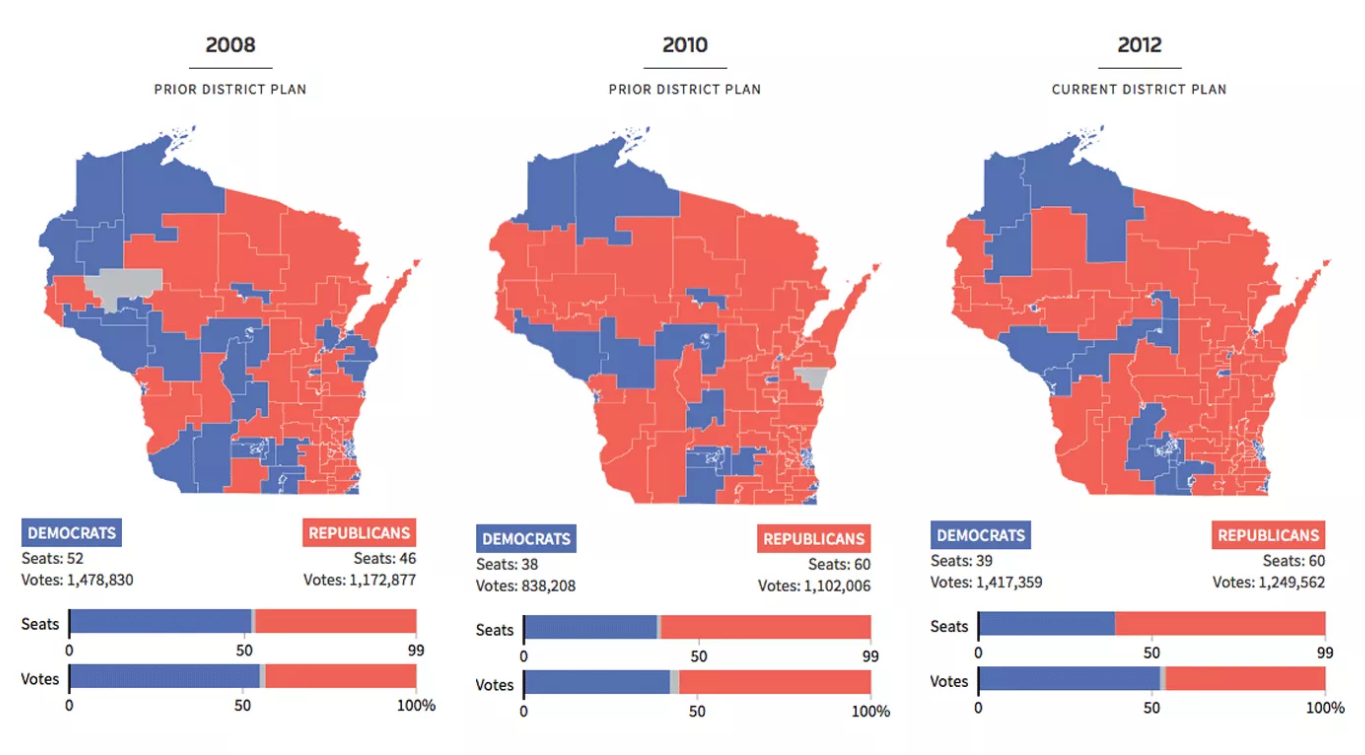

In the United States, they have a process of redrawing lines on a map within a state to benefit the political party who is doing the drawing. This process is known as gerrymandering.

In the state of Wisconsin, a key battleground that frequently decides the outcome of presidential elections, about half of the citizens are Republicans. However, thanks to creative boundaries they win about 66% of assembly seats.

Today the Supreme Court will review this process for the first time since 2004 and possibly pass a ruling. Though the status quo is largely expected to be upheld, one can't help but hope that action may be taken to ensure that democracy remains democratic.

Dollar is Gaining

The US Dollar continued to climb at the start of this week. Markets are focused on the interest rate decision that the Fed will publish in December. Currently, there is a 70% chance of a rate hike and it's driving the currently undervalued Dollar upward.

After reaching an extremely low level on September 8th, the Dollar has been on a bullish swing for the past two weeks. The move was spurred largely by the FOMC meeting of September 20th (big green candle in the center of the chart).

The Dollar strength is indeed having a knock-on effect on the commodities, which are priced in Dollars.

Gold has now reached its lowest level since August and Oil fell 2% yesterday. Here we can see both Oil and Gold getting bucked by the US Dollar over the past week.

US stocks on the other hand, which are also priced in Dollars, don't seem to notice anything. They continue to climb despite deteriorating geopolitics, extreme weather, a national tragedy, and mounting unsustainable US debt.

Both the Dow Jones and the S&P 500 closed on record highs yesterday and the Nasdaq didn't do so bad either.

The reason for this extreme move is likely due to the lack of trading activity. The low volatility has a way of influencing prices because each buy order that is made on a market where nobody is selling tends to drive prices upward.

The VIX volatility index has just opened very close to its lowest level ever at 9.31 points.

Crypto Divergence

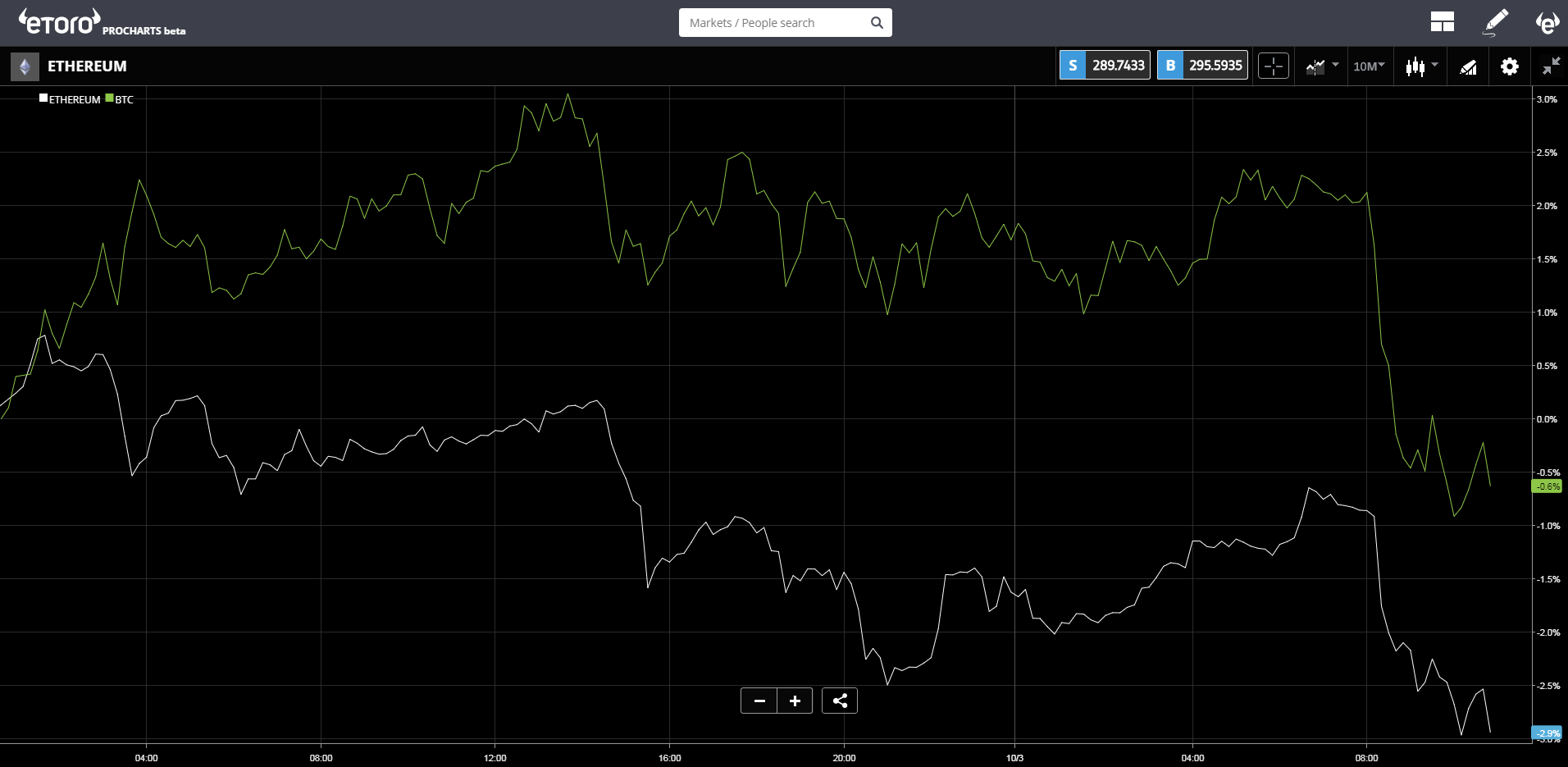

Yesterday we saw some divergence in the cryptocurrency market for the first time since August. All throughout September, all cryptos were moving together as a pack. Yesterday we saw Bitcoin rise about 1.5% while Ethereum fell by an approximately equal margin.

This morning it seems we're back inline with the single market though as we see declines across all the top 10 cryptos.

One comforting thing that is on the minds of alternative investors is the headline that Goldman Sachs (NYSE:GS) is now considering to add bitcoin as a tradable asset for their clients. If they do, it would no doubt be a large boost of confidence in the young borderless global currency.

Wishing you an amazing day ahead!

eToro, Senior Market Analyst

Disclosure: This content is for information and educational purposes only and should not be considered investment advice or an investment recommendation. Past performance is not an indication of future results. All trading carries risk. Only risk capital you're prepared to lose.