For those who missed last week in the markets, these were the returns of the major stock indices (second column to the right):

Source: Investing.com

As we can see, U.S. indices returned between 5.41%—for the Dow Jones Industrial Average—and 7.5%—for the NASDAQ Composite—in just one week.

Now, it's hard to say whether this will be another dead cat bounce or whether we have reached the bottom and markets are about to reverse. What is certain, however, is that timing the market is a fool's game.

That is why 99% of traditional investors should always have a medium- to long-term strategy instead of following the market's ups and downs.

Nonetheless, it is still fair to say that last month's most significant rebounds came when pessimism was at its highest.

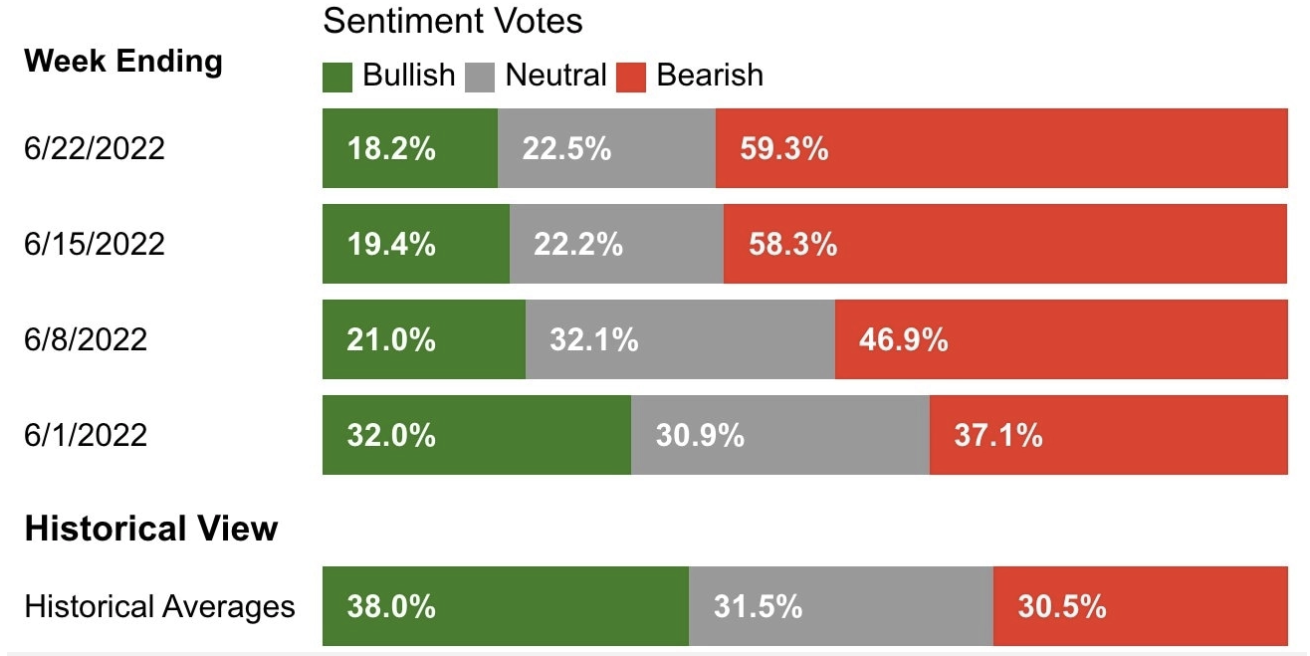

Source: Callum Thomas

The chart above shows investor sentiment in July 2022 compared to the historical average (which, for reference, is 38% bullish, 30.5% bearish, and 31.5% neutral). When we look at the entire movement from June 1 to June 22, we notice how pessimism increased daily.

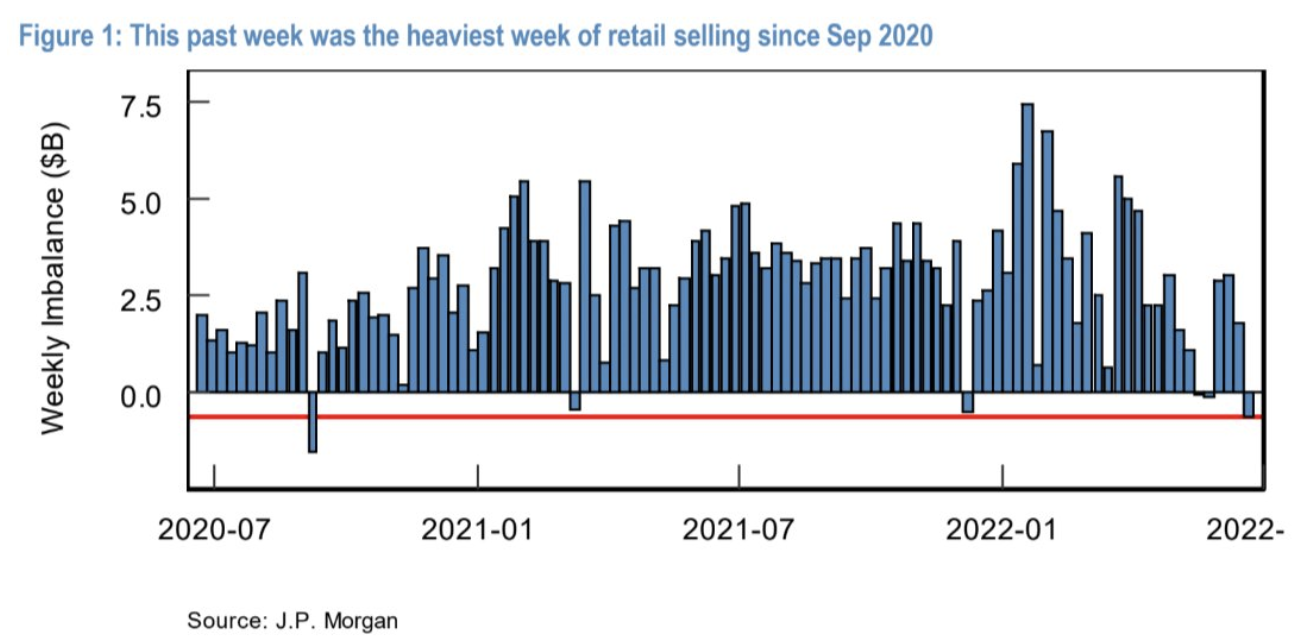

Source: JPMorgan

Moreover, (see chart above) the most significant weekly rebound in recent months was the one with and biggest-selling by the retail public. In short, most missed this recovery.

But if that wasn't enough (see chart below), professional investors and asset managers were at the minimum positioning on the equity component when the market bottomed.

Source: Macrocharts

This again highlights how being a short-term trader is a losing game for most investors—including those who do it for a living.

It is always better to leave it to the market and act on diversification and strategic and tactical asset allocation.